FilippoBacci/E+ by means of Getty Images

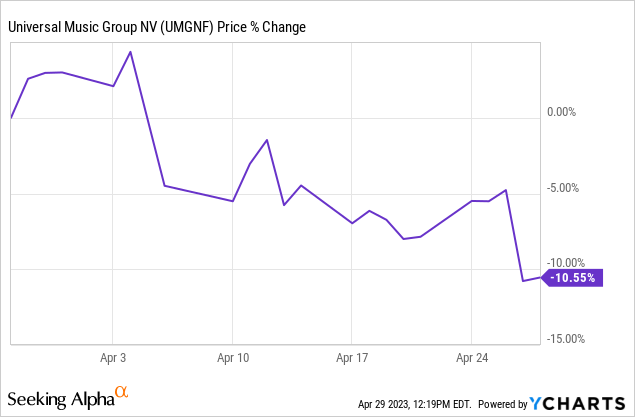

Universal Music Group ( OTCPK: UMGNF) ( OTCPK: UNVGY) revealed its Q1-23 results, reporting an earnings boost of 11.5% and an adjusted EBITDA boost of 14.7%, compared to the previous year duration. In spite of the outstanding numbers, a non-recurring expenditure and financier worry of possible AI disturbance sent out the stock to a 15.0% selloff. As UMG now trades at a 16.5 forward EV/EBITDA several, I discover the existing cost a very appealing chance to purchase the very best service in the music market. I declare my Strong Buy score and approximate a 29.0% advantage.

Background

2 months earlier, I began covering UMG on Looking for Alpha, with a Strong Buy score. I released 2 posts covering the business. In the initially post, I explained the business’s service design in information. Particularly, I discussed its complex earnings streams, the legal structure in which UMG runs, the business’s sectors, and its primary development motorists that include the ongoing adoption and growth of digital music services, in addition to continuous cost boosts as the cost of a music membership hardly altered considering that 2014, the year streaming companies began to get traction.

In my 2nd post, I covered the business’s FY22 outcomes and concentrated on the intro of its worker stock choice strategy, which is still exceptionally pertinent in order to comprehend the chance that occurred after the Q1-23 selloff.

Sadly, the stock has substantially underperformed the marketplace in the last 2 months. Nevertheless, I think the current selloff is triggered by false information and immaterial threats. Hence, I discover UMG’s existing cost an appealing chance to purchase a long-lasting compounder, which has among the greatest moats in the market, as UMG holds the rights to generate income from generational music of artists like Rihanna, The Beatles, Taylor Swift, Drake, Queen, Kendrick Lamar, Weapons N’ Roses, Justin Bieber, Aerosmith, BTS, The Weekend, Ariana Grande, and much more.

Unlike the majority of television programs and films, a great tune is taken in by fans over and over once again. Tunes that were produced 50 years earlier are still producing big quantities of cash, and artists require the support of big steady music labels now especially. In essence, purchasing a share of Universal Music Group is purchasing a share in properties like The Beatles’ White Album, Queen’s A Night At The Opera, or Kendrick Lamar’s Damn.

In Spite Of all that, as financiers, we can’t neglect the marketplace. It can’t all be ideal if the stock dropped 15% in less than a month. So, let’s begin by describing the current selloff.

Describing The Selloff – The AI Scare & & The EBITDA Decrease

After reaching the $25.7 cost per share mark, UMG’s stock started to decrease. As the business’s outcomes reveal no indication of degeneration, it was 2 other significant issues that triggered this selloff.

The AI Scare

It began on April 5th, when an expert that covers the stock devalued his score, mentioning that AI might be an existential hazard to significant labels like UMG. That has actually begun a flux of headings relating to the AI beast, which reached a climax after an AI-generated tune that utilizes Drake’s voice ended up being popular on TikTok.

The generative AI pattern which was very first begun by ChatGPT, has actually now reached the music market. Even Sir Lucian Grainge, UMG’s Chairman and CEO, resolved this concern in his opening remarks in the Q1-23 call, and it seemed like this was the only issue on experts’ minds throughout the call.

The current explosive advancement in generative AI will, if left untreated, both increase the flood of undesirable material hosted on platforms and develop rights concerns with regard to existing copyright law in the United States and other nations in addition to laws governing hallmark, name and similarity, voice impersonation and the right of promotion. Even more, we have arrangements in our business agreements that supply extra defenses. Unlike its predecessors, much of the most recent generative AI is trained on copyrighted product, which plainly breaches artists’ and labels’ rights and will put platforms entirely at chances with the collaborations with us and our artists and the ones that drive success.

— Sir Lucian Grainge – Chairman and CEO, Q1-23 Incomes Call

As an old-fashioned man who still gathers physical vinyl, I personally discover this AI scare to be overblown, to state the least. I encourage financiers to go and discover an AI-generated tune with a recognized artist’s voice, and see on their own if it comes anything near the genuine thing.

Putting my individual viewpoint aside, UMG and its artists are lawfully strengthened versus violation of their rights, consisting of unapproved usage of artists’ voices. In addition, music services like Spotify and Apple Music are bound by agreement to secure UMG’s rights versus 3rd parties. Additionally, client experience on such platforms will degrade materially if a flood of bad and phony material will occur. Currently today, these platforms hold countless tunes that aren’t taken in at all.

Here’s an example from one music platform’s own promotion divulged information. Of the 9 million material uploaders on that platform, yes, 9 million, 8.3 million, more than 92% of them have less than 1,000 month-to-month listeners and just 2% are expert or expertly striving artists.

— Sir Lucian Grainge – Chairman and CEO, Q1-23 Incomes Call

To conclude the AI point, I think this “beast” will be laid to rest really rapidly. Music services like YouTube and Deezer are working actively to take such material off their platforms, and till this will be arranged in a manner that enables the production of AI-generated tunes in a legal, non-infringing method, I think we will not see any considerable result on UMG’s service.

The EBITDA Decrease

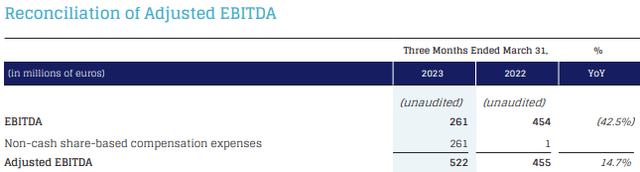

For Q1-23, UMG reported incomes of EUR2.5 B and changed EBITDA of EUR522M, representing 11.5% and 14.7% boosts from the previous year duration. On the other hand, the group reported a 43% decrease in routine EBITDA which came at EUR261M.

Prior to describing the EBITDA decrease, it is necessary to comprehend that as a European business, UMG does not report complete monetary declarations on a quarterly basis. Rather, it supplies partial monetary information every Q1 and Q3, and complete reports just on a semi-annual basis. On its quarterly reports, UMG supplies financiers with the following figures – Earnings, EBITDA, and Adjusted EBITDA.

The distinction in between EBITDA and Adjusted EBITDA, relating to UMG, is just one single account, which is share-based payment:

Universal Music Group Q1-23 Earning Release

Lots of business omit share-based payment from their adjusted figures since they can, and they do so to deceive financiers. Terry Smith dedicated a substantial area of his 2022 yearly letter to investors to resolve this phenomenon, and I encourage you to read it.

Nevertheless, UMG’s case is various. In my last post, I composed the following:

Unlike the majority of business on the marketplace, UMG went public without a currently developed equity prepare for workers. Financiers were stressed the equity strategy will be too aggressive in regards to dilution and awaited the business to fix this matter. Well, now we understand there is absolutely nothing to be frightened about. The group prepares to reward workers by means of share-based payment (SBC) at a yearly run rate of around EUR200M. This will affect EBITDA by around EUR100M each year in the future. Nevertheless, for 2023, due to IFRS accounting, the business anticipates a non-recurring shift expenditure to the quantity of EUR442M. In general, the net EBITDA effect for 2023 is anticipated to be EUR550M.

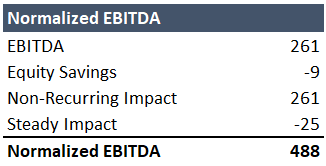

Simply put, the stock-based payment strategy will total up to around EUR100M each year on a constant state. Nevertheless, the truth that UMG started the strategy as a public business and changed some old strategies into the brand-new one, will lead to an overall non-recurring EUR550M expenditure. For that reason, the modification UMG is making objectives to deal with the non-recurring nature of the expenditure and not the truth that this is a stock-based expenditure. Nevertheless, the adjusted EBITDA figure is likewise rather deceptive, as EUR25M of the expenditure is repeating (a quarter of the consistent EUR100M each year). In addition, it consists of take advantage of non-recurring products to the quantity of EUR9M.

To sum all of it up, this is how the stabilized EBITDA, which just omits non-recurring products, need to appear like:

Produced and determined by the author utilizing information from UMG’s reports and details offered on the business’s making calls

The stabilized EBITDA shows a 19.9% margin, which is a reduction from the 20.6% in the previous year, as the business is yet to reach a balance in between SBC and incomes. Changing for SBC, margins in fact enhanced to 20.9%. As we can see, the EBITDA decrease does not paint a real image of UMG’s operations, and in 2024, these intricate changes will not be needed. When we reach that point, I think financiers who made use of the existing selloff will be substantially rewarded.

UMG’s management has actually assisted financiers beforehand for this expenditure, and it was understood. In spite of being anticipated, significant monetary sites neglected the non-recurring nature of the expenditure. For instance, Reuters developed a heading mentioning “ Universal Music repeats AI issues as quarterly revenue downturns“. Obviously, in the post itself, the author discusses that profits beat expectations.

When purchasing European business, financiers need to take into consideration the truth there will be even worse expert protection and less details about the business. Comparable to little caps, this is both great and bad, as it supplies comprehensive financiers with the chance to purchase business that are ruining experts’ expectations. However, it might likewise lead to significant selloffs without any obvious description.

In my view, this UMG selloff is offering us with an appealing chance.

Other Q1-23 Emphasizes

Although it was eclipsed by the above, Universal Music Group and its artists had another incredible quarter. For the very first time in the 56-year history of Signboard’s 200 chart, a single label, Republic (owned by UMG), had 7 of the leading 10 albums. Up until now, this year in the United States, UMG has actually had 5 of the 6 most taken in albums with releases by Drake, City Boomin, Taylor Swift, and Morgan Wallen who had 2. UMG’s publishing department ended up being the very first publisher to hold a higher than 30% market share in 3 successive quarters considering that tracking started in 2014.

The Artist-Centric Technique

UMG continued with the implementation of its artist-centric technique, which intends to incentivize music platforms to concentrate on satisfying deep artist-fan relationships and enhance the user experience on their platforms by minimizing inferior material and highlighting the artists and the music that clients appreciate the majority of. In basic words, UMG will charge lower charges from platforms that support its artists, whereas platforms that attempt to sway their clients into the 92% non-professional material will be charged more. This effort should not be ignored. Platforms like Spotify are assigning a great deal of resources to minimizing their reliance on UMG, as it’s nearly difficult for them to create make money from music due to the high part of incomes UMG takes. If it prospers, the artistic-centric technique might lower the dispute of interest in between UMG and the music banners, without UMG quiting revenues.

Marketing Market

UMG reported a 2% decrease in ad-supported incomes. As business like Meta ( META) and Alphabet ( GOOG) ( GOOGL) see slower development and decreases in their advertisement companies, UMG is no exception. It is necessary to keep in mind that the decrease is an outcome of advertisement rates reducing, rather than lower usage of ad-supported music streams. Hence, when the advertisement market enhances, this part of business need to go back to high single-digit development too. Management anticipates such healing as early as the 2nd half of the year.

Retailing

Merchandising incomes decreased by 4% in the quarter, as an outcome of hard contrasts to 2022. In the previous year, the post-Covid rebound led to really strong touring and selling. In the future, this section of business need to continue to see some cyclicality, however over the long term, retailing incomes are forecasted to grow, as UMG broadens the variety of artists it represents for retailing functions, which presently totals up to 200.

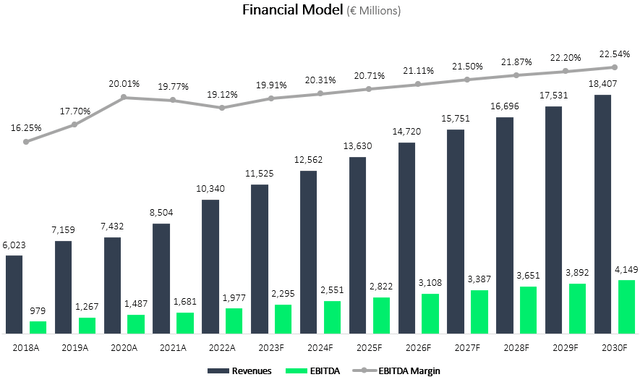

Updated Financial Design

I utilize an affordable capital method to assess UMG’s reasonable worth. I anticipate UMG to grow incomes at a CAGR of 7.5% in between 2023-2030, which remains in line with the management’s long-lasting assistance of high single-digit development. I approximate incomes will grow at this rate due to cost boosts of streaming services, a boost in overall worldwide customers, and the enhancement of money making in social networks (primarily TikTok). In addition, I think marketing spending plans will recuperate in the future. Concerning cost boosts, management discussed the cost boosts from Amazon ( AMZN) and Apple ( AAPL), which have both increased their music services rates by 10.0%. Management anticipates the complete result of those boosts to be displayed in the business’s 2023 outcomes.

Relating To EBITDA, I forecast margins to increase incrementally approximately 22.5% in 2030, Which is listed below the management’s assistance for mid-twenties EBITDA margins. I think margins will enhance due to a much better mix in between physical and digital usage, in addition to a lower portion of retailing incomes.

Produced by the author based upon information from UMG’s monetary reports and the author’s forecasts

Taking a WACC of 8.3%, I approximate UMG’s reasonable worth at EUR46.5 B, or EUR25.6 per share, which represents a 29.0% advantage compared to its market price on the day of composing. Transforming those numbers to the U.S noted ADR, I approximate its reasonable worth at $28.5, based upon the existing EUR/ USD rate.

An essential explanation to make, I increased the WACC and reduced my EBITDA margin forecast. Naturally, this leads to a lower reasonable worth than my previous post. I choose to be more conservative after the last quarter, as I am a little prevented by the time it takes UMG to reach a constant accounting state, after going public nearly a year and a half earlier. I am still exceptionally bullish on UMG’s service, and I anticipate the business’s reports in 2024 and beyond will be much smoother.

Near-Term Forecasts

In my previous post, I offered the following forecasts:

For Q1-2023 and H1-2023, I anticipate incomes of EUR2.5 B and EUR5.3 B, respectively, and net EBITDA of EUR404M and EUR877M, respectively.

As we can see, my earnings forecast was area on, and my EBITDA forecast came a little lower compared to the business’s stabilized EBITDA. Hence, I declare my H1-23 earnings assistance and upgrade my stabilized EBITDA forecast to EUR1.0 B. We’ll satisfy here after the H1-23 results, and see if I require to upgrade my presumptions.

Conclusion

Universal Music Group, the leader of the music market which represents the most effective artists worldwide, is growing and need to continue to grow at a double-digit rate. In spite of that, the stock is now trading at a 16.5 forward EV/EBITDA several, thanks to a mistaken selloff and what I discover as an immaterial AI scare. With 14.7% EBITDA development, UMG supplies a very uncommon chance to purchase a long-lasting compounder at a numerous that equals its development rate. I restate my Strong Buy score and approximate a 29.0% advantage.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please know the threats connected with these stocks.