Your social networks feed today is most likely abuzz with claims that the FHFA’s brand-new loan level rates modifications (LLPAs) on standard home loans prefer purchasers with bad credit over purchasers with excellent credit.

” A 620 FICO rating gets a 1.75% cost discount rate and a 740 FICO rating pays a 1% cost” checks out one screenshot from a Fox News section making the rounds on social.

Here’s the important things: that’s not real!

We’re going to break down the FHFA’s most current loan-level rates modifications, the majority of which are currently in result after being revealed in January

Let’s begin with the essentials: The rates grid includes credit bands that refer in advance costs based upon the home loan item, loan-to-value ratio, tenancy, and so on. Here’s the present design

As you can see, the grid completes at a 740 credit report, indicating anybody with a FICO rating of 740 would pay the very same rate on costs as somebody with a rating of 780. Under the present design, risk-based rates (RBP) has actually corresponded. Typically speaking, the lower the credit report and greater the LTV, the greater the in advance cost to alleviate the danger.

The brand-new design fine-tunes the risk-based rates formula in considerable methods.

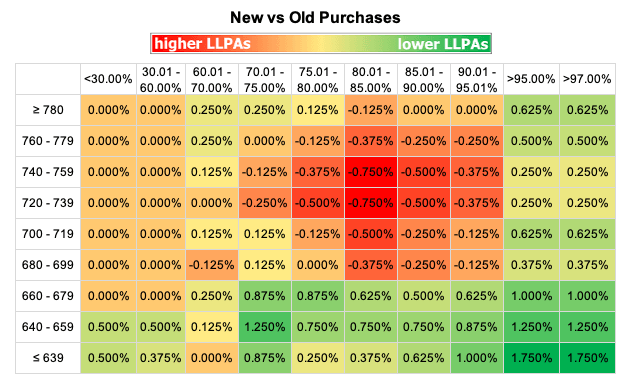

Here’s the brand-new rates matrix on purchase loans, which enters into result on May 1 however virtually speaking has actually remained in location for more than a month. (This isn’t the grid the GSEs utilize, however it does reveal where modifications are. Significant props to Matthew Graham of Home Loan News Daily for producing this color-coded chart)

There are brand-new credit bands beyond the 740. You’ll likewise discover that the FHFA has actually increased costs on greater credit rating and lower LTVs. At the very same time, the FHFA has actually reduced costs for customers with lower credit rating full-stop.

Let’s get one crucial thing out of the method– FICO customers with lower ratings are not improving rates than greater FICO customers. If you have much better credit, you’ll pay less than somebody with even worse credit. However there are some crucial modifications that total up to a cross-subsidy of sorts.

* Customers with credit rating in between 680 and 779 with deposits in between 10 and 20% will see a cost boost of in between 0.13% and 0.75%.

* On the other side, newbie property buyers with low or moderate home earnings pay no included costs whatsoever, and customers who put less than 5% down throughout all FICO ratings will benefit.

* This chart does not reveal it, however customers who will see the biggest cost boost are those looking for a cash-out re-finance, where 60% of the population examined by Experian would have experienced greater costs with a typical boost of 55 bps.

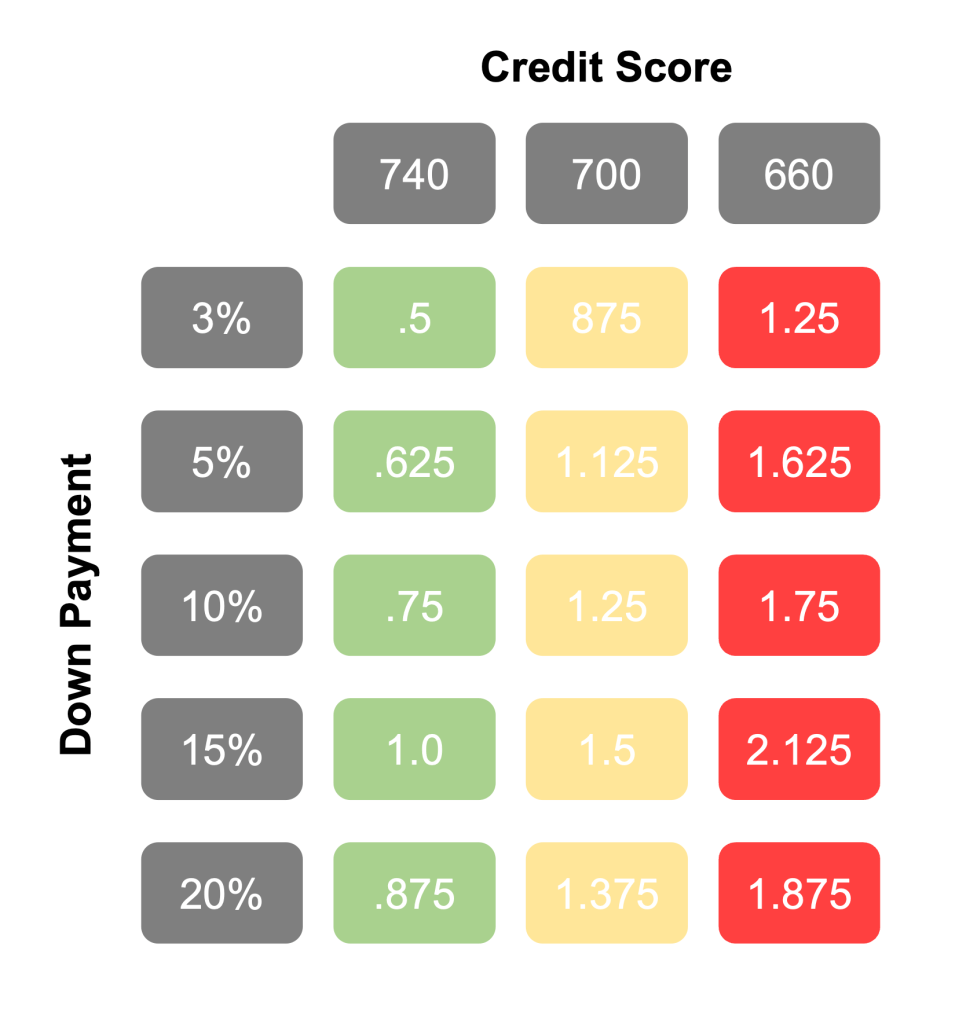

Rebecca Richardson, a loan officer at UMortgage, had a clever take on the modifications. Let’s have a look at her example, in which the list prices of the house is $400,000 and the situations are credit rating of 740, 700 and 660, with corresponding deposits of 3%, 5%, 10%, 15% and 20%.

” Individuals with excellent credit are not getting punished, nor are they funding low credit report purchasers,” Richardson stated in a LinkedIn post. “Which’s mainly since individuals who remained in the downpayment cheat code zone where they were putting more than 15% down however less than 20% had their terms funded by low-cost home loan insurance coverage, which generally provided the very same terms as someone who was putting 25% down. To me these modifications are more about bringing things in line where the real danger is based off of downpayment.”

ALRIGHT, BUT WHY IS THE FHFA DOING THIS?

This rates modification remains in line with the Biden administration’s mentioned objective to supply real estate funding chances to newbie property buyers with lower credit rating and those in underserved neighborhoods.

There were constantly going to be winners and losers when the FHFA chose to alter the rates matrix. In this case, a part of good-but-not-outstanding credit customers will get a little a shock, a couple thousand dollars worth in many cases.

I believe the FHFA is making a computation that better-credit customers will still purchase the house regardless of a boost in upfront costs and have sufficient skin in the video game that danger isn’t high. At the very same time, a couple thousand dollars might be the distinction in between a purchaser with a lower credit report attaining homeownership or not.

Should this policy modification come at the expenditure of those who are “doing things the proper way,” as James Duncan, director of marketing at Thrive Home Loan, put it? It’s a reasonable concern. This is a significant modification for the market and setting a precedent on moving far from a pure risk-based design is … a danger for the FHFA (even if the firm disagrees with that analysis).

Everybody acknowledges that the GSEs require to be much better capitalized, however this policy would appear to injure middle-class customers and objective to benefit those who are most likely to be in the FHA classification. We’ll understand quite quickly if this is a policy failure.

What do you consider it? Share your ideas with me and the techniques you’re utilizing to assist purchasers make the very best option for their specific circumstance.

DataDigest is a newsletter in which HW Media Handling Editor James Kleimann breaks down the greatest stories in real estate through an information lens. Register here! Have a topic in mind? Email him at [email protected]

.