Sergei Dubrovskii

Note:

I have actually covered Helix Energy Solutions Group, Inc. ( NYSE: HLX) formerly, so financiers ought to see this as an upgrade to my earlier protection of the business.

9 months earlier, I prompted readers to think about a financial investment in shares of leading overseas energy specialized companies Helix Energy Solutions Group, Inc., or “Helix,” to acquire direct exposure to an awaited multi-year healing in overseas oil and gas services.

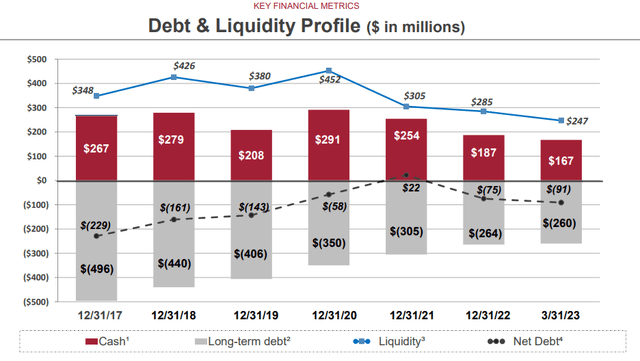

In contrast to lots of overseas drillers, Helix has actually done rather well for the majority of the market recession, as capital have actually been increased by a variety of high-margin tradition agreements. As an outcome, the business has not just handled to survive however likewise has actually minimized its financial obligation significantly recently:

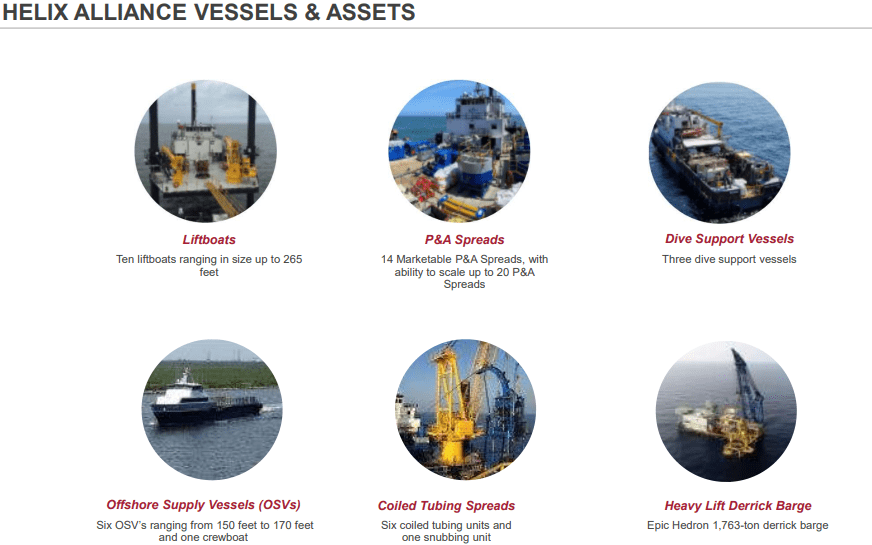

Please keep in mind that the decline in money in 2015 has actually been brought on by the current acquisition of the Alliance Group of Business (” Alliance”) for $120 million in money, a Louisiana-based service provider of services in assistance of the upstream and midstream markets in the Gulf of Mexico rack, consisting of overseas oil field decommissioning and improvement, job management, crafted services, intervention, upkeep, repair work, heavy lift, and industrial diving services.

Business Discussion

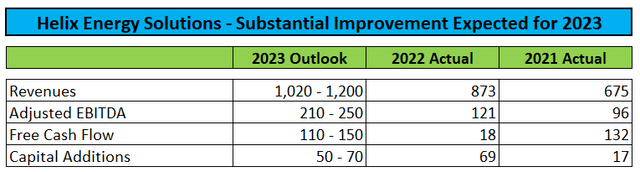

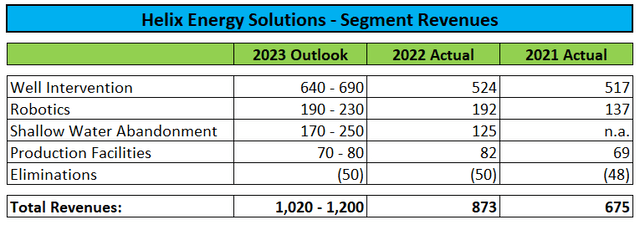

While 2022 was more of a shift duration, with a number of vessels going through regulative examinations, a sluggish return for the North Sea market, and a variety of systems carrying out short-term work at minimized rates, Helix completed the year better than initially anticipated and supplied a good outlook for 2023:

Especially, the just recently obtained Shallow Water Desertion sector (the previous Alliance company) is anticipated to continue its current outperformance, with year-over-year development possibly approaching 100%:

After the close of Monday’s routine session, Helix reported better-than-expected very first quarter outcomes and declared its full-year outlook. Nevertheless, market individuals obviously differed with the consecutive, seasonal decline in both the leading and bottom lines and somewhat unfavorable totally free capital for the quarter.

After the stock sold 15% in early trading, management’s good efficiency on the teleconference assisted cutting losses, however shares nonetheless completed the session down by more than 8% on a rather weak day for the oil and gas sector.

On the call, CEO Owen Kratz specified that the business’s efficiency to date in 2023 has actually been going beyond management’s preliminary expectations and EBITDA is really trending towards the upper end of the assistance variety:

As you have actually heard, 2023 has actually begun well, Helix is presently surpassing our preliminary 2023 expectations. Our preliminary assistance for the year was $210 million to $250 million EBITDA. And while it might be prematurely to upgrade the assistance due to the regular exchanges of the rest of the year, we can state that we’re presently trending towards the upper end of the assistance. Q1 is usually a bit unpleasant. It’s affected by just how much of the previous year’s customers’ allocated work brings into the New Year. How early the New Year’s allocated work starts and just how much upkeep deal with our properties as set up.

Naturally, overseas work is constantly affected due to the seasonality of the weather condition. This is likewise why we traditionally set up dry docks and associated CapEx expenses for Q1. The unfavorable effect to our quarterly totally free capital is simply a timing problem arising from the front-end loading of this CapEx.

The year-over-year contrast of Q1 results shows that need is strong and increasing. Even while we sustained a significant quantity of set up upkeep throughout the quarter and the Q7000 remained in transit from West Africa to Asia Pacific area, outcomes were favorably affected by having our 2 vessels in Brazil back on multiyear agreements, succeeding intervention work at much better rates. These and other rates were concurred prior to the rise in need. The agreements do have actually intensifying rates integrated in and future prices of choices implies we anticipate to see ongoing enhancing outcomes over the next couple of years.

In addition, Helix has actually started buybacks under its just recently revealed as much as $200 million share bought program:

Throughout the very first quarter, we bought 660,000 shares of our stock for around $5 million. As we continue carrying out the program, we will stabilize the requirement to handle and money our operations, capital invest, consisting of the Alliance earn-out, developing financial obligation and tactical financial investment chances together with the share bought program. We prepare to normally align this program with our capital generation and at first target releasing 25% of our totally free capital, keeping in mind the seasonality of our company.

Presuming Helix will create $140 million in totally free capital this year, buybacks might approach $35 million, or around 3.5% of impressive shares and present trading rates.

Please keep in mind that the business will need to pay back $30 million in senior convertible financial obligation later on this year, followed by a $40+ million earn-out payment associated with the above-discussed Alliance acquisition in 2024. Nevertheless, offered expected even more enhancements in totally free capital generation next year, this ought to not be a concern.

Even with Helix assigning a few of its totally free capital to share buybacks, the business is most likely to end the year in a net money position.

On the call, management likewise hinted to price escalation stipulations in a variety of long-lasting agreements that have actually been signed prior to the current rally in charter rates. As rates change closer to market value with time, incomes and capital will get another increase.

Bottom Line

Helix Energy Solutions Group, Inc. reported better-than-expected very first quarter outcomes and supplied a good outlook for the year, with EBITDA presently trending towards the upper end of the initially forecasted variety.

In addition, the business anticipates to designate 25% of totally free capital to share repurchases this year.

2024 ought to be an even much better year for Helix as brand-new work is granted at greater charter rates, while a variety of existing agreements are anticipated to take advantage of cost escalation stipulations.

With the overseas oil and gas market still in the early innings of an awaited multi-year upcycle, Helix Energy Solutions Group, Inc. financiers ought to utilize Tuesday’s baseless sell-off to start or contribute to existing positions.

Missing a significant economic downturn and resulting weak point in oil rates, Helix Energy Solutions’ shares ought to continue to exceed the marketplace moving forward.

Offered Tuesday’s problem, I am updating my ranking from “ Buy” to “ Strong Buy“

In spite of some current volatility in oil rates and associated stocks, I stay favorable on the whole overseas services market, consisting of leading offshore drillers Transocean ( RIG), Seadrill ( SDRL), Valaris ( VAL), Noble Corp. ( NE), Diamond Offshore Drilling ( DO), Borr Drilling ( BORR) and assistance service providers like Tidewater ( TDW) and SEACOR Marine Holdings ( SMHI).