{“page”:0,” year”:2023,” monthnum”:4,” day”:11,” name”:” results-from-the-recent-sp-500-net-zero-2050-paris-aligned-sustainability-screened-index-rebalance-march-2023″,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Core Product Management”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Fei Mei Chan”,”title”:”Director, Core Product Management”,”image”:”/wp-content/authors/feimei_chan-214.jpg”,”url”:”https://www.indexologyblog.com/author/feimei_chan/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Director, U.S. Equity Indices”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Berlinda Liu”,”title”:”Director, Multi-Asset Indices”,”image”:”/wp-content/authors/berlinda_liu-191.jpg”,”url”:”https://www.indexologyblog.com/author/berlinda_liu/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Strategy Indices”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, ESG Index Product Strategy, Latin America”,”image”:”/wp-content/authors/maria_sanchez-243.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-271.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Senior Director, Strategy Indices”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Ben Leale-Green”,”title”:”Associate Director, Research & Design, ESG Indices”,”image”:”/wp-content/authors/ben_leale-green-342.jpg”,”url”:”https://www.indexologyblog.com/author/ben_leale-green/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-516.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Sharon Liebowitz”,”title”:”Head of Innovation”,”image”:”/wp-content/authors/sharon_liebowitz-508.jpg”,”url”:”https://www.indexologyblog.com/author/sharon_liebowitz/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Michael Mell”,”title”:”Senior Director, Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Jason Ye”,”title”:”Director, Strategy Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Strategy & Volatility Indices”,”image”:”/wp-content/authors/Ari.Rajendra-400.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”}]

Arise From the Current S&P 500 Net Absolutely No 2050 Paris-Aligned Sustainability Screened Index Rebalance (March 2023)

-

Classifications

ESG -

Tags

Carbon Emissions, environment, Environment Shift, decarbonization, ESG, EU Environment Shift Criteria, EU Paris-aligned Benchmarks, greenhouse gas, Net Absolutely No, Paris Environment Contract, S&P 500 Net Absolutely No 2050 Paris-Aligned Sustainability Screened Index, S&P PACT, sustainability

Narottama Bowden,

The author wishes to thank Clara Arganaraz, Index Supervisor of the S&P 500 ®(* )Net Absolutely No 2050 Paris-Aligned Sustainability Screened Index, for her contributions to this post. S&P Dow Jones Indices just recently finished the rebalancing of all indices that intend to satisfy the minimum requirements for EU Environment Shift and EU Paris-Aligned Benchmarks.

1 This consists of the rebalancing of the S&P 500 Net Absolutely No 2050 Paris-Aligned Sustainability Screened Index, which is created to determine the efficiency of qualified equity securities from the S&P 500, chosen and weighted to be jointly suitable with a 1.5 ºC international warming environment circumstance at the index level, to name a few environment, ecological and sustainability goals. The index is created to accomplish a range of ESG goals through using sustainability screening in its eligibility requirements and an optimization procedure in constituent choice and weighting, consisting of a lowered total greenhouse gas (GHG; revealed in CO

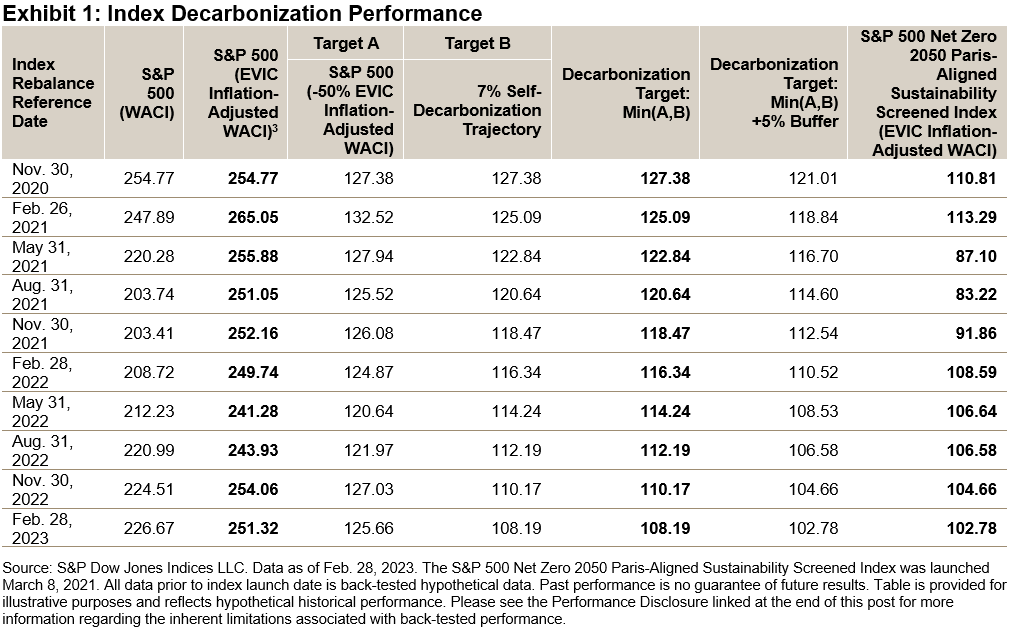

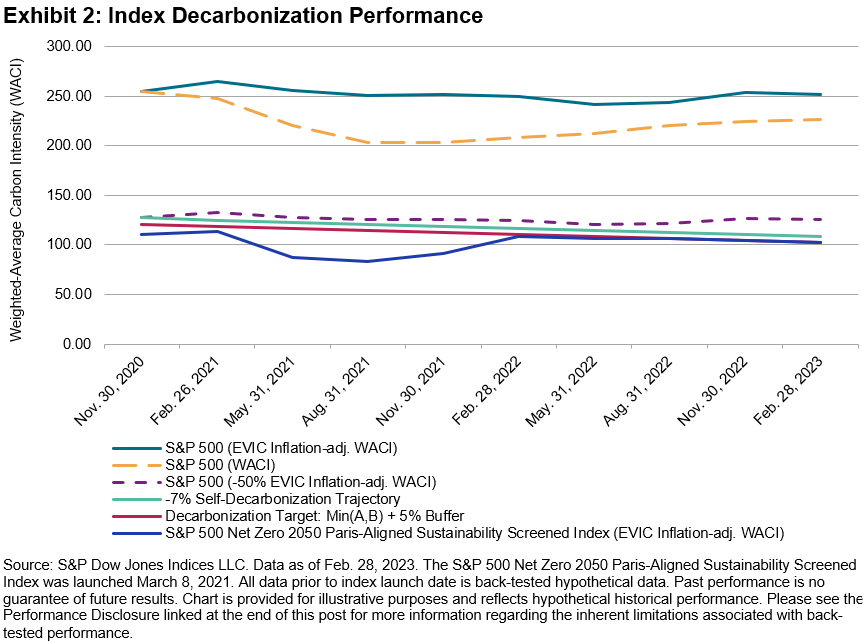

2 equivalents) emissions strength compared to its hidden index (the S&P 500) by a minimum of 50%. It likewise has a minimum self-decarbonization rate of GHG emissions strength in accordance with the associated trajectory indicated by the Intergovernmental Panel on Environment Modification’s (IPCC) most enthusiastic 1.5 ºC circumstance, corresponding to a minimum of a 7% GHG strength decrease typically annually. Since the index’s Feb. 28, 2023, rebalancing recommendation date (and all previous rebalances), the index’s business worth consisting of money (EVIC) inflation-adjusted weighted-average carbon strength (WACI)

2 attained its needed level of decarbonization– the minimum of either half the S&P 500 WACI or its 7% self-decarbonization trajectory WACI as at the rebalance recommendation date. The index attained a relative decarbonization to the hidden index of 59.10% at an EVIC inflation-adjusted WACI at the needed level (102.78 ). The index looks for to accomplish a range of other goals at the same time, and once again, had the ability to accomplish them effectively at the current rebalance.

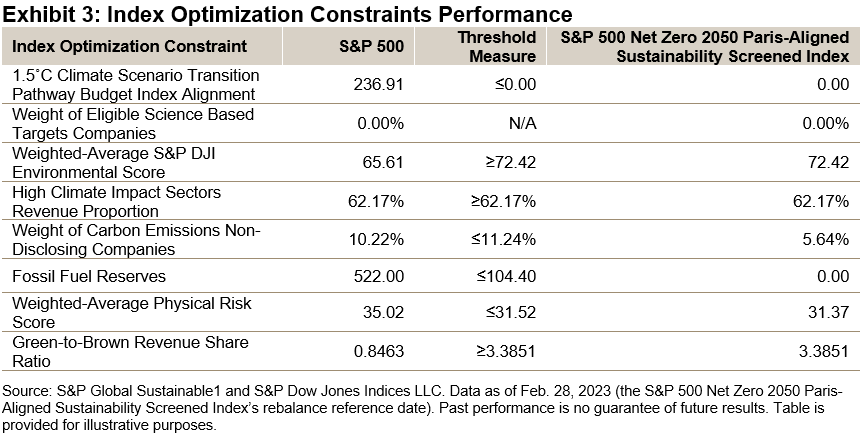

The index’s weighted-average 1.5 ËC Environment Shift Path Budget Plan Positioning

- 4 was no, indicating the index is 1.5 ËC Environment Scenario-aligned at the index level. 5 The index’s weighted-average S&P DJI Environmental Rating attained the minimum level needed at this rebalance (72.42) based upon this restraint in the approach, likewise going beyond ball game of the hidden index (65.61 ).

- The index’s high environment effect sectors earnings direct exposure was at least as high as in the hidden index, as needed by the

- minimum requirements for EU Environment Shift Criteria and EU Paris-aligned Benchmarks The index had a lower direct exposure to business considered to insufficiently reveal their GHG emissions, at a level well listed below its optimal direct exposure allowed by the approach.

- The index did not have any direct exposure to business with nonrenewable fuel source reserves, regardless of the approach allowing an optimum of 20% of the direct exposure of the underlying universe.

- The index-level physical threat rating (31.37) was listed below the needed level since the rebalance (31.52 ), as specified by the approach, and it was lower than the hidden index’s rating (35.02 ).

- 6 The index’s ratio of green earnings to brown earnings was 4 times greater than in the hidden index, as needed by the approach.

- The S&P 500 Net Absolutely No 2050 Paris-Aligned Sustainability Screened Index looks for to accomplish a series of environment modification, ecological and sustainability goals, and once again the index has actually fulfilled these aspirations.

1

Commission Delegated Guideline (EU) 2020/1818 of 17 July 2020 supplementing Guideline (EU) 2016/1011 of the European Parliament and of the Council as relates to minimum requirements for EU Environment Shift Criteria and EU Paris-aligned Benchmarks. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32020R1818&from=EN 2

Procedures are computed in metric lots of carbon dioxide-equivalent emissions per USD 1 countless EVIC (tCO2e/USDmn). To find out more on how this metric is computed, see “Weighted-Average Carbon Strength (WACI)” in the Constraint-related Meanings area of the S&P 500 Net Absolutely No 2050 Paris-Aligned Sustainability Screened Index Approach 3

To find out more on how the WACI is changed for EVIC inflation, see “Inflation Change” in Area 3, Part 4 of the EU Required ESG Disclosures Appendix in the S&P Paris-Aligned & & Environment Shift Index Household Criteria Declaration 4

To find out more on how this metric is computed, see the Constraint-related Meanings and Optimization Restrictions areas of the S&P 500 Net Absolutely No 2050 Paris-Aligned Sustainability Screened Index Approach, and the S&P Dow Jones Indices: ESG Metrics Referral Guide 5

A step at or listed below no implies the index is 1.5 ËC Environment Scenario-aligned at the index level. 6

A lower rating is connected with less physical threat direct exposure at the index level.

The posts on this blog site are viewpoints, not guidance. Please read our

Craig Lazzara

-

Equities,

S&P 500 & & DJIA Tags -

active management,

active share, Active vs. Passive, finest concepts, concentration, Craig Lazzara, equities, high conviction, index efficiency, institutional financier, passive management, S&P 500,(* )skewness, Ability vs. Luck, SPIVA, U.S. Core, United States FA Anybody acquainted with our (* )SPIVA Scorecards will acknowledge that the majority of active supervisors stop working the majority of the time. Anybody acquainted with active supervisors will acknowledge that they can be rather innovative in proposing both

reasons and solutions for this historic record. Among their most consistent tips, in truth, is that active management merely isn’t active enough, leading some possession owners to look for more “ direct exposure to focused active supervisors“ This method is misdirected for a minimum of 3 factors: Initially, it presumes that the level of a supervisor’s optimism about a stock anticipates its future efficiency. The argument for concentration always indicates both

that stock choice ability exists, which it is especially severe at its extremes Not just, e.g., needs to a supervisor have the ability to construct a 50-stock portfolio that will surpass, he needs to likewise have the ability to determine which 10 stocks of the preliminary 50 are the very best of the very best. For focused portfolios to surpass, both presumptions– that ability exists, which it is severe at the extremes– should hold true at the same time. There is no proof that either of them is. If it exists at all,

the requisite ability needs to be rather unusual. If this were not so, active funds would not be dealing with an efficiency difficulty in the very first location. 2nd, under sensible presumptions, focusing equity positions raises the likelihood of underperformance Among the most constant qualities of international equity markets is that returns are favorably manipulated– when graphed, they have a long best tail, as displayed in Exhibition 1. This is fundamentally sensible, given that a stock can just lose 100%, however has endless benefit.

For the twenty years ending in 2022, the average return of S&P 500 members (throughout their index subscription) was 93%, far listed below the typical return (390%). Just 31% of the index’s constituents outshined the typical stock. In such a market, a supervisor’s success depends on his ownership of a reasonably little number of strong entertainers.

The more focused a portfolio is, the less most likely it is to own the huge winners Third, focused portfolios make it more difficult to compare signal and sound While some supervisors might be competent, none are foolproof. A supervisor who is competent however not foolproof will take advantage of having

more, instead of less, chances to show his ability A helpful example is to your house in a gambling establishment: on any offered spin of the live roulette wheel, your house has a little possibility of winning; over countless spins, your house’s benefit is frustrating. Competent supervisors in some cases underperform; unskillful supervisors in some cases surpass. The difficulty for a possession owner is to differentiate real ability from all the best. The difficulty for a supervisor with real ability is to show that ability to his customers. The difficulty for a supervisor without real ability is to obscure his insufficiency. Focused portfolios make the very first 2 jobs harder and the 3rd simpler. The posts on this blog site are viewpoints, not guidance. Please read our

Disclaimers

Classifications Equities, S&P 500 & & DJIA

S&P Dow Jones Indices

-

2023,

diversity, -

Israel,

S&P 500, S&P MidCap 400, S&P SmallCap 600, Sherifa Issifu, U.S Equity Indices, U.S., U.S. Core, U.S. Equities, United States Our brand-new term paper reveals that Israeli financiers have a higher house predisposition than other countries: they have actually invested more greatly in domestic equities and designated to the U.S. in lower percentages than their industrialized markets peers such as the U.K.

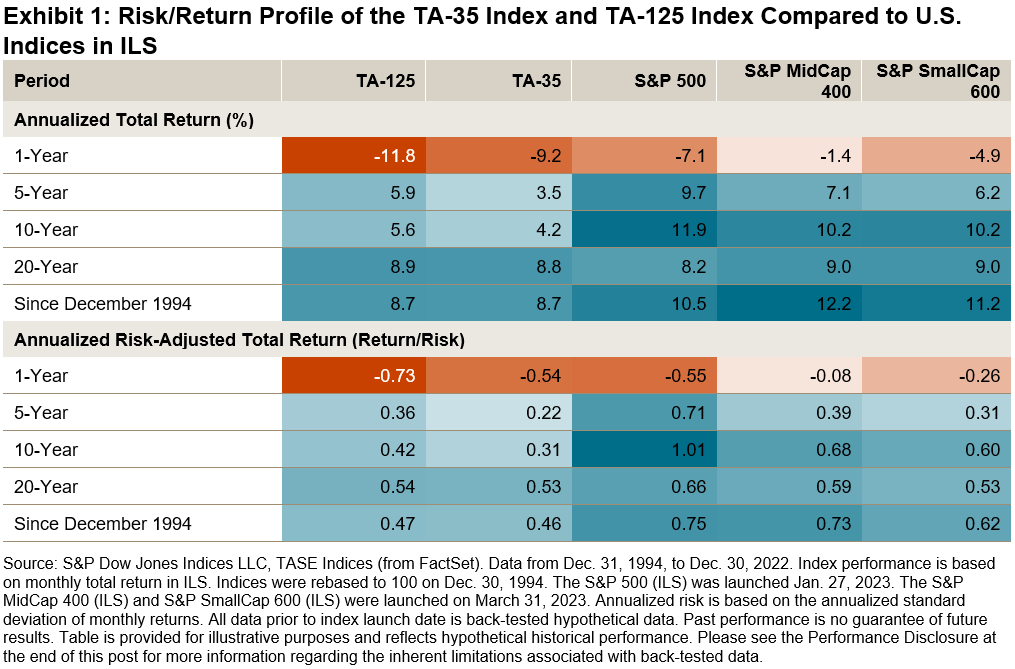

, Europe and Canada With U.S. equities comprising almost 60% of the S&P Global BMI’s market capitalization, such allowances might be neglecting a significant part of the international equity chance set. Including some U.S. decoration to a domestic Israeli equity allotment likewise traditionally offered greater return in both outright and risk-adjusted terms, and might provide the capacity for diversity. U.S. Equities Have Outperformed Their Israeli Equivalents over Numerous Horizons The S&P 500

®

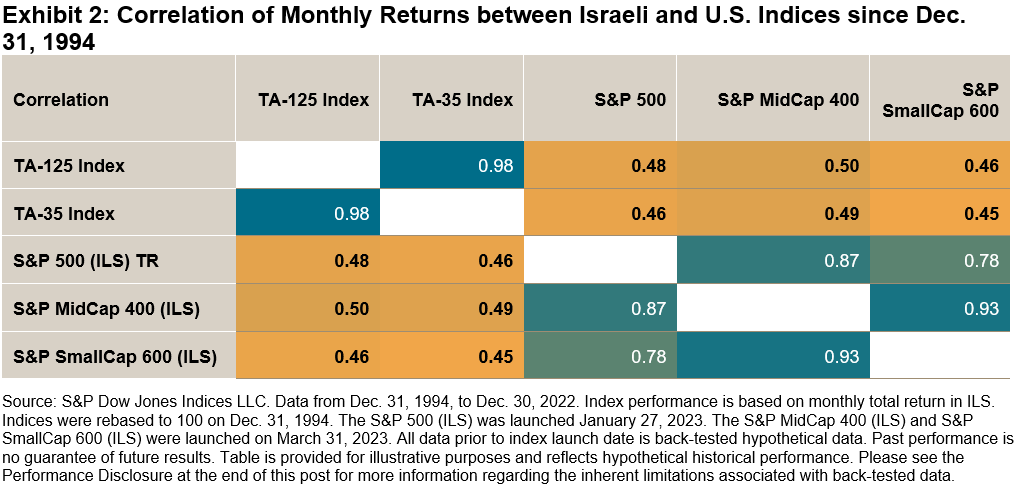

,& S&P MidCap 400 ® and S&P SmallCap 600 ® outshined the Israeli equity market– as represented by the TA-125– by 15%, 11% and 9%, respectively, in Q1 2023 (all in ILS and overall return terms). Exhibition 1 reveals that this phenomenon is not simply a current one: U.S. equities have actually outshined their Israeli equivalents over brief-, medium- and long-lasting horizons in both outright and risk-adjusted terms. Comparable outcomes are observed for USD-denominated variations of the indices. Taking a look at the connection of U.S. equities with the TA-125 and blue-chip TA-35 in Exhibition 2 we can see that all of the S&P Composite 1500 ®

The outperformance of U.S. equities, and their lower long-run connections with Israeli equities given that December 1994, has actually suggested that including U.S. equities to an Israeli equity allotment might have enhanced returns, with lower volatility. Exhibition 4a reveals the annualized return and volatility figures for different theoretical mixes of the S&P 500, S&P MidCap 400 and S&P SmallCap 600 with the TA-125, beginning with a 100% Israeli allotment and relocating 10% increments to a 100% U.S. equity allotment. Each theoretical portfolio rebalances back to the target weights at the end of each quarter. In addition to the possible efficiency and diversity advantages, integrating U.S. equities might assist Israeli financiers to reduce domestic sector predispositions. Compared to the S&P 500, Israeli equity indices like the TA-125 and TA-35 are greatly obese Financials and Realty, while underweighting Infotech by 11%, as displayed in Exhibition 4b. The S&P 500’s biggest constituents consist of a few of the world’s most widely known “huge tech” business, such as Apple and Microsoft. While U.S. equities are not the only method to look for diversity, financiers might want to assess their U.S. equity direct exposure in order to prevent neglecting a significant part of the international chance set. A basic grow of U.S. equities might not suffice to embellish a house, therefore one might wish to think about a genuine twist to determine the complete capacity of U.S. equities throughout capitalization varieties,

particularly as smaller sized U.S. equity sectors are as big as other nations’ stock exchange

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

Tags 2023, diversity,

S&P Dow Jones Indices

-

2023,

Active vs. Passive, -

dispersion,

IIS, Index Financial Investment Technique, japan, Japanese equities, Maya Beyhan, S&P Japan 500, S&P Japan MidSmallCap, SPIVA, SPIVA Japan The inaugural S&P Indices versus Active (SPIVA ® )U.S. Scorecard was released in 2002, and has actually given that been reached Australia, Canada, Europe, India,

Japan, Latin America, South Africa and the Middle East & & North Africa (MENA), permitting financiers to experience the active versus passive argument on a worldwide scale. The SPIVA Japan Scorecard determines the efficiency of actively handled funds domiciled in Japan versus their particular S&P DJI contrast criteria over different time horizons, covering big-, mid- and small-cap, along with worldwide and international equity funds. According to the just recently released SPIVA Japan Year-End 2022 Scorecard

,

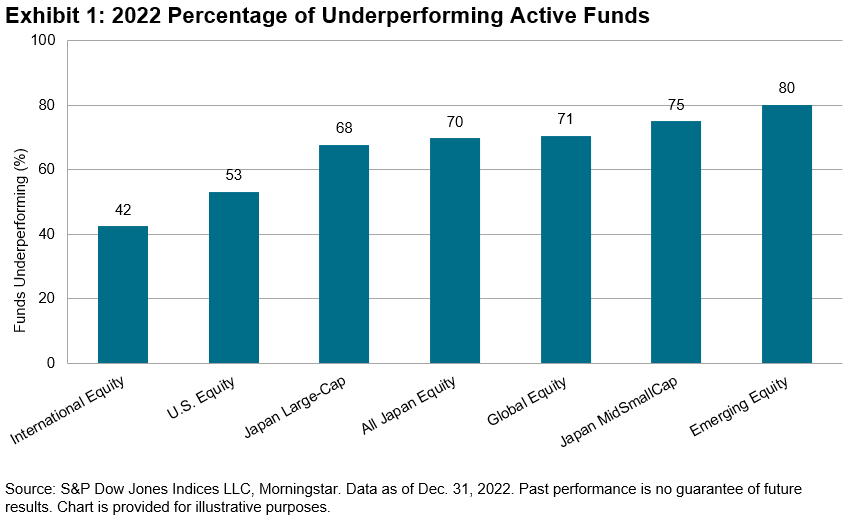

70% of All Japanese Equity funds underperformed the broad-based S&P Japan 500 over the full-year 2022, and majority of equity funds underperformed their criteria in every reported classification, other than for International Equity funds, which had an underperformance rate of 42% (see Exhibition 1). Numerous elements of the marketplace environment in 2022 stuck out as possibly a sign of a beneficial environment for active supervisors in Japanese equities over the duration For instance, the biggest business (as represented by the S&P/ TOPIX 150) had lower returns than little- and mid-sized Japanese business (as represented by the S&P Japan MidSmallCap; see Exhibition 2). This possibly developed a tailwind for active supervisors, as funds are usually less most likely to own all the biggest stocks at market weight.

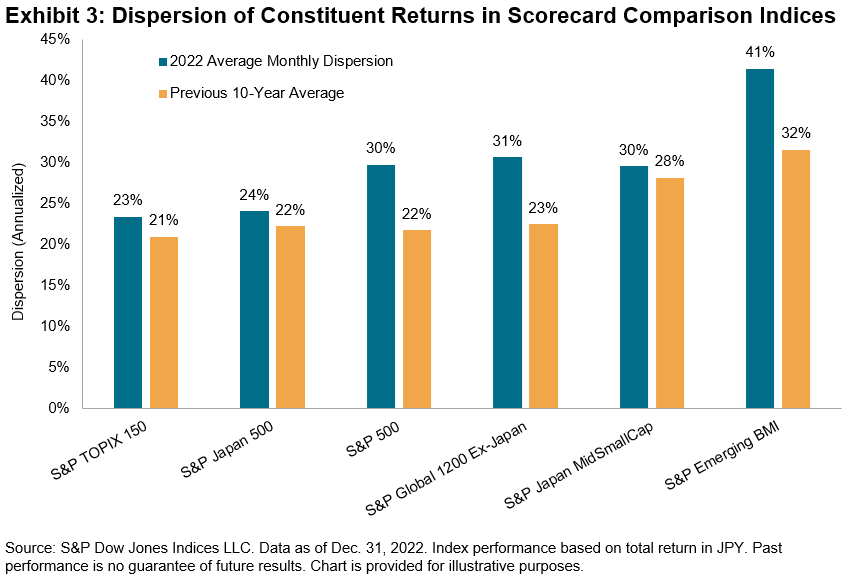

2nd, chances for outperformance through stock choice were plenty in 2022. At the benchmark level, dispersion is the procedure of

the degree to which securities vary– above or listed below– the typical efficiency 1 As highlighted in Exhibition 3, the typical month-to-month annualized dispersion in the securities of the scorecard contrast indices was greater in 2022 than was common over the previous ten years. Due to the expenses connected with running any portfolio, an actively handled fund might still underperform even

if it selects outshining securities For an active supervisor, the secret is to discover not simply securities that surpass, however those that surpass materially Sometimes when most securities carry out likewise, distinction is certainly more difficult to discover. Then, there are other times when the distinction in between winners and losers is bigger. Taken completely, the information in the SPIVA Japan Year-End 2022 Scorecard recommend that amongst the active funds used in Japan,

International Equity supervisors were fairly more effective in turning chances into favorable results. Nevertheless, active funds in all the other fund classifications had a hard time to make the most of the abundance of chance provided in 2022’s market environment. 1 For instance, see Edwards, Tim and Craig J. Lazzara, “

Dispersion: Measuring Market Chance

,” S&P Dow Jones Indices, 2014. The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

Tags 2023, Active vs. Passive,

Tags

-

Active vs. Passive,

core, -

equities,

GICS, GICS modifications, indexing, large-cap equities, large-cap ETFs, shared funds, S&P 500, S&P Indices vs. Active, SPIVA, U.S. Equities, United States FA How does indexing work for large-cap equities? S&P DJI’s Hamish Preston and State Street Global Consultant’s Michael Arone take a more detailed take a look at lessons from twenty years of SPIVA, consisting of charge cost savings, outperformance, and what the current GICS ® modifications suggest for sectors and markets moving on. https://www.youtube.com/watch?v=8EOu6EZLks4 The posts on this blog site are viewpoints, not guidance. Please read our