sasirin pamai

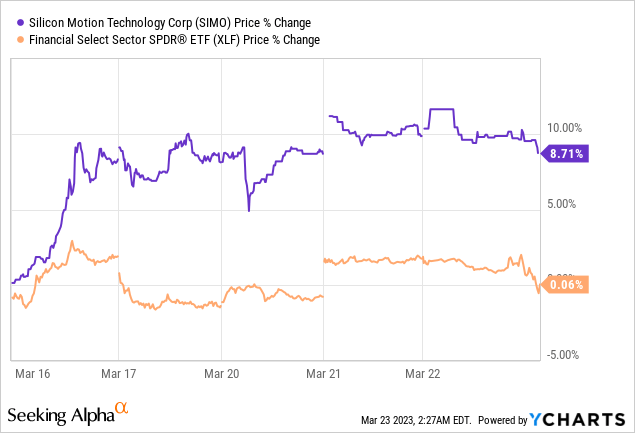

Risk-averse financiers might decide to keep away from the banking world where regardless of the federal government backstopping banks, unpredictability still rules with the Financial Select Sector SPDR ETF ( XLF) hardly handling to recuperate its losses in the past 5 days. On the other hand, Taiwan-headquartered Silicon Movement Innovation ( NASDAQ: SIMO) got 8.71% in the very same duration, as displayed in the blue chart listed below. This is a substantial gain and is definitely favorable in a market where unpredictability dominates.

Nevertheless, at around $65.5, the stock is well listed below its mid-2022 high of $95.15 when U.S.-based MaxLinear (NASDAQ: MXL) tried to get it to the tune of $3.8 billion. The offer presently being examined by China’s SAMR or State Administration for Market Policy stays on track to be nearby mid-year, as I will elaborate upon later on.

Nevertheless, my goal with this thesis is to reveal that even if the offer is not authorized due to an escalation of geopolitical stress in between the United States and China, this is a business worth thinking about, not just due to the fact that it has actually handled to exceed development in the PCs, tablets, and smart phones market, however likewise due to inflation in the western world most likely to stay high.

I begin by offering more comprehensive insights into the items.

The beauty of SIMO

The business was established in 1995 in San Jose, California, and has know-how in establishing incorporated circuits, more particularly, microcontrollers for NAND flash memory storage gadgets, and specialized RF (radio frequency) for mobile phones. These are bought by the huge NAND flash memory makers like Samsung ( OTCPK: SSNLF), SanDisk, Toshiba ( OTCPK: TOSYY), and Micron ( MU), when it comes to their memories to operate in a PC or server situated in an information center, Silicon Movement’s microcontrollers are needed.

For this function, with over twenty years of experience, the Taiwanese business is “a international leader” in providing NAND flash controllers for solid-state storage gadgets and SSD controllers. Its items are utilized in a number of the significant smart devices and other mobile phones offered today.

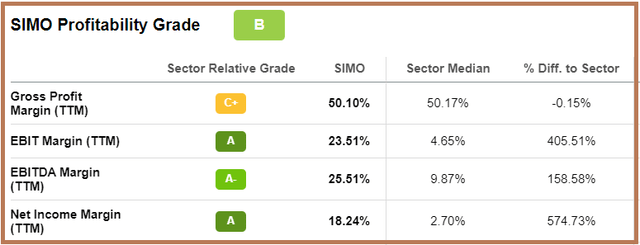

It deals with competitors from Semtech ( SMTC), Phison Electronic devices, and so on, and big memory makers wishing to incorporate along the semiconductor supply chain vertically. In this regard, its success grade of “B” accomplished regardless of typical gross earnings margins of C+, reveals that regardless of dealing with supply chain-related overheads, it has actually had the ability to decrease expenses significantly. This is more evidenced by its EBIT margin of 23.5% which is more than 400% than the sector average recommending a strong operating expense structure.

Success Grade (seekingalpha.com)

For That Reason, with a pickup in activities in the memories for PC, tablets, and smart devices, suggesting more sales, the business might see even greater earnings margins.

Sales Resiliency in the middle of Competitors

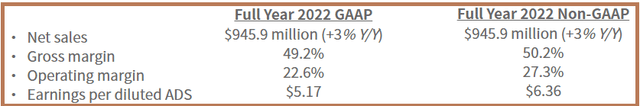

In this regard, Silicon Movement reported full-year 2022 monetary outcomes on February 7 when sales grew by 3% regardless of difficult end-market conditions where around the world deliveries of PCs, tablets, and smart devices decreased by 11.9% according to Gartner.

For that reason, by publishing a 3% increment in sales, it substantially exceeded the PC and smart device markets, in addition to the competitors. Surprisingly, sales of SSD (Strong State Gadgets) controllers reduced by 5-10% for the year, however this comes in the middle of a market that diminished in 2022 as server OEMs (Initial Devices Producers), specifically the ones from China purchased less parts from in the 2nd half of in 2015. For financiers, OEMs describe pc laptop computers or smart device makers which purchase parts like memories, controllers, or processors from various providers and assemble them to produce devices to offer to end users like you and me.

/ news-releases/news-release-details/silicoResults-period-ended- december-31-2022 (siliconmotiontechnologycorporation.gcs-web. com)

Believing aloud, with China resuming after the Covid freeze, the management anticipates some rebound in the need for SSDs in addition to greater costs for NAND memory. There is another cause for optimism with the development made to permeate the OEM market with its PCIe Gen 4 SSD controllers, which made up two-thirds of sales in 2022, compared to less than half in 2021. This figure needs to enhance even more thanks to innovation upgrades performed to boost SSD effectiveness as part of the innovation refresh cycle.

Subsequently, regardless of undesirable market conditions, Silicon Movement has the ability to enhance its sales figures, specifically by providing a big degree of item distinction. Likewise, the business had money amounting to $ 232.2 million since completion of 2022 and no financial obligation, which symbolizes that it does not require an infusion of liquidity from an acquirer to improve its competitive placing. For this matter, capital expenditure were $32.8 million in 2015, and considered that it pays, it suggests that there is an enough quantity of cash to purchase development.

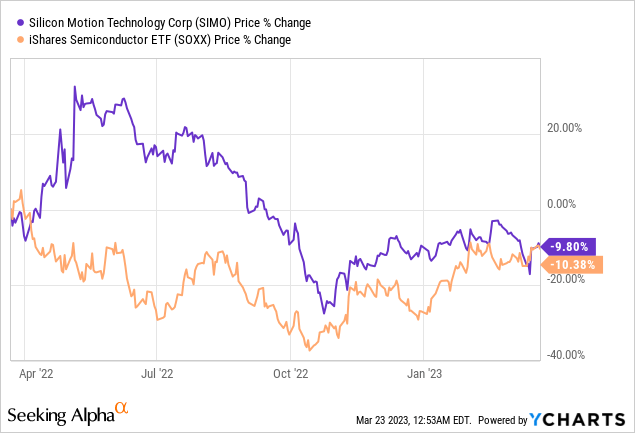

For that reason, while forming part of MaxLinear after a possible acquisition would have unquestionably brought more scale and broadened the main office, it is not a need for Silicon Movement. This is what the marketplace should have noticed as, after falling more than 40% given that the acquisition talks as revealed by the blue chart below, its stock is now developing more in line with the chips sector, represented here by the iShares Semiconductor ETF (NASDAQ: SOXX).

Valuing by Thinking About Inflation Vs. Geopolitics

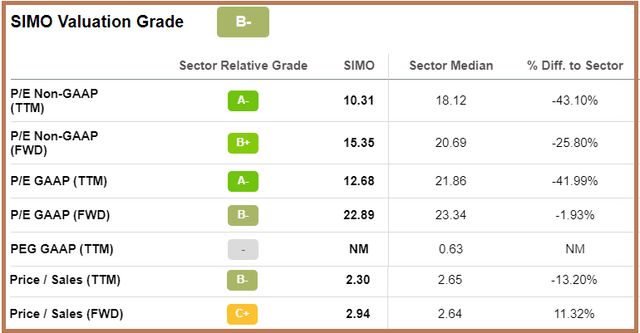

This symbolizes that evaluations have actually boiled down, and as imagined listed below they are mostly green, suggesting undervaluation. Embracing a moderate position and thinking about the tracking Cost to Sales of 2.3 x, this is underestimated with regard to the sector by 13.2%. Changing for a 10% boost, I develop a target of $72 (65.45 x 1.1), which stays lower than the rate of $93.54 which MaxLinear is all set to pay out for each share.

SIMO Appraisals (seekingalpha.com)

Pursuing even more, there were indicators by MaxLinear in January of this year that the Chinese regulator might think about the offer positively. The very same kind of optimism was voiced by Silicon Movement’s management in February, and they anticipate a last decision by SAMR in the “ 2nd or 3rd quarter of 2023, and even later on.” Nevertheless, one should be practical that provided the level of stress in between the U.S. and China, just being bullish on regulative premises is pure speculation at this phase.

On the other hand, fractures are appearing along the liquidity front, both in Europe and the U.S., which the authorities are attempting to plug by managing capital injection steps and even mergers. Considered that these locations likewise deal with high inflation issues, the job of stabilizing rate and monetary stability might show to be challenging, as I just recently described. Now, monetary stability is elaborately linked to the health of the banking system, while rate stability has to do with combating high inflation. In this case, with reserve banks most likely to focus on the health of the monetary market, less effort is most likely to be made to fight inflation which is most likely to remain high in the western world, compared to Asia where Silicon Movement has its centers

Conclusion

This must prefer business that produce in Asia and do not produce sophisticated processors like Taiwan Semiconductor Business ( TSM) which go through export constraints. For this matter, memory and associated controllers are more passive parts when compared to NVIDIA ( NVDA) GPUs.

Thus, it is most likely that, other than for durations of volatility which are most likely to continue as more liquidity fractures appear in an environment of continual financial tightening up, Silicon Movement’s stock might move higher as it bones up rivals’ market share. Here, financiers will keep in mind that I have a reasonably bullish position with a $72 rate target in view of the PC, tablet, and smart device markets most likely to be pushed this year. Lastly, sales conditions might end up being exacerbated in case of an economic crisis in the U.S. lowering need for the business’s item, which is not balanced out by the pickup in financial activities in China which soaks up a substantial amount of its items, following the Covid resuming.