A modification in method has actually assisted change the GoodHaven Fund from a long-lasting underperformer into an outperformer considering that completion of 2019. The fund follows a concentrated-value method and now has a four-star ranking (out of 5) in Morningstar’s Big Blend fund classification.

Larry Pitkowsky, handling partner of GoodHaven Capital Management, based in Millburn, N.J., discussed how this was accomplished in an interview with MarketWatch.

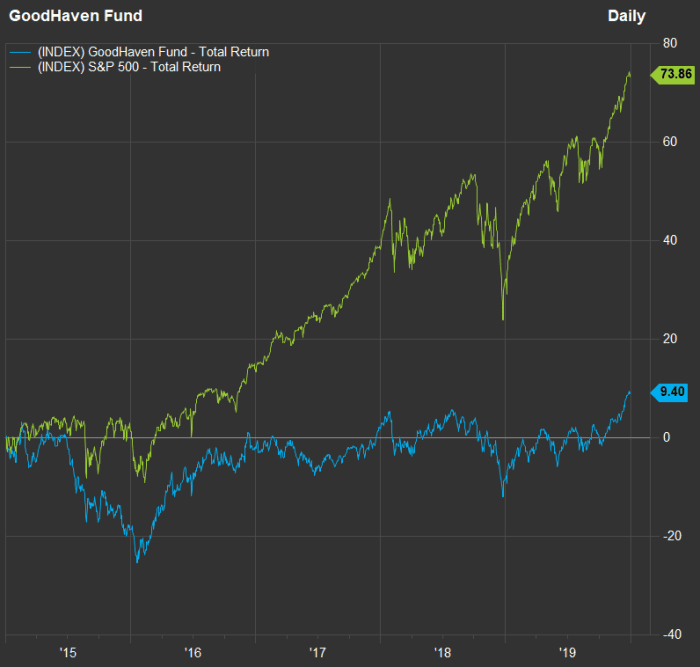

To start, have a look at how the GoodHaven Fund carried out, with dividends and capital-gains circulations reinvested, over a five-year duration through 2019, compared to the S&P 500:

For 5 years through 2019, the GoodHaven Fund returned just 9.4%, while the S&P 500 returned 73.9%.

FactSet.

Late in 2019, Pitkowsky led a series of modifications in how the fund ran, consisting of paying less attention to macroeconomic elements, carrying on quicker if financial investments aren’t exercising well and hanging on to effective business longer, to prevent offering too early. He mentioned Microsoft Corp.

MSFT,.

as an example of a stock he had actually parted methods with prematurely, and stated an example of a market and macro-based financial investment play that didn’t work out was a group of energy and products stocks that were squashed when product costs dropped from mid-2014 and 2015 through early 2016.

” We like to own high return-on-capital business” with great trajectories for development, Pitkowsky stated, “before everybody else has actually figured it out.”

He included: “We attempt to prevent structurally challenged services that may be statistically inexpensive.”

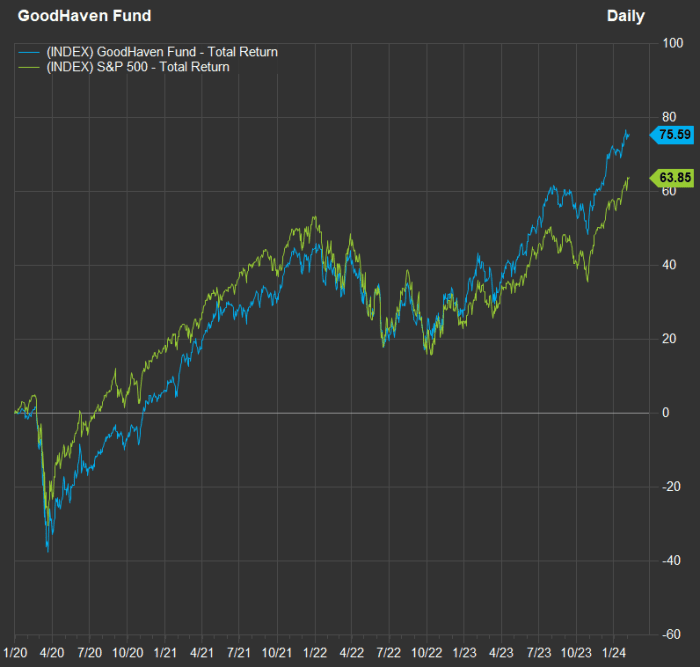

Now have a look at how the fund has actually carried out versus the S&P 500.

SPX

considering that completion of 2019:

The GoodHaven Fund has actually outshined the S&P 500 considering that altering its investment-selection procedure late in 2019.

FactSet.

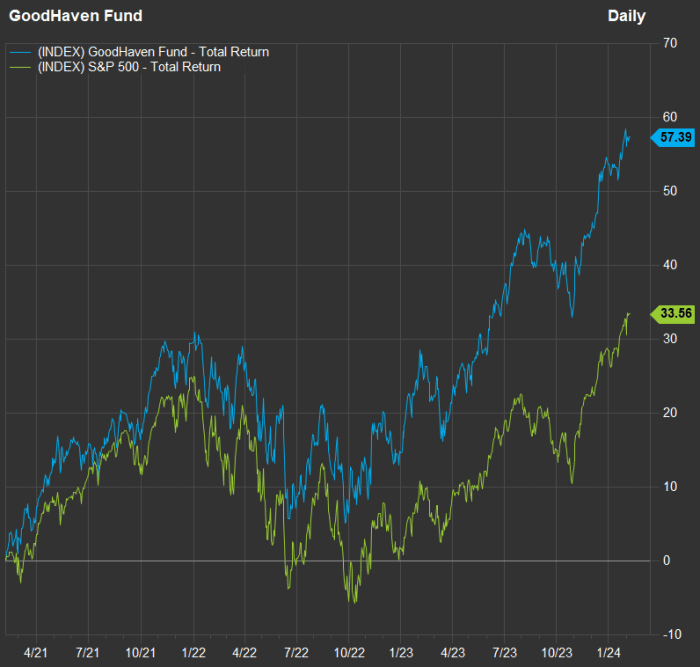

Narrowing even more to a three-year chart through Feb. 6 sheds more light on the seesaw efficiency of the broad stock exchange, with an 18.1% decrease for the S&P 500 in 2022 followed by a 26.3% return in 2023.

The GoodHaven Fund has actually had a smoother trip throughout the stock exchange’s up-and-down cycle over the previous 2 years, resulting in a much greater three-year return than that of the S&P 500.

FactSet.

Fund holdings and remarks about business

GoodHaven Capital Management has about $340 million in possessions under management, consisting of different customer accounts and about $230 million in the fund.

Since Nov. 30, the fund’s portfolio was 29% in money and short-term financial investments, in part since of an increase of brand-new cash from financiers however likewise since Pitkowsky wishes to keep cash easily offered to make purchases at appealing costs and to fulfill any redemption demands from the fund’s investors. Sometimes the fund’s level of money and short-term financial investments has actually been much lower.

Here are the fund’s leading 10 stockholdings since Nov. 30, comprising 52% of its portfolio:

| Stock | Ticker | % of fund | Forward P/E |

|

Berkshire Hathaway Inc.

Class B. |

BRK.B,. |

11.2%. | 22.0. |

|

Alphabet Inc. Class C. |

GOOG,.

|

7.0 %. | 21.1. |

|

Contractors FirstSource

Inc. |

BLDR,.

|

6.6%. | 14.6. |

| Bank of America Corp. |

BAC,. |

5.4%. |

10.3

. |

| Devon Energy Corp. |

DVN,.

|

4.4%. | 7.6. |

| Jefferies Financial Group Inc. |

JEF,. |

4.2%. |

11.1

. |

| Exor N.V. |

EXO,. |

4.2%. | 7.6. |

|

Lennar Corp

. |

LEN.B,.

|

3.5%. | 9.6. |

| Progressive Corp. |

PGR, . |

2.8%.(* ). 21.0. | KKR & Co. |

| KKR,. |

+0.50 % 2.8%. |

18.5. | Sources: GoodHaven Capital Management, FactSet. |

| Click the tickers for more about each business, fund or index. | |||

Click On This Link for Tomi Kilgore’s in-depth guide to the wealth of details readily available free of charge on the MarketWatch quote page.

2 “big wins” Pitkowsky mentioned when going over the GoodHaven Fund’s current outperformance were Builders FirstSource Inc.

BLDR,.

+0.04%

and the Class B shares of Lennar Corp.

+0.64%

a home contractor that is trading at a low P/E, together with its whole market group. We noted P/E ratios for 17 home contractors in October, when the majority of them were really low. At that time, the S&P Composite 1500 Homebuilding subindustry group was trading at a weighted forward P/E of 7.6. The group now trades at a forward P/E of 10.2. Pitkowsky thinks both Builders FirstSource and Lennar have “a lot of development ahead of them” and stated he was likewise happy that both business have low levels of financial obligation. “The huge contractors have actually ended up being far better services,” he stated.

Something else to think about is that Pitkowsky holds Lennar’s Class B shares, which trade at a forward P/E of 9.6– a discount rate to the assessment of the business’s Class A shares.

LEN,.

-0.18%

which trade at a forward P/E of 10.3. Lennar’s Class B shares have 10 times the ballot rights as the Class A shares, however they trade at a lower P/E, most likely since they are less liquid and are not consisted of in the S&P 500, Pitkowsky stated. “When we started to research study

, we saw the super-voting shares traded at around a 20% discount rate to the non-super-voting shares,” he stated, including that the fund has actually benefited as the assessment space has actually narrowed. [Lennar] Another huge winner for the fund has actually been Bank of America Corp., which Pitkowsky stated was his biggest purchase throughout the 12-month duration that ended Nov. 30. Bank of America now trades at a forward P/E of 10.3, compared to a five-year average of 11.1 and a 10-year average of 11.3.

“

return on equity is a depressed 11%+,” he composed in the November letter to GoodHaven Fund investors. However he likes the stock’s risk/reward capacity for a number of factors, consisting of “repeating incomes from the nonbanking services.”[Bank of Americaâs] While regreting what he now understands was an early sale of Microsoft shares, Pitkowky indicates Alphabet Inc.

GOOGL,.

+2.12%

+2.04%

as a strong holding he has actually stuck to considering that 2011.

the most affordable P/E amongst the 10 biggest business in the S&P 500 Pitkowsky stated he stayed comfy with Alphabet as a big holding, in part since the business has actually ended up being “more focused over the previous year or 2 on re-engineering the expense base.” He included that the stock’s assessment “does not appear requiring” relative to Alphabet’s more development capacity.

Do not miss out on: