Coprid/iStock through Getty Images

The Goldman Sachs Hedge Market VIP ETF ( NYSEARCA: GVIP) is a passively handled car offering direct exposure to about 50 worthiest hedge-fund selects picked utilizing quarterly 13F filings. This is a fairly simplified yet however powerful method with a reputable performance history, however, as it constantly takes place in investing, not an entirely perfect one. GVIP had an incredible 2023 amidst expectations for looser financial conditions in the U.S., with momentum lasting into 2024 as it outshined the iShares Core S&P 500 ETF ( IVV) by roughly 2.5% in January, notching its 3rd month of gains in a row. However, even presuming GVIP has an engaging element combine with an unexpected GARP tilt (there are arguments doubters can utilize to refute that point), I would go with a more neutral view on this car, with the primary issues gone over in the short article.

How does GVIP discover hedge-fund favorites?

GVIP’s financial investment method has the Goldman Sachs Hedge Fund VIP Index at its core. As clarified on its site, the index

… is built in accordance with a rules-based method originated from principles formerly established by Goldman Sachs’ Global Financial investment Research study department. The Index includes basically driven hedge fund supervisors’ “Very-Important-Positions,” which appear most often amongst their leading 10 long equity holdings.

As stated on page 10 of the prospectus:

The building and construction of the Index includes accessing the identifiers and share counts of U.S. equity holdings revealed by hedge fund supervisors in their quarterly 13F filings with the Securities and Exchange Commission (” SEC”).

The index is made up of about 50 names; they are designated equivalent weights at each quarterly rebalancing. Since January 31, the fund had 47 equity holdings.

What are the significant problems with GVIP?

After inspecting the GVIP holdings dataset utilizing, to name a few things, the Looking for Alpha Quant information, I can with confidence conclude that the ETF is a fairly high-beta, absolutely premium, growth-heavy portfolio. A minimum of in the present model. And here comes the very first concern: high turnover.

Raised turnover

I have actually been expecting GVIP for rather a long time, so I have actually a holdings dataset from July 6 downloaded from its site, and we can evaluate how substantial the basket structure modifications have actually been ever since. It ends up that stocks that existed in the portfolio at that time now represent around 73% of the net possessions (34 stocks out of 47). This may not look that considerable at all. Nevertheless, in the most current prospectus, it is stated that GVIP’s

portfolio turnover rate for the ended August 31, 2023 was 120% of the typical worth of its portfolio.

And this is substantial. Why is this an issue? There are a couple of factors. For example, let us price estimate page 10 of the prospectus:

The Fund might pay deal expenses when it purchases and offers securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover might lead to increased deal expenses, consisting of brokerage commissions, which should be borne by the Fund and its investors, and is likewise most likely to lead to greater short-term capital gains for taxable investors.

Besides, high turnover in fact negates the possibility of even meticulously anticipating prospective returns utilizing present element information, as the mix can alter in a blink of an eye.

GVIP element mix may change with time

Another concern that is totally linked with turnover is that the method can producing rather strange element blends, with the factor being its neglect for aspects; simply put, its hidden index merely aggregates equities hedge funds are enamored of, no matter their development, worth, or quality attributes.

At this point, I must state the ETF has a GARP or GARP-ish tilt, as it originates from a relatively strong incomes yield and forward development rates in the mid-to-high teenagers. Nevertheless, there are a number of subtleties here. Initially, the development at an affordable rate design lovers choose the PEG ratio as a gauge, preferring stocks with that metric listed below 1. When it comes to GVIP, simply 8 stocks (16.7% weight) have a forward PEG listed below 1.

| Sign | Business | Weight | PEG FWD |

| ( VRT) | Vertiv Holdings Co | 2.48% | 0.51 |

| ( BABA) | Alibaba Group Holding Ltd | 1.65% | 0.51 |

| ( EQT) | EQT Corp | 1.70% | 0.62 |

| ( PGR) | Progressive Corporation | 2.14% | 0.70 |

| ( TMUS) | T-Mobile United States, Inc. | 2.10% | 0.78 |

| ( APO) | Apollo Global Management, Inc. | 2.20% | 0.80 |

| ( PYPL) | PayPal Holdings, Inc. | 2.08% | 0.84 |

| ( UBER) | Uber Technologies, Inc. | 2.32% | 0.97 |

Information from Looking For Alpha and the fund

Nevertheless, a less orthodox estimation based upon the weighted-average Price/Earnings and forward EPS development reveals the portfolio-wise PEG at 0.8. This is a great outcome, specifically thinking about that a practically 20% EPS development rate is supported by 14.3% profits development (which indicates there may be a margin growth story under the hood).

| Metric | 31-Jan |

| Market cap | $ 372.56 billion |

| EY | 6.4% |

| P/S | 6.65 |

| EPS Fwd | 19.5% |

| Profits Fwd | 14.3% |

| ROA | 8.5% |

| ROE | 44.3% |

| Quant Evaluation B- or greater | 16.6% |

| Quant Evaluation D+ or lower | 71.6% |

| Quant Success B- or greater | 93.2% |

| Quant Success D+ or lower | 4.6% |

| Quant Development B- or greater | 72.1% |

| Quant Development D+ or lower | 18.2% |

The figures calculated by the author utilizing information from Looking for Alpha and GVIP; monetary information since February 1

On a side note, for a blend with a WA market cap of over $372 billion, a more than 6% EY is absolutely a remarkable outcome. However, there are subtleties here once again. The figure is driven mainly by the energy sector and one monetary sector name; with their EYs decreased to no, the portfolio-wise figure would drop to 3.5%.

| Sign | Weight | Sector | EY |

| Chesapeake Energy ( CHK) | 1.8% | Energy | 53.8% |

| Very First People BancShares ( FCNCA) | 2.0% | Financials | 51.6% |

| Cheniere Energy ( LNG) | 1.8% | Energy | 31.8% |

| EQT Corporation (EQT) | 1.7% | Energy | 20.2% |

Information from Looking For Alpha and GVIP

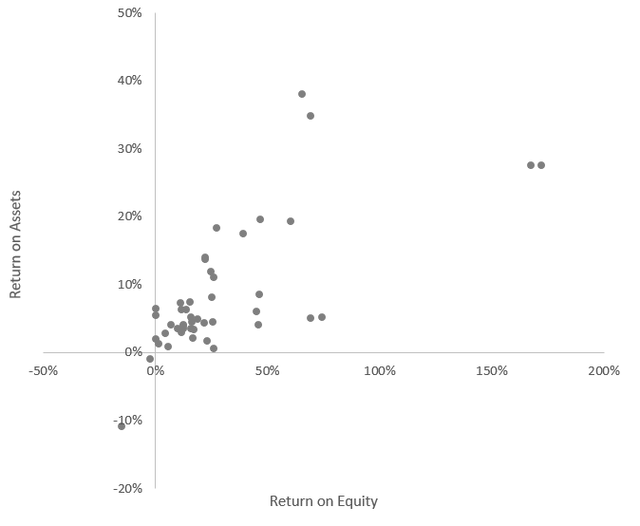

Concerning quality, GVIP ratings well versus a set of metrics I frequently utilize in my ETF research study, consisting of a couple of success and capital effectiveness indications. Direct exposure to stocks with a Quant Success score of B- or greater is likewise informing.

Developed utilizing information from Looking for Alpha and GVIP

The chart above covers 46 holdings, as LNG with its nearly 860% ROE was gotten rid of to enhance readability. For the following stocks with a missing out on ROE, the metric was changed with 0%.

| Sign | Weight | Sector |

| GoDaddy ( GDDY) | 2.3% | Infotech |

| TransDigm Group ( TDG) | 2.1% | Industrials |

| Splunk ( SPLK) | 2.0% | Infotech |

Information from Looking For Alpha and GVIP

Still, there is undoubtedly no warranty that the fund will not end up being lighter in quality, worth, or development moving forward.

High beta and other efficiency subtleties

Taking a look at the danger & & return information for GVIP, careful financiers would definitely discover how strong its benefit capture ratio is, at more than 106%, which indicates it can providing more when the U.S. market was going greater. Here, they would definitely explain that the method unquestionably works and as a result must be thought about no matter the marketplace environment. However I would riposte that this is simply the pointer of the iceberg.

| Metric | GVIP | IVV |

| Upside Capture Ratio (%) | 106.26 | 100.71 |

| Disadvantage Capture Ratio (%) | 106.23 | 97.23 |

Information from Portfolio Visualizer. The duration is December 2016 – January 2024

The issue is that the disadvantage capture ratio is on par at 106.23%, which indicates the fund fell much deeper than the marketplace throughout the tension durations. Now, what about its annualized returns? Sadly, it underperformed both IVV and the Invesco QQQ Trust ETF ( QQQ), though it sturdily beat the International X Expert Index ETF ( MASTER).

| Portfolio | GVIP | IVV | QQQ | MASTER |

| Preliminary Balance | $ 10,000 | $ 10,000 | $ 10,000 | $ 10,000 |

| Last Balance | $ 24,381 | $ 24,968 | $ 37,434 | $ 17,977 |

| CAGR | 13.24% | 13.62% | 20.22% | 8.53% |

| Stdev | 19.60% | 16.56% | 19.90% | 19.23% |

| Finest Year | 44.11% | 31.25% | 54.85% | 30.98% |

| Worst Year | -31.95% | -18.16% | -32.58% | -27.95% |

| Max. Drawdown | -33.44% | -23.93% | -32.58% | -36.87% |

| Sharpe Ratio | 0.64 | 0.75 | 0.94 | 0.43 |

| Sortino Ratio | 1.01 | 1.14 | 1.54 | 0.65 |

| Market Connection | 0.94 | 1 | 0.92 | 0.95 |

Information from Portfolio Visualizer. The duration is December 2016 – January 2024

The main factor is that the fund had a dreadful 2022 when it dipped by nearly 32% (vs. IVV’s decrease of around 18.2%), which may indicate it uses little to no security amidst bearishness. Next, GVIP had a basic variance more than 3% greater than IVV. This is something volatility-averse financiers must keep in mind. Besides, my estimations reveal the weighted-average 24-month beta of its portfolio at 1.16 and the 60-month beta at 1.2.

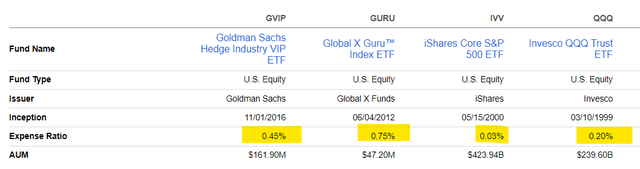

GVIP cost ratio: modest, yet can be a drag over the long term

Concerning expenditures, GVIP has an edge over master.

Looking For Alpha (ERs highlighted by the author)

Nevertheless, 45 bps is still relatively high compared to easier passive options like IVV and QQQ, specifically thinking about GVIP underperformed both.

Does GVIP should have a Buy score?

GVIP is a minimalist portfolio loaded with hedge-fund favorites. I am not positive that this car will can exceeding IVV in the future, as its previous efficiency has actually been primarily irregular. The fund has rather raised turnover, a changing element mix that is difficult to even meticulously forecast, efficiency subtleties, and bad dividend attributes (i.e., irregular circulations). Besides, it deserves estimating my April 2023 short article on MASTER:

I think passive equity methods taking advantage of stocks popular with institutional supervisors are more of a moist squib. The most likely factors for that may be weighting and timing problems.

And GVIP has exactly the very same issues. In amount, I would go with a Hold score today.