Kenneth Cheung/iStock Unreleased through Getty Images

I have formerly voiced unfavorable belief on Airbnb ( NASDAQ: ABNB) stock, as I have actually been worried about the business’s assessment, along with unsustainably high reservations post-COVID. Nevertheless, 6 quarters following my preliminary evaluation, I argue in favor of a significant ranking upgrade for the world’s biggest travel business: I mention that Airbnb has actually handled to strongly enhance its success over the previous couple of quarters, today operating at a 23% EBIT margin. Additionally, travel volume post-COVID has actually held up far better than formerly predicted and feared, as reservations today pattern >> 20% above pre-COVID levels in spite of macro headwinds. Checking out 2024, I anticipate scheduling development for Airbnb to speed up once again, as customer belief is poised for a strong year on falling inflation and rates of interest.

On the background of encouraging, and most likely improving, business momentum I upgrade my EPS approximates for Airbnb through 2028; and I now compute a reasonable implied share rate of $154.

For context, Airbnb stock has actually outshined the broad U.S. equities market in 2023. For the routing twelve months, ABNB shares are up about practically 48%, compared to a gain of around 20% for the S&P 500 ( SP500).

Resilient Travel Need Supports The Airbnb Purchase Thesis

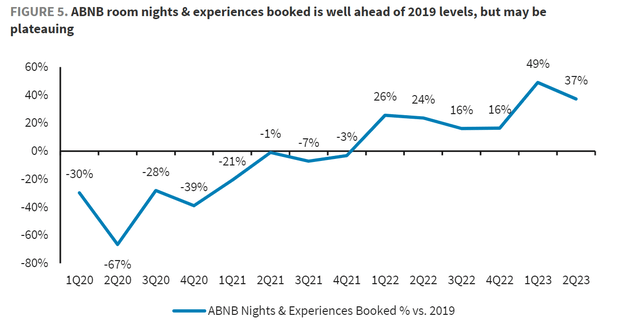

In 2023, the travel market carried out far better than anticipated, owing to the unforeseen durability of customer costs in spite of noteworthy macro headwinds. Because context, fears that leisure travel would get better to pre-2019 levels, following a duration of suppressed need, showed rather unneeded. In reality, it is sensible to anticipate that international leisure travel, Airbnb’s core audience, has actually conveniently supported at about 20% greater levels compared to 2019. Because context, Airbnb has actually caught much of the post-COVID need, with Barclay’s mapping Airbnb’s reserved experiences about for Q1 and Q2 at +49% and +37% compared to 2019 levels (Source: Barclays equity research study note on Airbnb outdated 12th December). Wanting to next couple of years, I think that the general market development will line up with GDP development, which must supply a healthy background for Airbnb’s development, independent of extra market share gain.

Looking ahead into Q4, BoFA research study leverages AirDNA’s price quotes to forecast Airbnb’s fourth-quarter incomes at $2.25 billion, going beyond Wall Street’s expectation of $2.16 billion according to information gathered by Refinitiv. If BofA is appropriate, then Airbnb would log an 18% YoY development, well ahead of the 12-14% YoY development predicted by Airbnb management. In more information, AirDNA’s estimations, utilizing a quarterly indexing technique, recommend that in Q4 Airbnb had around 99.8 million reserved nights and an overall reservation worth of $15.8 billion. These figures surpass Wall Street’s projections, which expected 98.1 million nights and $15.1 billion in reservations. ( Source: BofA research study note on Airbnb, dated 12th December: November information recommends strong rebound vs October for Airbnb).

Airbnb’s Service Design Is Poised For More Development

Airbnb, given that its beginning in 2008, has actually reinvented the hospitality market with its special company design. Throughout the years, it has actually not just changed how individuals take a trip however likewise how they experience brand-new locations. Its success story is one marked by ingenious techniques to internationalization, adjusting to varied markets, and leveraging innovation to fulfill regional requirements. Because context, while Airbnb’s core offering as a two-sided market for alternative lodgings might be reaching a fully grown phase in the U.S and Europe, Airbnb’s capacity in emerging markets still provides considerable chances for development: Especially, nations in Africa, Southeast Asia, and Latin America, along with Japan, with their abundant cultural offerings and untapped tourist capacity, might be essential chauffeurs of Airbnb’s future growth. Additionally, Airbnb’s development capacity likewise recommends the growth into more standardized offerings, such as hotels, and cruise liner. Because context, according to Phocuswright, the international hotel scheduling TAM is predicted to reach $ 557 billion in 2024, a section that Airbnb has actually just partially used.

On a different note, Airbnb is well-positioned to take advantage of emerging innovations for structural, nonreligious development and market share gain. Particularly, current item updates display Airbnb’s dedication to leveraging innovation for improved service shipment. Particularly, the comprehensive combination of AI and artificial intelligence for tailored suggestions changes the user experience from a basic deal to a customized travel preparation journey. Moreover, the (most likely) adoption of virtual and enhanced truth innovations might support digital sneak peek of lodgings and in-stay experiences.

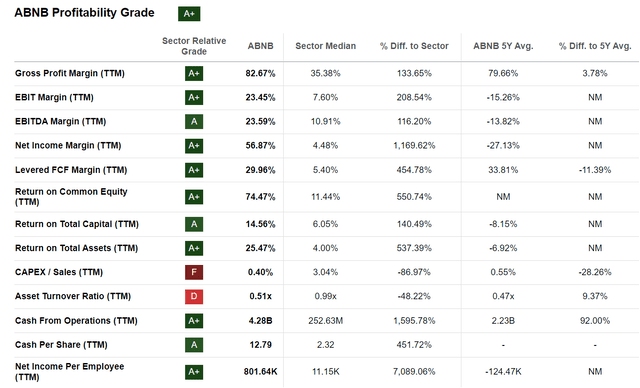

Going over Airbnb’s development outlook, financiers must think about that any incremental topline is extremely worth accretive for financiers. Particularly, I mention that Airbnb’s company design runs on an 83% gross margin and a 23% EBIT margin, while just requiring 0.4% of CAPEX as a portion of sales!

The Airbnb Experience Is Not Merely Transactional

The Airbnb experience goes beyond the simple transactional exchange normal of standard hospitality services. Unlike its rivals such as TUI, Booking.com, and Expedia, Airbnb has actually effectively distinguished itself by developing an environment that promotes genuine experiences, identifying itself through a mix of customization, neighborhood connection, and cultural immersion.

Throughout Airbnb’s 3Q23 incomes call, CFO Dave Stephenson stressed that Airbnb is significantly concentrated on motivating tourists instead of simply assisting in deals. By enhancing the search experience to focus on motivation and multi-session conversion, Airbnb shows a clear technique to engage users over a longer duration. This shows Airbnb’s dedication to being an inspiring platform that motivates expedition and discovery, instead of a simple transactional service for scheduling lodgings.

Airbnb’s inspiring, instead of transactional nature, supports less expensive and more interesting platform traffic. Unlike its peers who sustain considerable expenses in traffic acquisition, Airbnb’s technique concentrates on creating direct traffic. This method not just lowers reliance on paid marketing however likewise boosts earnings margins. Additionally, Airbnb’s strength in bring in direct traffic likewise pays for the versatility to carry out more bold efforts and welcome greater levels of threat. This capability is essential in a market that is quickly progressing and significantly competitive.

Change Target Cost to $154

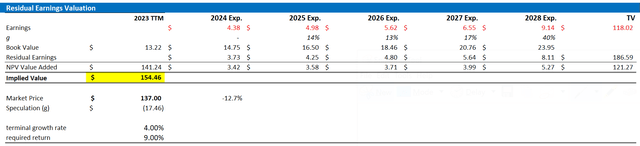

Showing a bullish background, and in line with upgraded expert agreement EPS price quotes for ABNB through 2028, I structure a recurring incomes design for the business’s stock. Based On the CFA Institute:

Conceptually, recurring earnings is earnings less a charge (reduction) for typical investors’ chance expense in creating earnings. It is the recurring or remaining earnings after thinking about the expenses of all of a business’s capital.

With regard to my ABNB stock assessment design, I make the following presumptions:

- To anticipate EPS, I anchor on the agreement expert projection as readily available on the Bloomberg Terminal till 2028. In my viewpoint, any quote beyond 2025 is too speculative to consist of in an appraisal structure. However for 2-3 years, expert agreement is generally rather exact.

- To approximate the capital charge, I anchor on ABNB’s expense of equity at 9%, which is around in line with the CAPM structure.

- For the terminal development rate after 2025, I use 4%, which has to do with 100-150 basis points above the approximated small international GDP development. The development premium must show structural development of experience-centered intake.

Offered these presumptions, I compute a base-case target rate for ABNB stock of about $154/share.

Looking For Alpha; Business Financials; Author’s Estimations

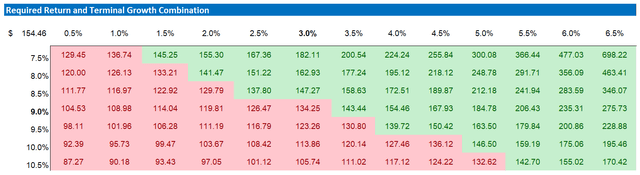

As I argued that my price quotes for development and equity charges might be conservative, I acknowledge that financiers might hold differing presumptions concerning these rates. For that reason, I have actually consisted of a level of sensitivity table to check various situations and presumptions. See listed below.

Looking For Alpha; Business Financials; Author’s Estimations

Financier Takeaway

Formerly, I voiced issues about Airbnb’s high assessment and understanding of unsustainable post-COVID travel need. Nevertheless, the business’s efficiency in the routing twelve months have actually triggered me to reassess my thesis. Regardless of macroeconomic headwinds, Airbnb has actually preserved strong travel volumes (above 2019) and is poised for additional development in 2024, boosted by enhancing customer belief and financial aspects like falling inflation and rates of interest. Additionally, the business’s growth into emerging markets, combined with its capacity in varied offerings such as hotels and cruises, make me bullish on Airbnb’s structural development capacity. Based upon these aspects, I am reviewing my thesis on Airbnb stock, and now compute a reasonable indicated target rate of around $154/share. “Purchase”.