Summary.

Regardless of its long mining history, beneficial regulative environment and steady political background, Ghana stays mostly ignored as a financial investment jurisdiction for battery metals. Positioned on the West African coast, the nation boasts a strong tactical place and abundance of mineral wealth.

In 2023, the nation recovered its title as Africa’s primary manufacturer of gold And gold isn’t the only rare-earth element to be discovered in the nation. Ghana is likewise home to substantial lithium reserves, with c. 180,000 tonnes of approximated resources

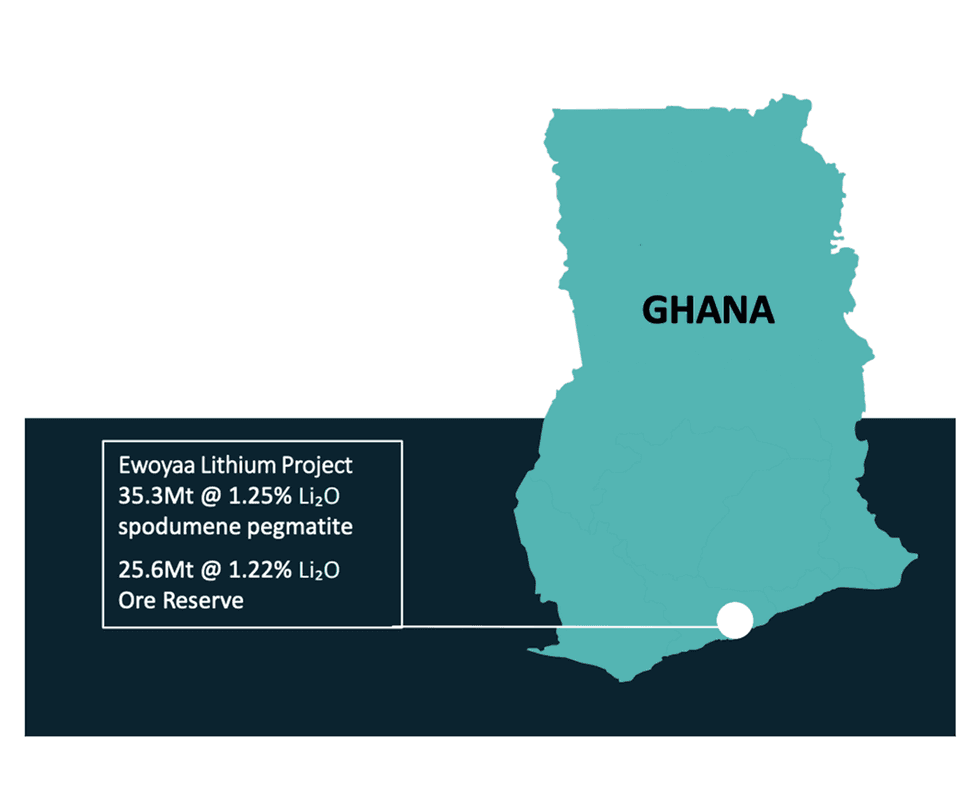

Found in between Europe, the United States and China, Ghana is completely placed to act as a crucial center for the worldwide supply of the battery metal.

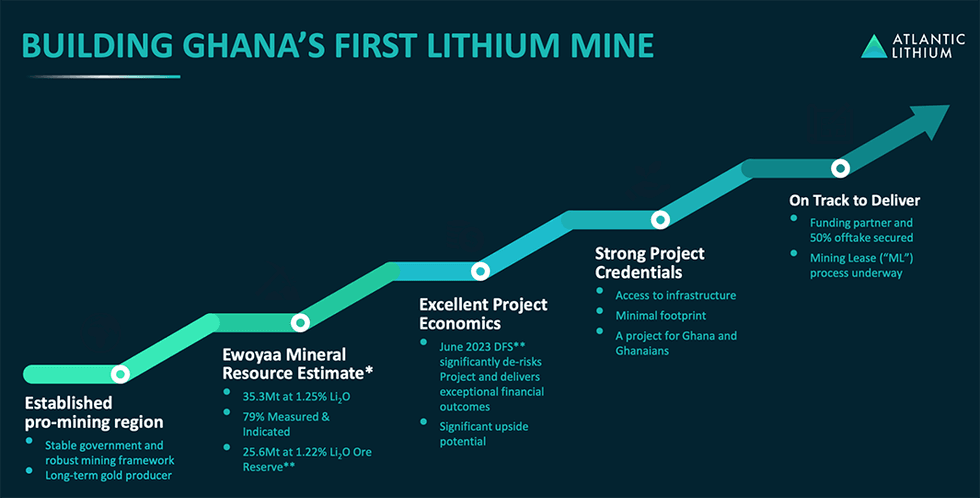

Australian lithium expedition and advancement business Atlantic Lithium (ASX: A11, GOAL: ALL, OTCQX: ALLIF) means to utilize this chance through its flagship Ewoyaa task, set to end up being Ghana’s very first lithium-producing mine. Atlantic means to produce spodumene concentrate efficient in conversion to lithium hydroxide and carbonate for usage in electrical lorry batteries, assisting drive the shift to decarbonisation.

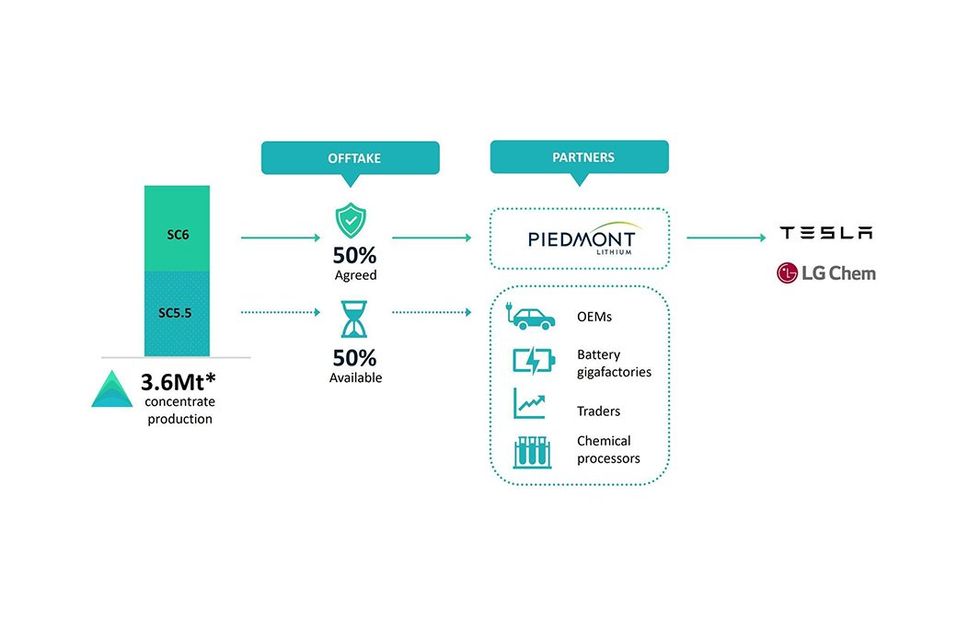

A conclusive expediency research study (DFS) launched in June 2023 programs that, considering its present 35.3 million lots (Mt) @ 1.22 percent lithium oxide JORC Mineral Resource Quote and conservative life-of-mine concentrate prices of US$ 1,587/ t, FOB Ghana Port, Ewoyaa has verifiable financial practicality, low capital strength and exceptional success. Through basic open-pit mining, three-stage squashing and standard Thick Media Separation (DMS) processing, the DFS lays out the production of 3.6 Mt of spodumene concentrate over a 12-year mine life, providing US$ 6.6 billion life-of-mine incomes, a post-tax NPV8 of US$ 1.5 billion and an internal rate of return of 105 percent.

Atlantic Lithium means to release a Modular DMS plant ahead of starting operations at the massive primary plant to create early earnings, which will minimize the peak financing requirement of the primary plant. The task is anticipated to provide very first spodumene production as early as April 2025.

The advancement of the task is co-funded under a contract with NASDAQ and ASX-listed Piedmont Lithium (ASX: PLL), with Piedmont anticipated to money c. 70 percent of the US$ 185 million overall capex. In accordance with the arrangement, Piedmont is moneying US$ 17 million towards research studies and expedition and a preliminary US$ 70 million towards the overall capex. Expenses are split similarly in between Atlantic Lithium and Piedmont afterwards.

In return, Piedmont will get half of the spodumene concentrate produced at Ewoyaa, offering a path to customers through a number of significant battery makers, consisting of Tesla. With half of its offtake still readily available, Atlantic Lithium is among really couple of near-term spodumene concentrate manufacturers with uncommitted offtake.

Currently the biggest taxpayer and company in Ghana’s Central Area, Atlantic Lithium is anticipated to offer direct work to approximately 800 workers at Ewoyaa and, through its neighborhood advancement fund where 1 percent of maintained revenues will be designated to regional efforts, will provide lasting advantages to the area and to Ghana.

Atlantic Lithium likewise has the prospective to capitalise upon substantial extra benefit throughout its substantial expedition portfolio– prospective it means to utilize to the maximum as it ends up being an early mover in West African lithium production.

Set to be Ghana’s very first lithium-producing mine, Atlantic Lithium’s flagship Ewoyaa Job is positioned within 110 kilometres of Takoradi Port and 100 kilometres of Accra, with access to exceptional facilities and an experienced regional labor force. A conclusive expediency research study (DFS) launched in June 2023 validated the task’s financial practicality and success capacity, suggesting a 3.6-Mt spodumene concentrate production over the mine’s 12-year predicted life.

Atlantic Lithium is presently in the procedure of protecting a mining lease for the task, which will make it possible for the start of the allowing procedure. Through the release of a Modular DMS plant, which will process 450,000 lots of ore as the primary 2.7-Mt processing plant is being built, the mine is anticipated to provide very first production in 2025.

Atlantic Lithium presently has 2 applications pending for a location of approximately 774 square kilometres in the West African nation of Côte d’Ivoire. The underexplored yet extremely potential area is understood to be underlain by respected birimian greenstone belts, characterised by fractionated granitic invasive centres with lithium and colombite-tantalum incidents and outcropping pegmatites. The location is likewise extremely well-served, with substantial roadway facilities, reputable cellular network and high-voltage transmission line within approximately 100 kilometres of the nation’s capital, Abidjan.

Management Group.

Neil Herbert – Executive Chairman

Neil Herbert is a fellow of the Association of Chartered Qualified Accounting Professionals and has more than thirty years of experience in financing. He has actually been associated with growing mining and oil and gas business both as an executive and as a financier for over 25 years. Up until Might 2013, he was co-chairman and handling director of AIM-quoted Polo Resources, a natural deposits investment firm.

Prior to this, Herbert was a director of resource investment firm Galahad Gold, after which he ended up being financing director of its most effective financial investment, the start-up uranium business UraMin, from 2005 to 2007. Throughout this duration, he worked to drift the business on objective and the Toronto Stock Market in 2006, raise US$ 400 million in equity funding and work out the sale of the group for US$ 2.5 billion.

Herbert has actually held board positions at a variety of resource business where he has actually been associated with handling many acquisitions, disposals, stock exchange listings and fundraisings. He holds a joint honours degree in economics and financial history from the University of Leicester.

Keith Muller – Ceo

Keith Muller is a mining engineer with over twenty years of functional and management experience throughout domestic and global mining, consisting of in the lithium sector. He has a strong functional background in acid rock lithium mining and processing, especially in DMS spodumene processing. Before signing up with Atlantic Lithium, he held functions as both a magnate and basic supervisor at Allkem, where he dealt with the Mt Cattlin lithium mine in Western Australia.

Prior to that, Muller functioned as operations supervisor and senior mining engineer at Simec. He holds a Master of Mining Engineering from the University of New South Wales and a Bachelor of Engineering from the University of Pretoria. He is likewise a member of the Australian Institute of Mining and Metallurgy, the Board of Specialist Engineers of Queensland, and the Engineering Council of South Africa.

Amanda Harsas – Financing Director and Business Secretary

Amanda Harsas is a senior financing executive with a verifiable performance history and over 25 years’ experience in tactical financing, service improvement, business financing, client and provider settlements and capital management. Prior to signing up with Atlantic Lithium, she worked throughout a number of sectors consisting of health care, insurance coverage, retail and expert services. Harsas is a chartered accounting professional, holds a Bachelor of Company and has global experience in Asia, Europe and the United States.

Len Kolff – Head of Company Advancement and Chief Geologist

Len Kolff has more than 25 years of mining market experience in the significant and junior resources sector. With a tested performance history in deposit discovery and a specific concentrate on Africa, Kolff most just recently operated in West Africa and contributed in the discovery and examination of the business’s Ewoyaa Lithium Job in Ghana, along with the discovery and examination of the Mofe Creek iron ore task in Liberia. Prior to this, he operated at Rio Tinto with a concentrate on Africa, consisting of the Simandou iron ore task in Guinea and the Northparkes Copper-Gold mine in Australia.

Kolff holds a Master of Economic Geology from CODES, University of Tasmania and a Bachelor’s Degree (Honours) degree from the Royal School of Mines, Imperial College, London.

Patrick Brindle – Non-executive Director

Patrick Brindle presently acts as executive vice-president and chief running officer at Piedmont Lithium. He signed up with Piedmont in January 2018. Prior to this, he held functions as vice-president of task management and consequently as primary advancement officer.

Brindle has more than twenty years’ experience in senior management and engineering functions and has actually finished EPC jobs in varied jurisdictions consisting of the United States, Canada, China, Mongolia, Australia and Brazil. Before signing up with Piedmont, he was vice-president of engineering for DRA Taggart, a subsidiary of DRA Worldwide, an engineering company specialising in task shipment of mining and mineral processing jobs internationally.

Kieran Daly – Non-executive Director

Kieran Daly is the executive of development and tactical advancement at Assore. He holds a BSc Mining Engineering from Camborne School of Mines (1991) and an MBA from Wits Company School (2001) and operated in financial investment banking/equity research study for more than ten years at UBS, Macquarie and Investec prior to signing up with Assore in 2018.

Daly invested the very first 15 years of his mining profession at Anglo American’s coal department (Anglo Coal) in a variety of global functions consisting of operations, sales and marketing, technique and service advancement. Amongst his essential functions were leading and establishing Anglo Coal’s marketing efforts in Asia and to steel market consumers internationally. He was likewise the worldwide head of technique for Anglo Coal instantly prior to leaving Anglo in 2007.

Christelle Van Der Merwe – Non-executive Director

Christelle Van Der Merwe is a mining geologist accountable for the mining-related geology and resources of Assore’s subsidiary business (making up the pyrophyllite and chromite mines) and is likewise interested in the business’s iron and manganese mines. She has actually been the Assore group geologist considering that 2013 and included with tactical and resource financial investment choices of the business. Van Der Merwe belongs to SACNASP and the GSSA.

Aaron Maurer– Head of Operational Preparedness

Aaron Maurer is a senior-level service executive with over 25 years’ global multi-commodity mining experience, managing tactical, functional and monetary efficiency. Over his profession, he has actually held a number of engineering, production, functional and senior executive functions. Before signing up with Atlantic Lithium, he functioned as executive basic supervisor – operations at Minerals Resources, where he supervised the Mt Marion Lithium mine and 3 iron ore mines in Western Australia. He was formerly the handling director and CEO of PVW Resources and basic supervisor (website senior executive) at Peabody Energy Australia.

His substantial competence covers the advancement and application of security and cost-saving efforts, modification management, tactical preparation, service advancement and worker advancement. Maurer holds a Master in Business Financing and a Bachelor of Engineering (Mining).

Roux Terblanche – Job Supervisor

Roux Terblanche is a mineral resource task shipment expert with tested African and Australian experience working for owners, EPCMs, experts and professionals. He has a vast array of product experiences, consisting of lithium, gold, copper, diamonds and platinum. He has actually shown to include worth and provide jobs securely, on time and within budget plan.

Terblanche has actually operated in the UAE and throughout Africa, consisting of Ghana, the DRC, Burkina Faso, Zambia, Rwanda, Botswana and Senegal. He contributed in increasing the operating footprint of a worldwide building and construction business throughout Africa and was essential to the structure of the Akyem, Tarkwa Stage 4 and Chirano mines in Ghana.

Terblanche holds a nationwide diploma in mechanical engineering, a diploma in task management and a Bachelor of Commerce from the University of South Africa.

Iwan Williams – Expedition Supervisor

Iwan Williams is an expedition geologist with over twenty years’ experience throughout a broad variety of products, primarily iron ore, manganese, gold, copper (porphyry and sed. hosted), PGE’s, nickel and other base metals, along with chromitite, phosphates, coal and diamond.

Williams has substantial southern and west African experience and has actually operated in Central and South America. His experience consists of all elements of expedition management, task generation, chance evaluations, due diligence and mine geology. He has substantial research studies experience having actually taken part in the shipment of numerous task research studies consisting of resource, mine style requirements, standard ecological and social research studies and metallurgical test-work programs. He is really knowledgeable about operating in Africa having actually invested 23 years of his 28-year geological profession in Africa. Williams is a graduate of the University of Liverpool.

Abdul Razak – Nation Supervisor

Abdul Razak has substantial expedition, resource examination and task management experience throughout West Africa with a strong concentrate on data-rich environments. He has substantial gold experience having actually worked throughout Ghana with AngloGold Ashanti, Goldfields Ghana, Perseus and Golden Star, along with global expedition and resource examination experience in Burkina Faso, Liberia, Ivory Coast, Republic of Congo, Nigeria and Guinea.

Razak is an important member of the group, handling all website activities consisting of drilling, lab, regional groups, geotech and hydro, neighborhood assessments and stakeholder engagements and contributed in facility of the present advancement group and specifying Ghana’s first lithium resource price quote. He is based at the task website in Ghana.