{“page”:0,” year”:2023,” monthnum”:12,” day”:6,” name”:” happy-days-for-how-long”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities, Real & Digital Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”George Valantasis”,”title”:”Associate Director, Factors and Dividends”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Daniel Perrone”,”title”:”Former Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Elizabeth Bebb”,”title”:”Director, Factor & Dividend Indices”,”image”:”/wp-content/authors/elizabeth_bebb-511.jpg”,”url”:”https://www.indexologyblog.com/author/elizabeth_bebb/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”}]

Pleased Days for The Length Of Time?

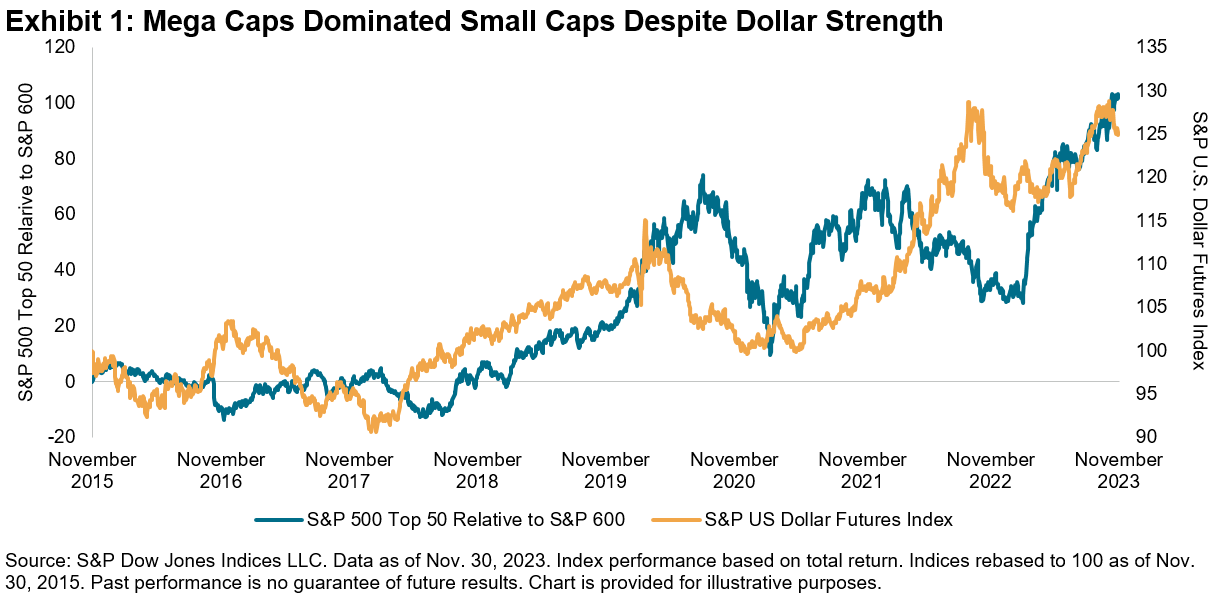

With less than a month delegated go to liquidate the year, it’s a great time to assess the low and high that market individuals have actually experienced. While the year started with a rocky start due to the Silicon Valley Bank collapse, the marketplace continued to power forward, stumbling in Q3 as 10-year Treasury yields increased to a 15-year high, however recuperating with a bang in November, with the S&P 500 ® up 21% YTD. 1 One repercussion of increasing Treasury yields was the rise in the U.S. dollar, which normally is a currency headwind for mega caps, as U.S. multi-nationals tend to acquire the majority of their earnings from abroad. However that didn’t obstruct the tear that mega caps were on this year, as Exhibition 1 highlights, with the S&P 500 Leading 50 exceeding the S&P 600 ®(* ) by 28% YTD. While we just recently saw a pullback in 10-year yields in addition to the dollar, with the S&P U.S. Dollar Futures Index down 2% in November, if that pattern continues, that might possibly be a more advantage to mega-cap strength. While little caps recuperated in November

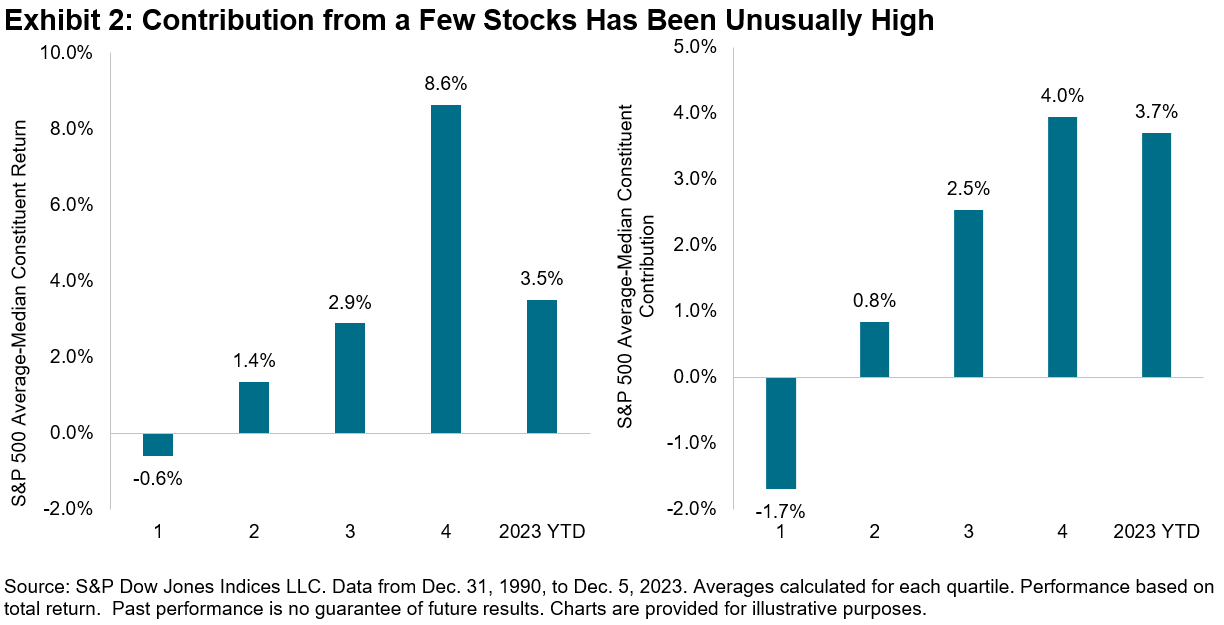

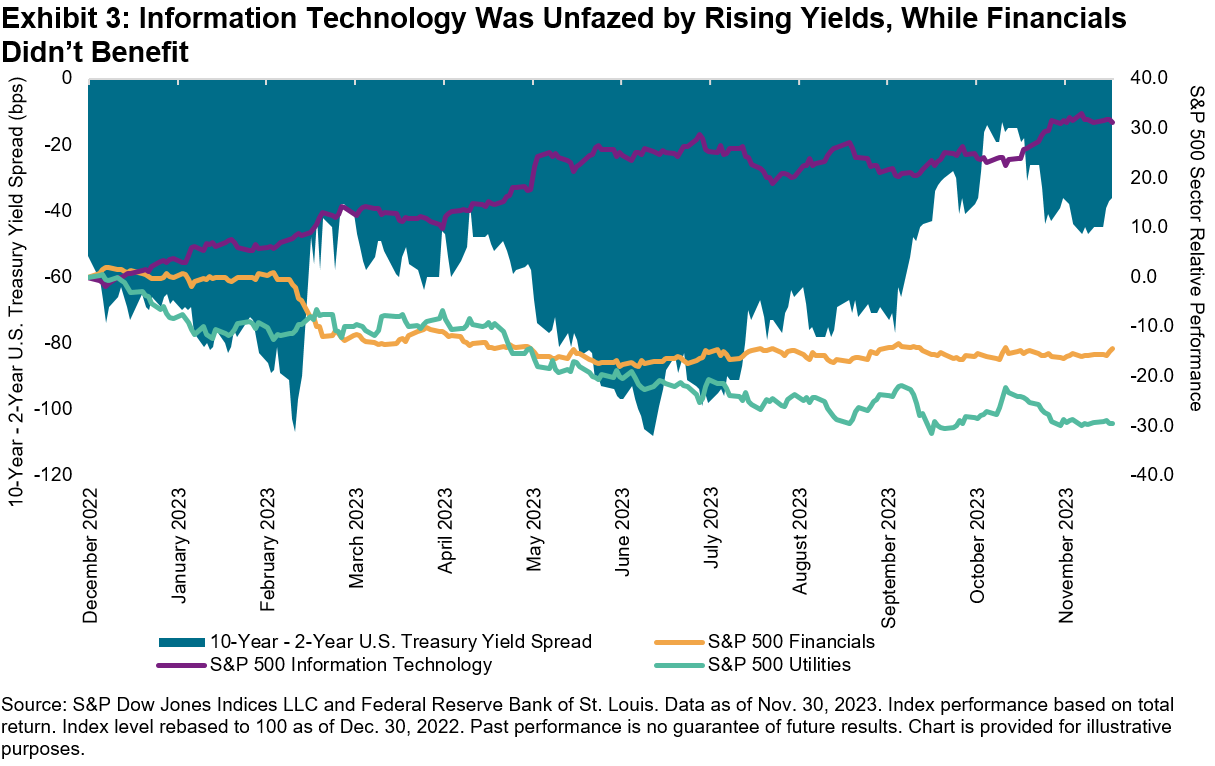

, this year’s large-cap-led rally has actually been uncommon in regards to its narrow breadth. We can picture this in Exhibition 2, where we rank the historic yearly S&P 500 returns in our database by skewness of constituent returns, as determined by the distinction in between the typical versus average constituent return, and consequently divide them into quartiles. Then we carry out the exact same workout, now ranking by skewness of constituents’ return contribution. Up until now this year, the typical return has actually been higher than the average by 3.5%, in between the 3rd and 4th quartile, while the typical constituent contribution has actually been higher than the average by 3.7%, put right listed below the 4th quartile level. These fairly severe outcomes follow the concentration of outperformance within the Spectacular 7 stocks, which has actually been uncommonly high relative to history, and maybe a headwind for more focused active supervisors that are underweight the biggest stocks Going back to the climb of 10-year Treasury yields, the increase was not restricted to the long end of the curve, with a substantial climb in short-term Treasury yields on the back of Fed rate walkings to fight inflation. However as 10-year yields got steam, the inverted yield curve started to disinvert. At a sector level, Exhibition 3 reveals that the momentum in Infotech has actually continued in spite of the sector’s standard level of sensitivity to greater rates, while Energies, generally more bond-like in nature, is unsurprisingly the worst sectoral entertainer YTD. What is unexpected is that while Financials ought to take advantage of the disinversion of the yield curve, which can enhance banks’ net interest margins, the sector has actually not handled to totally recuperate post the Silicon Valley Bank tumult.

In addition to magnificent equity efficiency, we experienced a strong healing in set earnings compared to in 2015’s abysmal efficiency, with the

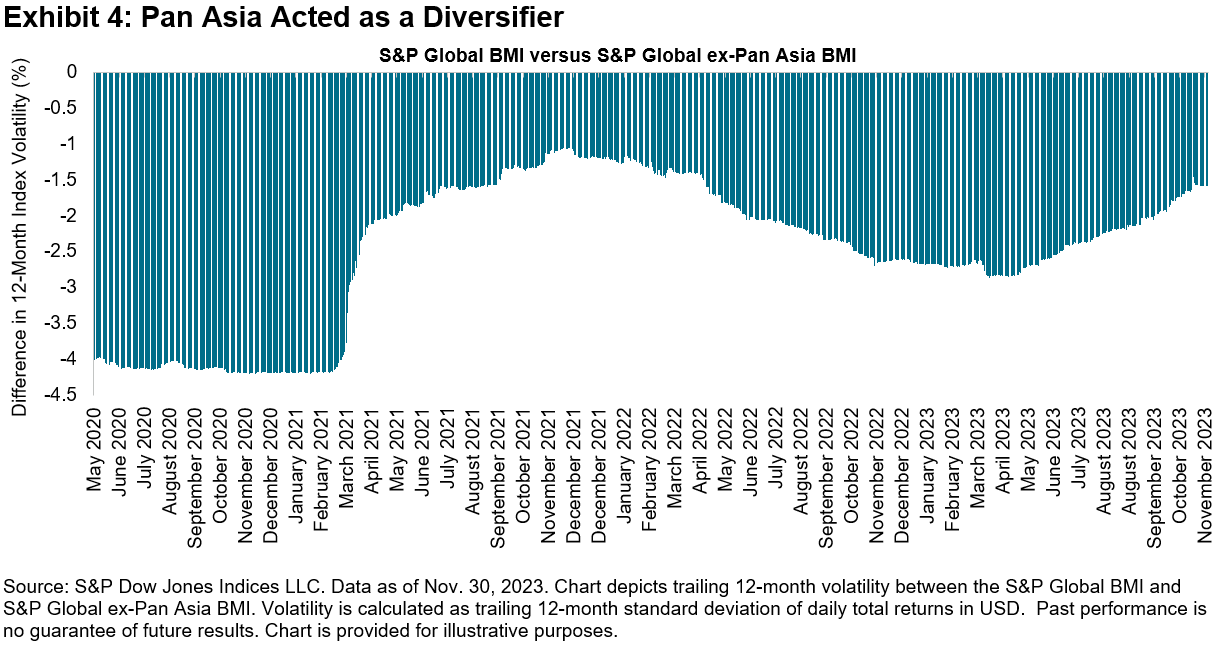

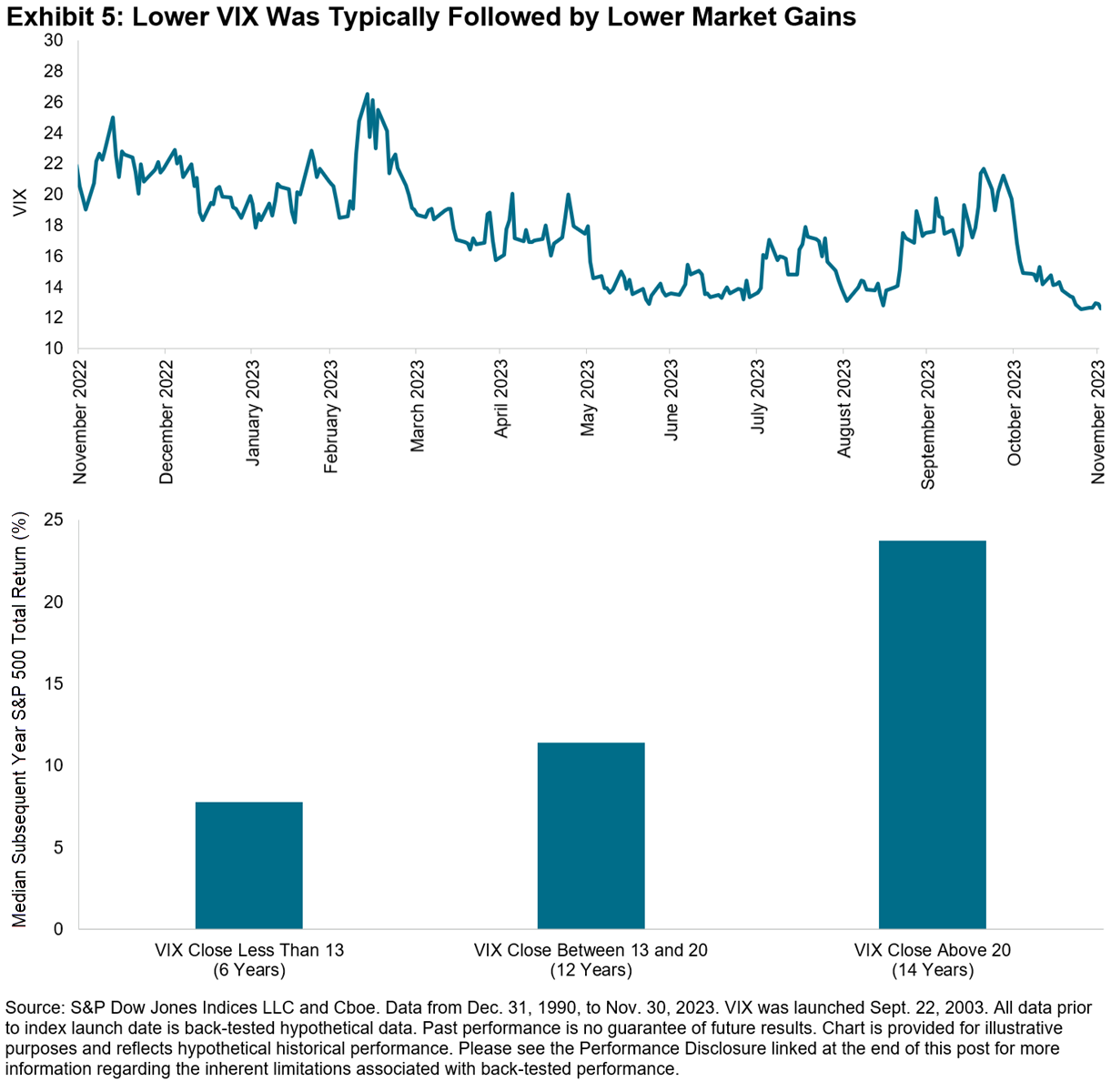

iBoxx Liquid Financial investment Grade up 8% in November, its finest month-to-month return because December 2008. However while outright efficiency has actually been rosy, risk-adjusted efficiency can be more tough provided continued favorable connections in between equities and bonds, a natural result of gains throughout both possession classes. On the other hand, in spite of China’s financial and realty issues, with the S&P China 500 down 14% in USD terms year-to-date, Asian markets provided some solace, as we see in Exhibition 4, where a constant unfavorable spread in tracking 12-month volatility in between the S&P Global BMI and S&P Global ex-Pan Asia BMI shows Pan Asia has actually functioned as a diversifier. Putting threat into context, in spite of geopolitical stress combined with remaining inflation and economic crisis issues, Exhibition 5 reveals that the marketplace has actually been at ease, with the

VIX ® trending downward in the previous 12 months, ending November listed below the 13 deal with. However what signal has low equity suggested volatility provided for future equity returns traditionally? We rank the exact same years in our database by VIX and divide them into 3 containers based upon a VIX level at year-end of less than 13, in between 13 and 20, and above 20. Historically, we see a direct relationship in between the year-end level of VIX and average subsequent year S&P 500 returns, showing that, typically, years ending with greater suggested volatility tended to be followed by greater returns. While forecasting the future has actually shown to be an useless workout

YTD since Dec. 5, 2023.

The posts on this blog site are viewpoints, not guidance. Please read our

Classifications

-

Thematics

Tags -

fourth commercial transformation,

altering demographics, tidy energy, Environment Shift, disruptive innovation, Electric Cars, ESG, healthcare, Jason Ye, artificial intelligence, megatrends, natural language processing, robotics, S&P Kensho New Economies, sustainability, thematics What’s driving interest in thematics and how can indices assist financiers target world-shaping structural patterns? Sign up with S&P DJI’s Jason Ye for a more detailed take a look at how ingenious standards, consisting of the S&P Kensho New Economy Indices, are tracking long-lasting, market-altering styles by style.

Classifications

-

Equities

Tags -

2023,

Benedek Voros, equity efficiency, international equities, IIS, institutional financier, S&P 400, S&P 500, S&P 600, S&P BSE SENSEX, S&P Europe 350, S&P France BMI, S&P Germany BMI, S&P Italy BMI, S&P TOPIX 150, S&P TSX 60, S&P UK, S&P/ HKEex LargeCap, Santa Claus Rally At this time of year, my 9 years of age excitedly polishes his boots so that, according to Hungarian custom, Santa can fill them with sugary foods and toys throughout the night in between December 5 and 6 (yes, he does show up a couple of weeks early in Central Europe). Similar to in years past, I make sure he will not be dissatisfied. However will Old Saint Nick have any goodies for equity financiers too?

History recommends that there is at least some proof supporting the concept of a “Santa Claus Rally.” We call our light-hearted measurement of option the “Santa Rating,” which we specify as the ratio of a market’s typical efficiency in the month of December to its overall return in the matching year. Given that there are 12 months in the year, a Santa Rating of one-twelfth (around 0.08) would suggest that December had a typical influence on the year’s overall return. A Santa Rating above 0.08 shows that December was a much better month for stocks, typically, than the other 11 months of the year.

As it ends up, all 12 market sections that we chose for our analysis prospered on the test. The Santa Rating’s cross-market average of 0.23 shows that because 1994, December, typically, has actually had to do with 3 times more lucrative than other months. Having stated that, there have actually been substantial distinctions throughout different areas: Japanese financiers typically had a pleased and lucrative December, with the last month of the year producing, typically, 5 times the return of the typical month; on the other hand in Canada, December returns have actually tended to be just somewhat above average. It is likewise significant that Santa was rather stingier in the previous years than in the previous 2: the December average return in the last ten years was substantially lower than in the previous 18 years, with 3 out of 12 market sections surveyed providing a straight-out unfavorable typical return in the Decembers in between 2013 and 2022.

Santa is understood to reward good kids with sweets however to leave coal for the naughty. Does he do something comparable for equity markets? As Exhibition 2 programs, he does certainly. Historically, the typical equity efficiency throughout December tends to be better when the previous 11 months’ return was favorable (” good”) than when it was unfavorable (” naughty”), with the spread best in Canada, at 5.2%. The only exception is U.S. little caps, which tends to take advantage of a January result rather.

Taking a look at YTD returns

, the bright side is that all market sections besides Hong Kong have actually been good up until now in 2023– let’s hope Santa takes notification. However despite where markets head in the next couple of weeks: Pleased vacations and a thriving New Year to all! The posts on this blog site are viewpoints, not guidance. Please read our

Brian Luke

Everybody longs for silver and gold.”

– Burl Ives

My all-time preferred stop-motion animation program was the 1964 television unique

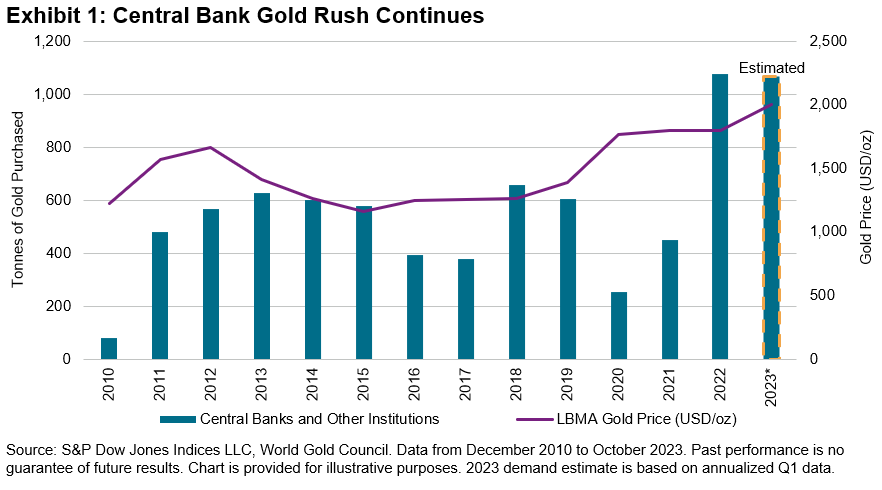

Rudolph the Red-Nosed Reindeer, told by Burl Ives. Playing the function of Sam the Snowman, Ives sang “Silver and Gold,” commemorating the work of Yukon Cornelius, a prospector mining near Santa’s workshop. Those tracking the Dow Jones Product Index Silver struck it abundant, as the index published a 10.6% gain in November. The Dow Jones Product Index Gold, not to be outshined, struck an all-time high before settling on thin volumes. Reserve banks continued to include 800 lots of gold to their portfolio in the very first 3 quarters of the year, led by the Individuals’s Bank of China. Purchases so far drove gold to an all-time high, as inflation ruined fiat currencies. Following a year of record gold purchases, reserve banks are on speed to almost match 2022 levels. Financiers seem combating the U.S. Fed, nevertheless, as net redemptions in physical gold ETFs have actually seen USD 12 billion in outflows YTD. Beyond rare-earth elements, restored optimism of a rebounding Chinese economy led commercial metals to a strong month-to-month efficiency. Industrial metals, consisting of the

S&P GSCI Lead, S&P GSCI Zinc and S&P GSCI Copper, acquired 2%, 3% and 4%, respectively. While “silver bells” phoned 10% returns, cocoa and coffee signed up 12% and 13%, respectively, with the

S&P GSCI Coffee striking double-digit returns for the 2nd successive month. Decreased production due to heavy rains in the Ivory Coast enhanced the S&P GSCI Cocoa to 72% YTD; integrated with the S&P GSCI Sugar, which was up over 50% YTD, the 2 will certainly sweeten the holiday. Simply do not exaggerate it, else Yukon Cornelius will need to bring you to the dental practitioner to take out that craving for sweets. The posts on this blog site are viewpoints, not guidance. Please read our

Classifications

-

Equities,

Fixed Earnings Tags -

Anu Ganti,

dispersion, diversity, dividends, ETFs, elements, indexing, insurance coverage, insurance providers, liquidity, Raghu Ramachandran, threat management, SPIVA How and when are insurance providers executing index-based methods as they look for liquidity, diversity, and threat mitigation? S&P DJI’s Raghu Ramachandran and Anu Ganti sign up with BlackRock’s Andrew Masalin to discuss what’s driving passive outperformance and making use of ETFs by insurance providers through the lens of SPIVA.