Open the Editor’s Digest free of charge

Roula Khalaf, Editor of the feet, chooses her preferred stories in this weekly newsletter.

Eurozone residential or commercial property business are being struck by rising losses and some will have a hard time to support their financial obligations, which have actually increased to a greater level than before the 2008 monetary crisis, the European Reserve bank has actually cautioned.

The losses, which the ECB stated would have “effects for the durability of banks’ loan books”, originate from greatly greater funding expenses, falling industrial residential or commercial property worths, weaker rental earnings and increasing issues about the energy effectiveness of structures.

The reserve bank stated indications of tension in the industrial residential or commercial property sector, which represents 10 percent of all eurozone bank loans, “have the possible to substantially magnify an unfavorable circumstance” and would “drive big losses” in the larger monetary system.

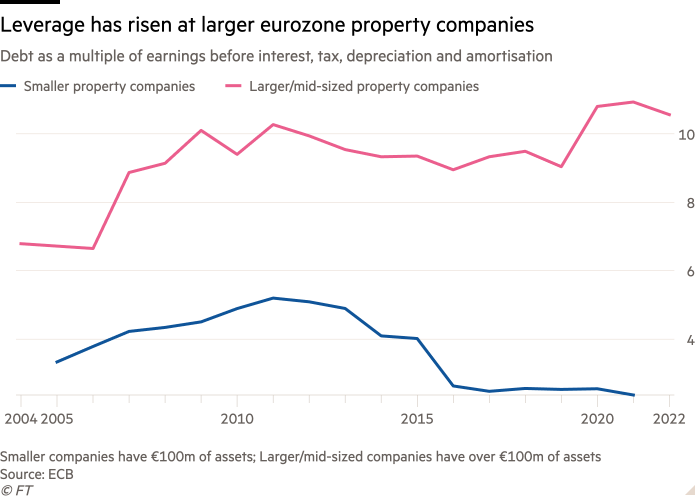

The typical financial obligation of bigger European residential or commercial property business has actually increased above 10 times their revenues, “near or above pre-global monetary crisis levels”, the ECB stated in part of its twice-yearly monetary stability evaluation. The complete evaluation is out on Wednesday, however the ECB released its issues on industrial property a day early.

Increases in ECB rate of interest have actually struck the sector hard. It now costs 2.6 portion points more to fund the purchase of industrial property properties in Europe than it did before rates began increasing in 2015, according to eurozone credit windows registry information. The reserve bank’s benchmark deposit rate is now 4 percent– up from minus 0.5 percent before the tightening up cycle started.

The increase in loaning expenses would present a refinancing obstacle for the most indebted business, the ECB stated, explaining that score company Moody’s Analytics had actually cut rankings or outlooks on 40 percent of European property business in the year to March 2023.

The issue is most intense in nations such as Finland, Ireland, Greece and the Baltic states, where more than 90 percent of loans to industrial residential or commercial property business are at variable rates or fully grown in the next 2 years. This compares to just 30 percent in the Netherlands and 40 percent in Germany.

” Company designs developed on the basis of pre-pandemic success and low-for-long rate of interest might end up being unviable over the medium term,” the ECB cautioned.

The sharp decline in eurozone industrial property is highlighted by the 47 percent drop in the variety of deals in the sector in the very first half of this year, compared to the exact same duration in 2022.

The share of bank loans to lossmaking property customers is anticipated to double to 26 percent, the ECB stated. However it cautioned this might increase to half of all loans if turnover in the sector fell by a 5th and the tighter funding conditions continued for another 2 years.

The reserve bank stated financial obligation levels were most likely to “degrade even more as these companies’ revenues decrease and industrial property costs are revalued downwards”.

Moves to homeworking and online retail have actually struck need for workplaces and stores, weighing on rental earnings for homeowner, while older and lower-quality structures are suffering larger drops in leas as renters focus more on a structure’s energy effectiveness.

In an indication of how financiers think the rate of industrial residential or commercial property has actually fallen greatly in the previous 2 years, the marketplace worth of noted eurozone residential or commercial property business has actually fallen from 110 percent of the book worth of their properties to less than 70 percent.

Europe’s home sector has actually dealt with comparable difficulties However the ECB stated a strong labour market was assisting to keep home mortgage defaults low, while real estate lacks and increasing building and construction expenses were offering assistance to costs.