The Conference Board’s Leading Financial Indicators (LEI) continued its decrease in October, dropping 0.8% MOTHER (even worse than the 0.7% decrease anticipated).

-

The most significant favorable factor to the leading index was constructing licenses at +0.03

-

The most significant unfavorable factor was ISM N brand-new orders and typical customer expectations both at -0.22

This is the 19th straight mama decrease in the LEI (and 18th month of 19) – the longest streak of decreases considering that ‘Lehman’ (22 straight months of decreases from June 2007 to April 2008)

” The United States LEI trajectory stayed unfavorable, and its 6- and twelve-month development rates likewise kept in unfavorable area in October,” stated Justyna Zabinska-La Monica, Elder Supervisor, Company Cycle Indicators, at The Conference Board.

” Amongst the leading signs, weakening customers’ expectations for organization conditions, lower ISM ® Index of New Orders, falling equities, and tighter credit conditions drove the index’s newest decrease.

After a time out in September, the LEI resumed signaling economic crisis in the near term.

The Conference Board anticipates raised inflation, high rates of interest, and contracting customer costs – due to diminishing pandemic conserving and obligatory trainee loan payments – to tip the United States economy into a really brief economic crisis.

We anticipate that genuine GDP will broaden by simply 0.8 percent in 2024.”

In spite of ‘soft landing’ buzz, the LEI is revealing no indications at all of ‘recuperating’, toppling back in line with the peak in March 2006 …

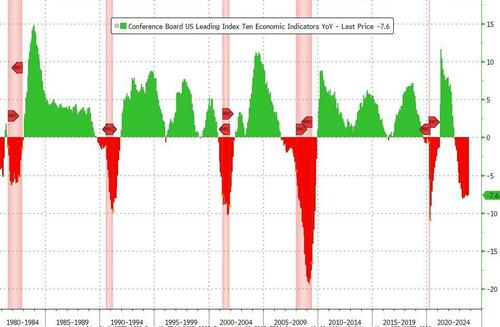

And on a year-over-year basis, the LEI is down 7.6% (down YoY for 16 straight months) – near its most significant YoY drop considering that 2008 (Lehman) beyond the COVID lockdown-enforced collapse …

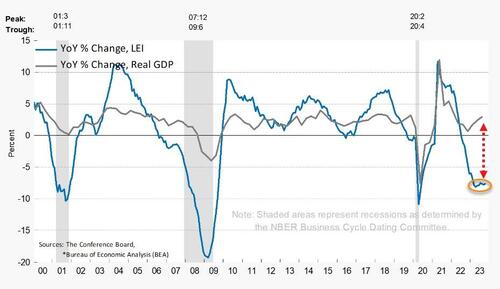

The yearly development rate of the LEI continues to be unfavorable, however may have reached a bottom …

The trajectory of the United States LEI continues to signal an economic crisis over the next 12 months

Is this the cleanest view of The Fed’s tightening up influence on the United States economy? Definitely does not appear like a ‘soft’ landing …

Packing …