More big United States business are nestling in personal bankruptcy court, an indication of a tightening up credit capture as rate of interest increase and monetary markets end up being less congenial to debtors.

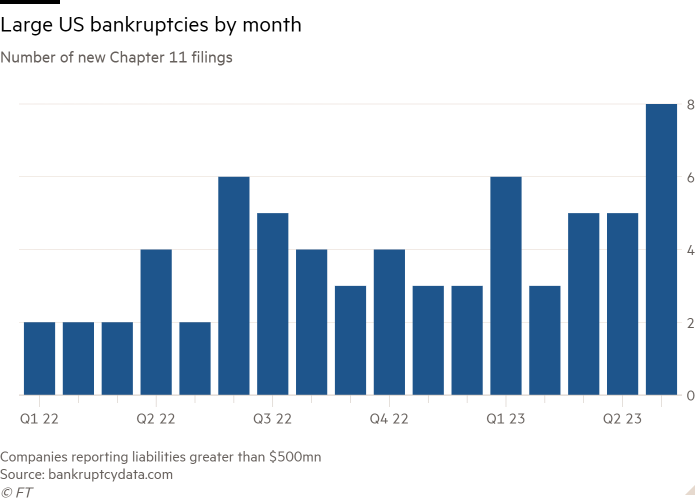

8 business with more than $500mn in liabilities have actually applied for Chapter 11 personal bankruptcy this month, consisting of 5 in a single 24-hour stretch recently. In 2022 the regular monthly average was simply over 3 filings.

Twenty-seven big debtors have actually applied for personal bankruptcy up until now in 2023 compared to 40 for all of 2022, according to figures put together by bankruptcydata.com. Amongst current business to catch financial institutions consist of Envision Health care, Vice Media and Kidde-Fenwal, a maker of fire control systems dealing with countless suits over its usage of so-called permanently chemicals.

The insolvencies followed years of quiescent markets and increasing assessments permitted even economically stressed out companies to raise financial obligation and equity capital to survive. Financial obligation default rates had actually been up to about 1 percent in 2021 as reserve banks pumped cash into the coronavirus pandemic-stressed economy.

Now, S&P Global anticipates that the 12-month tracking default rate for speculative-grade securities will leap from the existing 2.5 percent to 4.5 percent by early 2024.

Yields on scrap bonds have actually more than doubled from less than 4 percent in mid-2021, as determined by the BofA United States High Yield Index, a sign of just how much more pricey capital has actually ended up being for less creditworthy debtors. The Federal Reserve has actually cautioned that loan providers might even more contract the supply of credit to companies after current chaos in the banking sector.

” Our basic view is that we are visiting a boost in ‘difficult restructurings’, driven by the mix of greater financial obligation levels from the loaning binge of Covid and increasing rate of interest. The triggers will be going out cash and failure to re-finance developing financial obligation,” stated Expense Derrough, a financial investment lender at Moelis who recommends customers throughout distressed scenarios.

” Some business have actually utilized every technique in the book and now have actually lacked techniques.”

In Between 2020 and 2022, a number of personal equity-backed business pursued “liability management” deals to endure, raising money through brand-new loanings and extending maturities.

Such offers have actually been questionable as they lowered the claims of big groups of financial institutions in case of personal bankruptcy. 2 business that pursued prominent liability management deals, Envision Health care and Serta Simmons Bed Linen, have actually applied for personal bankruptcy in 2023.

In the view of some observers, the business might have gone through less intricate restructurings, and collected lower financial obligation problems, had they prevented these deals. “Extremely few of these liability management deals have actually achieved success,” Mike Harmon, a previous financier at Oaktree Capital who now teaches at Stanford University, just recently informed the Financial Times

Struggling business can conserve the time and high expert charges connected with personal bankruptcy by reaching consensual restructurings out of court, such as financial obligation exchanges that minimize primary quantities and swaps of equity.

Still, the elements of official personal bankruptcy procedures, consisting of the capability to shed undesirable leases and agreements and the capability to require recalcitrant financial institutions to accept financial terms, made them the very best alternative for some business. For instance, Vice Media, whose backers consist of TPG and Sixth Street Partners, has actually chosen to utilize Chapter 11 to get quotes for the business.

” Financial institutions would much choose to reorganize their financial obligation in a meeting room, instead of a courtroom, however often business have issues that just the Chapter 11 tool kit can repair,” stated Vincent Indelicato, a law partner at Proskauer Rose.

.