Stefano Spicca/iStock through Getty Images

In this piece, we reveal that, not-withstanding the Republican politician Congress drawing out costs cuts in exchange for raising the approximate “financial obligation” ceiling, the present net-flow of cash from Federal Federal government costs into the economy (economic sector) will avoid an economic downturn in 2023, and the SPX might see brand-new highs prior to completion of the year.

The Issue (not-withstanding)

The 14th modification (stipulation 4) was produced after the Civil War in order to avoid the extremely exact same kind of hostage-taking that the Republicans are associated with today. The 14th modification was needed due to the fact that the losing side (Southern slave-owning oligarchs) were intent on ruining the brand-new Federal government from within by repudiating the Federal government financial obligation.

Some analysts are recommending that if Biden conjures up the 14th and directs the Fed to pay all agreements according to Congressional costs legislation, the GOP needs to take him to court. Envision going to the Supreme Court and informing it that the GOP desires Biden to break agreements with the economic sector and other World federal governments and therefore break his constitutional responsibility to “make sure that the laws be consistently carried out.” Envision the court hearing that the GOP desires Biden to break Congressional costs laws and not satisfy his own Constitutionally-mandated obligations. The Republicans will not go to the courts if the 14th is conjured up, and Biden needs to invoke it if they decline to raise the ceiling to spend for previous financial costs.

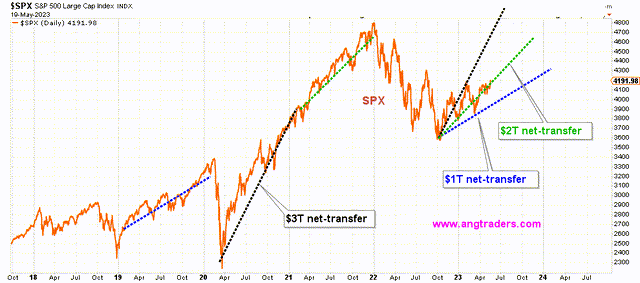

The debt-ceiling will be raised or gotten rid of. There might be a “sell-the-news” pullback in the market, however unless Biden consents to considerable costs cuts, the pullback will be a purchasing chance due to the fact that the net-transfers are including practically two times as much cash to the economic sector this compared to in 2015.

Fund-Flows

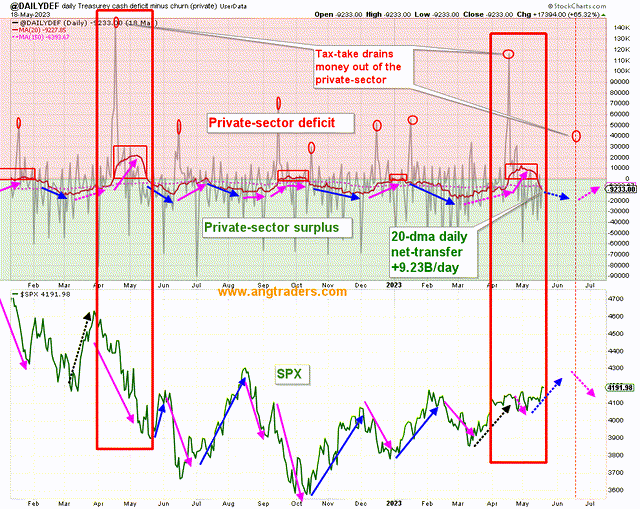

- This year, the April tax-drain was smaller sized and had less of an unfavorable influence on the stock exchange than in 2015; the marketplace traded sideways rather of falling.

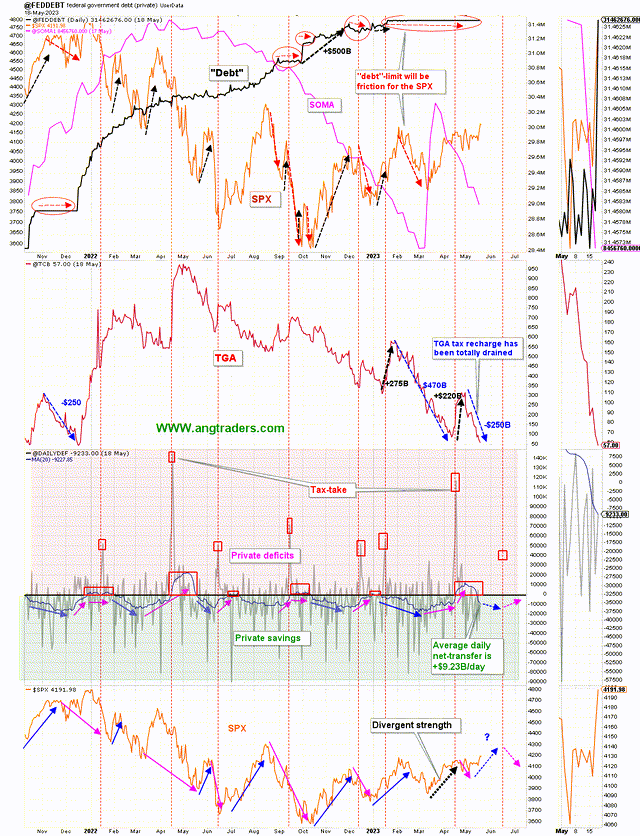

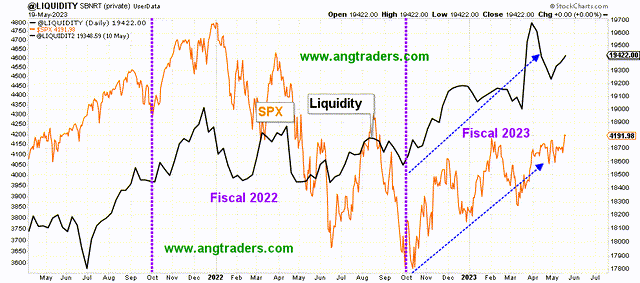

- The 150-dma of the everyday internet transfers stands at +$ 6.39 B/day, compared to just +$ 3.61 B/day on the very same date in 2015. Annualized at those rates, it ends up being +$ 1.60 T/year and +$ 0.90 T/year, respectively. And thinking about that the rate is accelerating this year, the annualized quantity needs to be closer to +$ 2.0 T/year by the end of financial 2023.

The SPX need to be climbing up with the normal slope of a +$ 2T/year net-transfer rate (green line listed below).

The TGA is down to simply $57B which is not likely to last up until the June 15 tax-take. This implies that either the GOP consents to a tidy debt-ceiling boost, or Biden stimulates Post 14 of the Constitution. In any case, the United States will not default on its responsibilities.

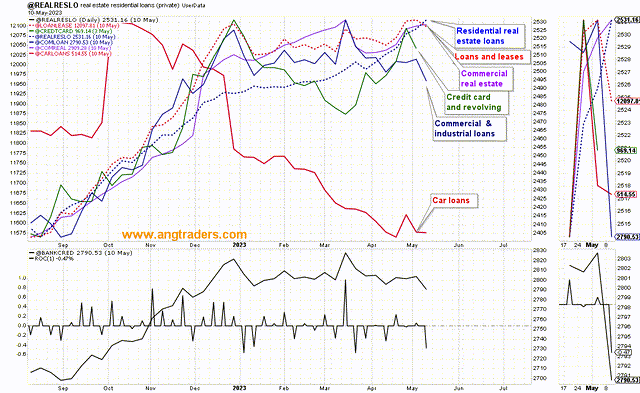

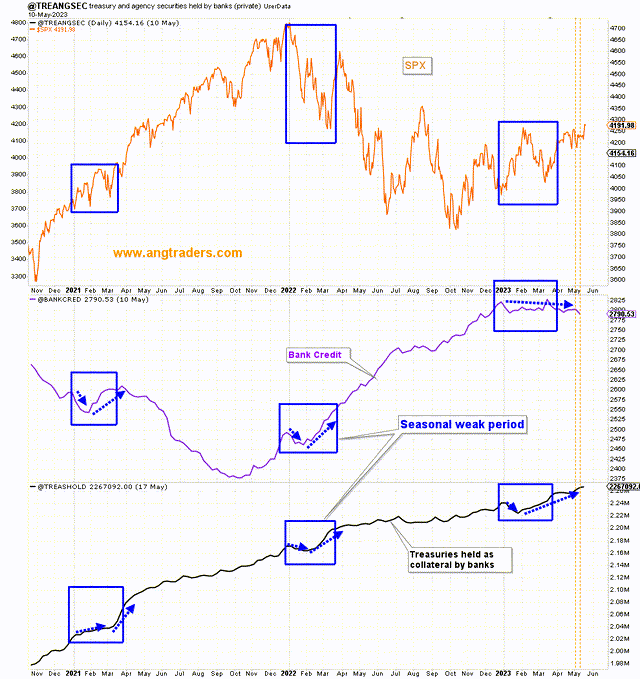

Aggregate bank credit contracted in the current reported week (ending May 10); both retail and industrial realty loans increased while all other loan-types reduced.

The seasonal weak duration in bank credit that happens in Q1 of many years, reveals a favorable connection in between aggregate bank credit and the Treasuries held-as-collateral by banks. This year, the treasuries held-as-collateral has actually recuperated typically, however the bank credit has yet to recuperate. I believe that as the debt-ceiling is raised and the Fed stops briefly rate walkings, the aggregate bank credit will go back to the mean and recuperate like the security held by banks is currently doing.

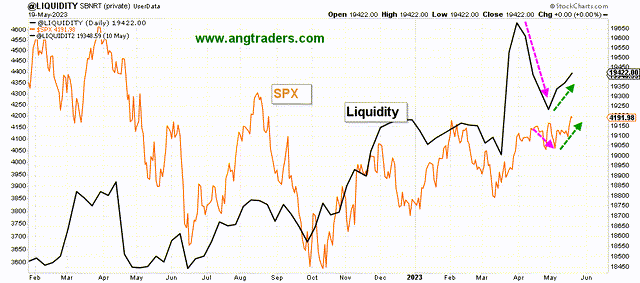

Regardless of the stall in bank credit and the Fed’s QT, liquidity has actually trended greater and the SPX has actually relocated compassion.

The longer-view reveals that liquidity is greater now than it was at the old SPX high of 2022. We anticipate the SPX to capture up and make brand-new highs also.

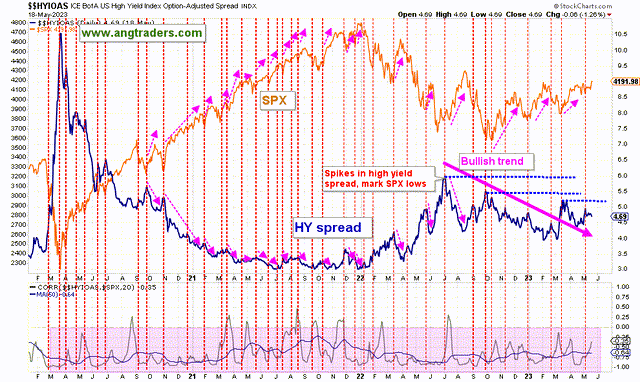

The HY spread continues to follow the bullish pattern (pink-arrow listed below) in spite of all the concern over the health of the banks.

Fund-flows and worry are the motorists of the stock exchange and, at the minute, we have enough of both. Unless Biden consents to considerable costs cuts, the favorable net-transfers will continue, therefore will the stock exchange rally. Financiers can buy this circumstance by buying broad-spectrum index ETFs such as SPY, QQQ, and IWM.