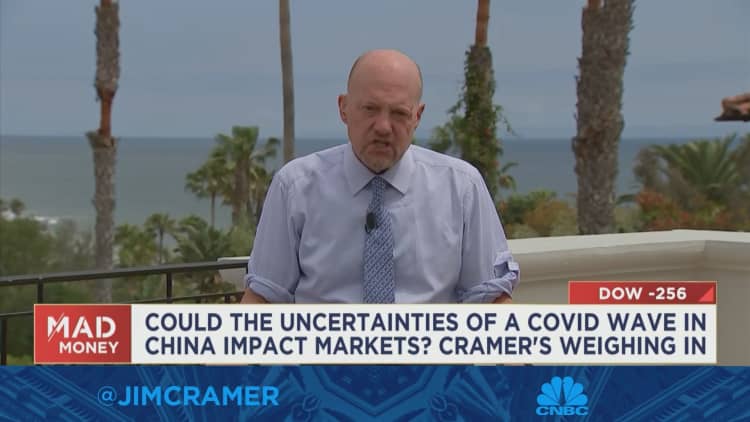

After a sour day in Washington and on Wall Street, CNBC’s Jim Cramer alerted financiers that legislators will undoubtedly cost them cash as financial obligation ceiling settlements drag out.

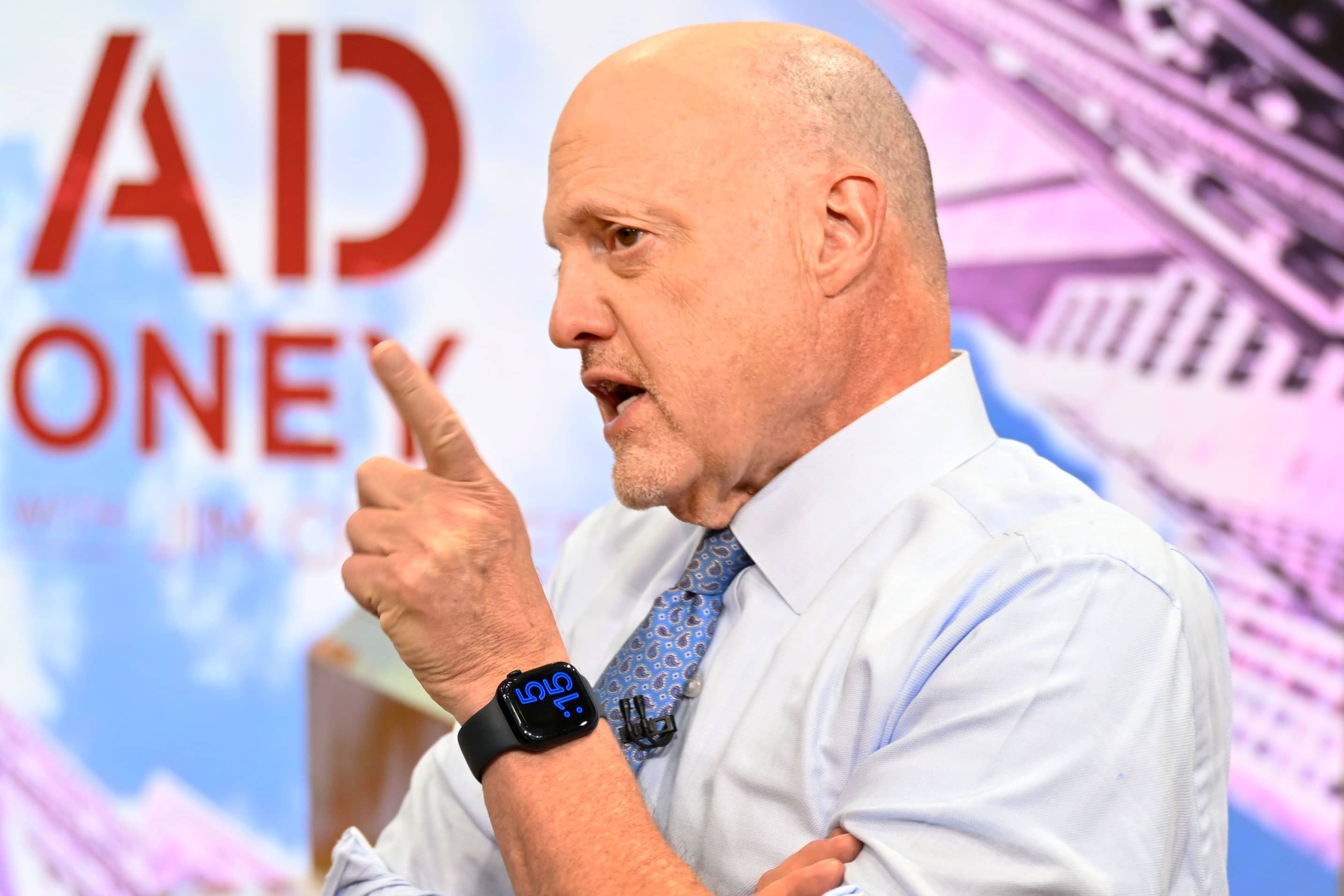

” Prepare for our political leaders to lose you some more cash,” Cramer stated, referencing the earlier deadlock surrounding the financial obligation ceiling in 2011. “They injure you then. They aren’t done harming you now. However unless you trade full-time it’s extremely tough to go out and return in early sufficient for it to make a distinction, which implies the majority of us require to take the discomfort.”

Market watchers are likewise weighing the news of the introduction of a brand-new Covid-19 variation in China, he stated. It’s uncertain whether this new age will trigger Beijing to enforce brand-new travel constraints, a number of which reduced up a number of months earlier.

” We do not understand if travel will be prohibited or limited, although the Macau gambling establishment stocks are trading like it’s gon na occur,” Cramer stated. “And we do not understand if the mind of the just recently ebullient Chinese customer will be affected.”

With 2011’s fitful financial obligation ceiling settlements calling in his ears, Cramer is downhearted about legislators’ capability to come to an offer prior to turmoil rules.

” Although we eventually got an offer [in 2011] and prevented the worst-case situation, the standoff sufficed to make Requirement & & Poor’s downgrade our federal government’s credit score,” he stated.

Cramer thought about the benefits of offering stocks prior to the possible market swoon, however stressed that numerous will not have the ability to purchase them back quick sufficient to see genuine gains.

” I would dislike to encourage you to offer and after that redeem later on, however, since we do not understand if you’ll have the ability to return in prior to the all-clear,” Cramer mentioned. “That stated, if you believe our leaders are severe about negotiating, then it may be worth attempting to avoid the coming decrease– and if we’re following the 2011 script, there ‘d have to do with a 12% decrease from here up until the bottom.”