{“page”:0,” year”:2023,” monthnum”:5,” day”:1,” name”:” lessons-from-20-years-of-equal-weight”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Director, U.S. Equity Indices”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Berlinda Liu”,”title”:”Director, Multi-Asset Indices”,”image”:”/wp-content/authors/berlinda_liu-191.jpg”,”url”:”https://www.indexologyblog.com/author/berlinda_liu/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Strategy Indices”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Indices Product Management, Latin America”,”image”:”/wp-content/authors/maria_sanchez-243.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-271.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Senior Director, Strategy Indices”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Ben Leale-Green”,”title”:”Associate Director, Research & Design, ESG Indices”,”image”:”/wp-content/authors/ben_leale-green-342.jpg”,”url”:”https://www.indexologyblog.com/author/ben_leale-green/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Michael Mell”,”title”:”Senior Director, Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Jason Ye”,”title”:”Director, Strategy Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Strategy & Volatility Indices”,”image”:”/wp-content/authors/Ari.Rajendra-400.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Narottama Bowden”,”title”:”Director, ESG Index Intelligence, Index Governance”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”},{“display”:”Lalit Ponnala”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/lalit.ponnala-388.jpg”,”url”:”https://www.indexologyblog.com/author/lalit-ponnala/”}]

Lessons from twenty years of Equal Weight

How has equal-weight compared to cap-weight traditionally? S&P DJI’s Hamish Preston and Invesco’s Nick Kalivas check out how distinctions in index building have actually affected index efficiency, sector and element structure, and leads to the most recent SPIVA Scorecards.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

The S&P GSCI Cooled in April as Inflation Cooled

-

Classifications

Products -

Tags

farming, products, copper, energy, gold, grains, commercial metals, inflation, S&P GSCI, S&P GSCI Farming, S&P GSCI Environment Aware, S&P GSCI Copper, S&P GSCI Grains, S&P GSCI Industrial Metals, S&P GSCI Softs, S&P GSCI Sugar, S&P GSCI Zinc, soft products, sugar, Zinc

The S&P GSCI fell 0.8% in April as the Fed’s favored step of inflation, Personal Intake Expenses (PCE), fell somewhat on a year-over-year basis to 4.6%. Continued raised readings of inflation, albeit cooling, resulted in market expectations that the Fed would trek rates once again in Might to bring inflation back to its 2% target. Products are usually great inflation hedges since they tend to move with modifications in inflation to the benefit and, most just recently, to the disadvantage.

Within the broad S&P GSCI criteria, numerous product sectors decreased, with the S&P GSCI Industrial Metals falling the most, down 3.0%. The S&P GSCI Copper and the S&P GSCI Zinc dragged down efficiency, as China’s Politburo specified their economy is still in a healing stage, which will need ongoing financial and financial assistance due to inadequate domestic need. Expectations for China’s commercial sector to detect the need side have not concern fulfillment yet, and current problems with trade relations in between Australia and China have actually not assisted the commercial metals area.

The S&P GSCI Farming was the second-worst-performing sector, down 2.9% in April, with the S&P GSCI Grains the most affordable entertainer, down 6.9%. Corn, soy and wheat were all dragged lower owing to strong crop development and subsiding need, as the U.S. Department of Farming stated personal exporters just recently canceled numerous hundred thousand lots of corn. Brazil has a huge corn crop this year, and their cheaper crop has actually weighed on U.S. grain rates. The S&P GSCI Softs increased 12.3%, powered by the S&P GSCI Sugar, which increased 22.1% to a brand-new 10-year high.

Contending forces were at play for the S&P GSCI Energy, resulting in flat efficiency for the month. This sector makes up over half of the weight in the heading S&P GSCI and tends to have the greatest inflation beta (or level of sensitivity to modifications in inflation) of all products. Our just recently released S&P GSCI Environment Mindful is the first-to-market products benchmark integrating ecological factors to consider, and presently has a 3rd of its weight towards energy products.

The S&P GSCI Gold flirted with a brand-new all-time high as the U.S. dollar moved lower and unpredictability throughout markets resulted in a safe-haven quote.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Similarly Weighting within Sectors: Effect and Possible Applications

The outperformance of equivalent weight indices is well recorded, specifically for the S&P 500 ®(* )Equal Weight Index‘s twenty years of live history Equal Weight’s relative returns show the effect of numerous crucial index attributes For instance, smaller-size direct exposure and (anti-) momentum results together represent around 75% of the historic variation of its relative returns. Raised sector dispersion

has actually made sector allowances more crucial in describing Equal Weight’s current relative returns. Certainly, the S&P 500 Equal Weight Index’s higher direct exposure to Energy and lower direct exposure to Interaction Provider, Infotech and Customer Discretionary represented around two-thirds of its 7% outperformance in 2022 These direct exposures likewise assisted to discuss the index’s underperformance in Q1 2023 At the exact same time,

it is very important not to ignore the effect of equivalent weighting within each sector To see why, we build theoretical “intermediate” portfolios that represent actions along unique courses in between the S&P 500 and the S&P 500 Equal Weight Index. Display 1 sums up these 2 theoretical courses. The theoretical “Sectors Matching EQW” portfolio changes S&P 500 sector weights so that they match those of the Equal Weight Index while guaranteeing that business

within the exact same sector stay float market-cap weighted. Additionally, the theoretical “EQW Within Sectors” portfolio maintains the S&P 500’s sector allowances however weights every name similarly within each sector. Display 2 reveals that

similarly weighting within each sector mattered more when describing the S&P 500 Equal Weight Index’s historic returns. Certainly, the cumulative overall return for the theoretical “EQW Within Sectors” portfolio is graphically equivalent from that of the S&P 500 Equal Weight Index. While the equivalent weight index might have sporadically gained from its unique sector allowances, having more direct exposure to the smaller sized names within each sector was the most crucial chauffeur of the S&P 500 Equal Weight Index’s returns The relative degree of concentration within sectors recommends a possible tactical application

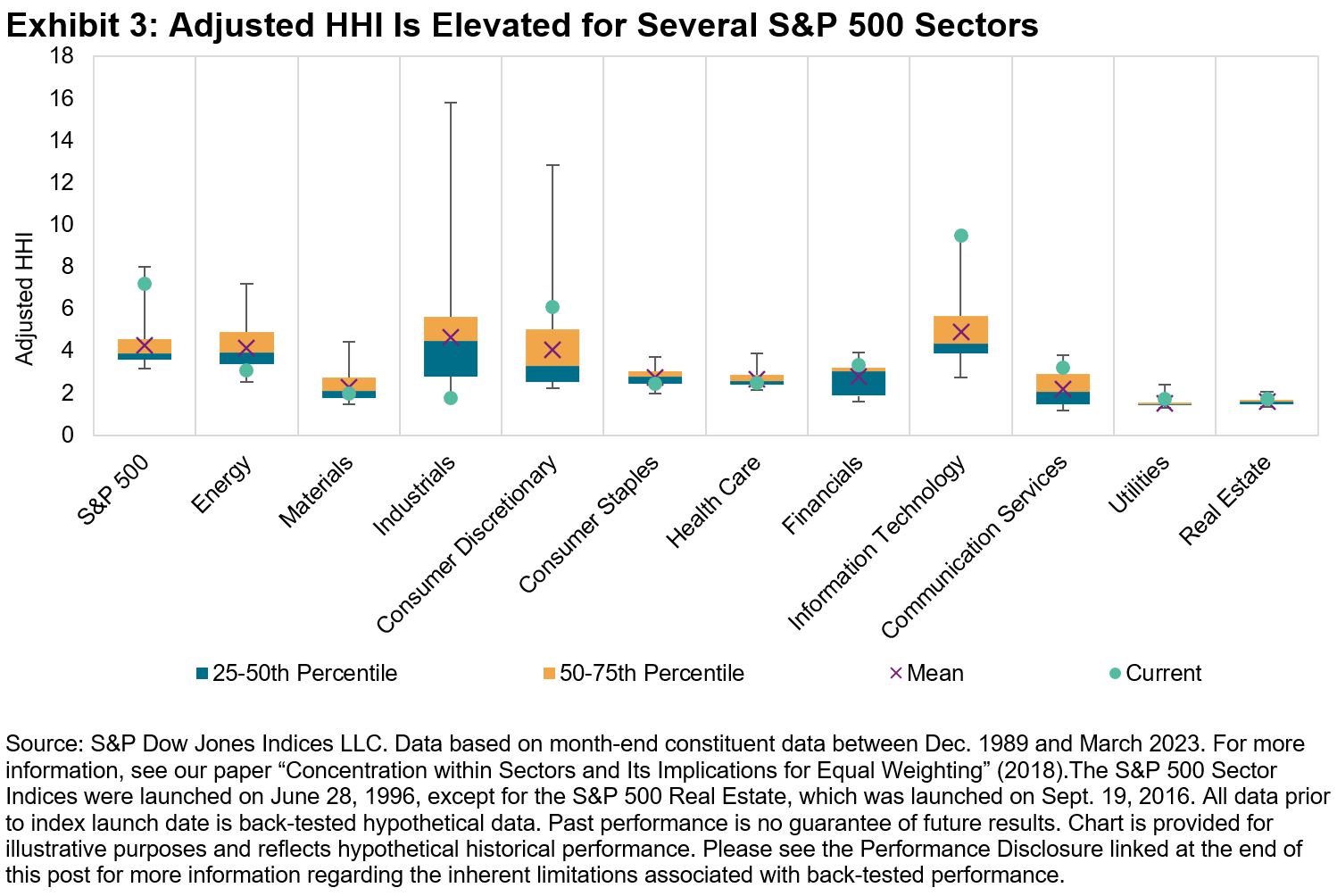

Display 3 reveals the circulation of changed Herfindahl-Hirschman Index (HHI) figures for the S&P 500 and its 11 GICS sectors; a greater adjusted HHI figure indicates that concentration is greater, independent of the variety of stocks in each index The present concentration rises in numerous sectors, especially in Infotech. By meaning, similarly weighted sector indices have less direct exposure to bigger names than do their float market-cap equivalents. All else equivalent, falling concentration suggests underperformance from the biggest names, and vice-versa. For this reason, one would anticipate similarly weighted sectors to exceed when concentration falls.

Display 4 verifies this expectation: the

S&P 500 Equal Weight Infotech Index usually surpassed its float market-cap equivalent when the sector’s changed HHI decreased. For this reason, to the degree that present concentration levels decrease, market individuals might want to think about the possible applications of a similarly weighted sector technique. To find out more on the interaction in between concentration and equivalent weight efficiency, and to commemorate the S&P 500 Equal Weight Index’s 20

th birthday, have a look at the replay of our Index Financial investment Technique call from April 20, 2023. The posts on this blog site are viewpoints, not suggestions. Please read our

Disclaimers Possible Applications of U.S. Equities for Asia-Based Financiers

Sherifa Issifu

-

Equities

Tags -

2023,

Asia, diversity, S&P 500, S&P MidCap 400, S&P SmallCap 600, Sherifa Issifu, U.S Equity Indices, U.S., U.S. Core, U.S. Equities, United States Lots of financiers have a so-called “house predisposition,” assigning to their domestic market in higher percentage than would be anticipated based upon its representation in worldwide equity markets.

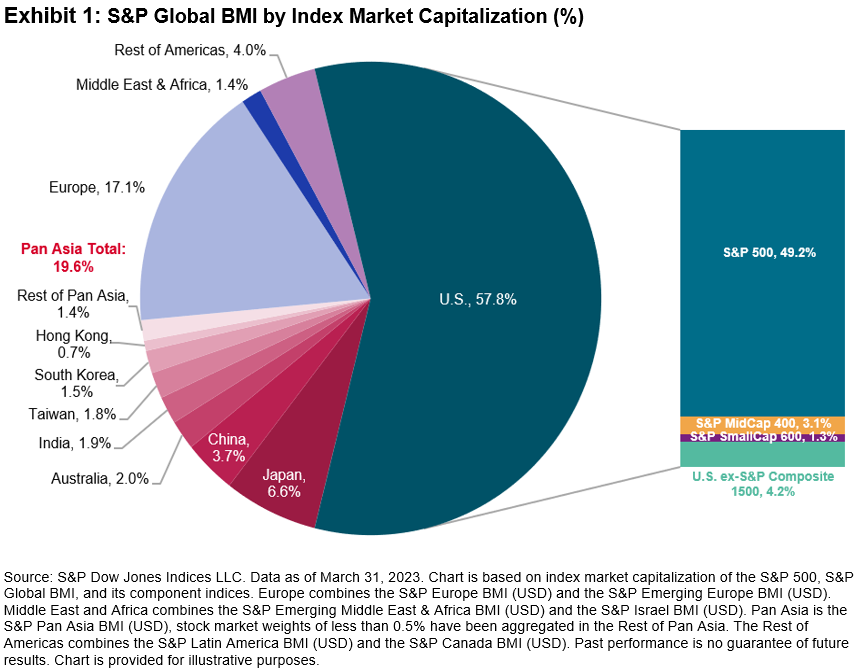

Asia-based financiers are no exception Here we provide our U.S. equity icons as one possible method to supply diversity for Asian financiers. The breadth and depth of the U.S. equity market indicates that financiers run the risk of neglecting a substantial portion of the worldwide equity chance set by under-allocating to U.S. equities, which might lead to a big active share compared to an international criteria. For instance, Display 1 reveals that the U.S. was almost 3 times bigger than the whole investable Asian equity market, with smaller sized U.S. equity sections as big as whole regional stock exchange. The

S&P 500 ®(* )comprises almost half of the pie, with the S&P MidCap 400 ® and SmallCap 600 ® being bigger than the Australian and Hong Kong stock exchange, respectively. Beyond U.S. equities representing a substantial part of the worldwide chance set, their unique sector weights might assist financiers to get rid of domestic sector predispositions. Display 2 programs GICS

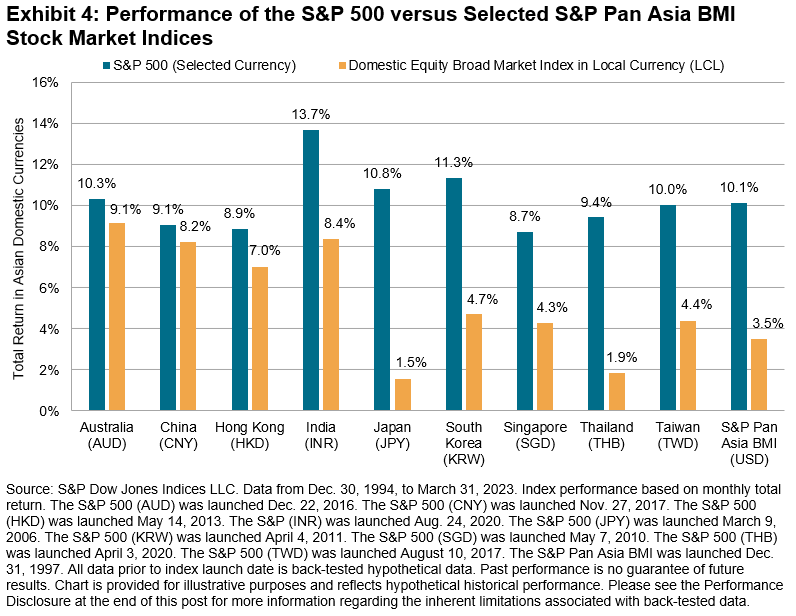

®(* )sector weights of the S&P Pan Asia BMI and the relative weight compared to the S&P Global BMI and the S&P 500. The S&P Pan Asia BMI’s biggest weights remain in Financials (17%) and Infotech (16%), with its tiniest weight in the Energy sector, at 3%. Some crucial distinctions in between the S&P Pan Asia BMI and S&P Global BMI and S&P 500 are that the worldwide and U.S. criteria have a bigger weight in Healthcare and Infotech and lower weights in Customer Discretionary, Products and Industrials. The efficiency of U.S. equities might likewise inspire some to think about integrating U.S. equities along with domestic equities. Display 3 reveals the cumulative efficiency, in USD terms, of the S&P Pan Asia BMI versus U.S. equity indices considering that Dec. 30, 1994. The right-hand bar chart reveals the annualized overall returns of different single stock exchange indices versus the S&P 500, S&P MidCap 400, S&P SmallCap 600 and DJIA ®

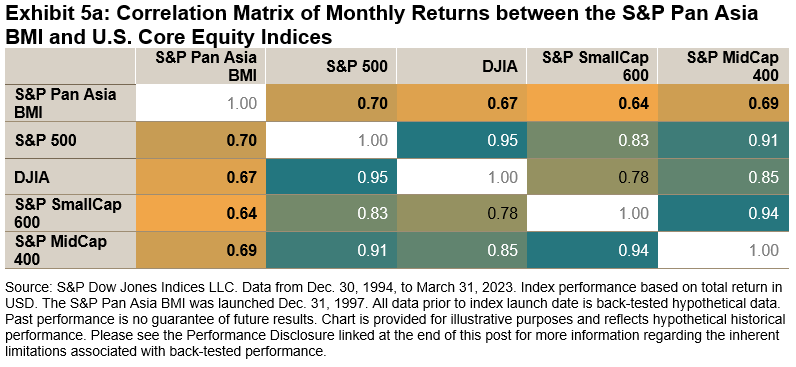

Rather plainly, the U.S. equity indices surpassed, traditionally. Display 4 reveals that the outperformance of U.S. equities was not driven by currency results. Certainly, the S&P 500 surpassed single-market indices (as represented by the S&P Global BMI sub-indices) in regional currency terms also. Display 5a likewise reveals the possible diversity advantage of integrating U.S. equities: there was a non-perfect connection with Asian equities over the last 28 years. Display 5b likewise highlights that numerous single-market indices rank substantially lower in regards to connection, with China having a 0.4 connection to the U.S.

considering that Dec. 30, 1994.

Unsurprisingly, maybe, integrating allowances to the S&P 500 might have enhanced risk-adjusted returns. For instance, Display 6 reveals the annualized returns and volatility for different theoretical mixes of the S&P 500 and the S&P Pan Asia BMI. These theoretical mixes rebalance back to the target weights at each year end. Portfolios that consisted of some percentage of the S&P 500 published greater returns than a 100% allowance to the S&P Pan Asia BMI. The high returns were likewise attained at a lower annualized threat. Have a look at more research study and insights on the S&P 500 and DJIA at

https://www.spglobal.com/spdji/en/education/article/comparing-iconic-indices-the-sp-500-and-djia/

and

https://www.spglobal.com/spdji/en/education/article/regional-relevancy-of-sp-500-and-dow-jones-industrial-average-futures-in-asia The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Tags 2023, Asia,

Tags

-

Active vs. Passive,

Bond ETFs, -

bond yields,

Brian Luke, credit threat management, Derivatives, period threat management, set earnings, Fixed Earnings ETFs, set earnings shared funds, futures, high yield corporates, iBoxx, earnings generation, indexing, rates of interest management, financial investment grade corporates, iTraxx, liquidity, choices, increasing rates, S&P Indices vs. Active, SPIVA, overall return swaps Take a better take a look at the most recent SPIVA results as S&P DJI’s Brian Luke and BlackRock’s Stephen Laipply talk about how indexing works for set earnings, the iBoxx liquidity community, and what a growing series of passive tools might imply for yield applicants as earnings go back to set earnings. https://www.youtube.com/watch?v=vzVSzU6EaSk The posts on this blog site are viewpoints, not suggestions. Please read our