JHVEPhoto/iStock Editorial by means of Getty Images

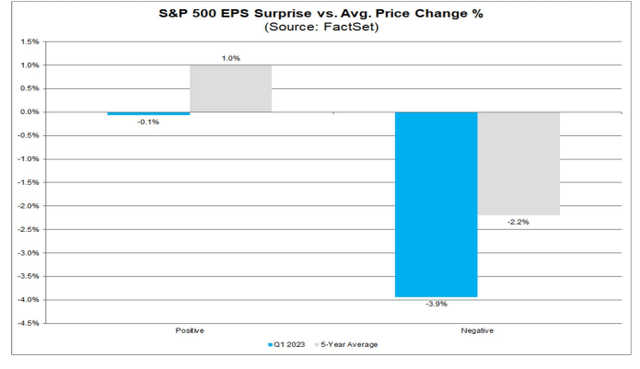

Business beating on fundamental quotes have actually not been rewarded up until now this revenues season. According to FactSet, the common stock cost response is a decrease amongst beaters, while those missing on agreement quotes have actually seen their stock cost fall by almost 4% compared to the marketplace.

I have a hold score on McKesson ( NYSE: MCK) offered its lofty evaluation compared to its history. Still, its totally free capital is strong, and the technical view is likewise motivating.

No Benefits For Beats This Incomes Season

According to Bank of America Global Research Study, MCK is the biggest drug supplier in the United States and has substantial services in Canada and Europe, consisting of circulation and retail drug store properties. MCK is the biggest medical surgical supplier in the non-acute care market and uses different supply chain services and innovation, although it just recently divested its scientific health IT platform.

The Dallas-based Healthcare Distributors market business within the Healthcare sector trades at a near-market 16.8 tracking 12-month GAAP price-to-earnings ratio and pays a little 0.6% dividend yield, according to The Wall Street Journal.

Back in February, MCK topped revenues quotes while missing on the leading line. Sales development was simply +3% year-on-year, and the expectation this time is for simply a 3% sales increase. What was motivating about the previous EPS report was that the business increased its 2023 changed EPS (watered down) assistance variety to $25.75 to $26.15, from the previous series of $24.45 to $24.95 versus a $24.80 agreement.

The business is now into its FY 2024, however, and revenues development is really rather slow. With 3 straight assistance boosts, nevertheless, it is rather possible that the management group provides more sanguine projections. As a strong totally free capital generator, business appears on sound footing. Drawback threats consist of increasing competitors in the drug prices market together with opioid lawsuits threats.

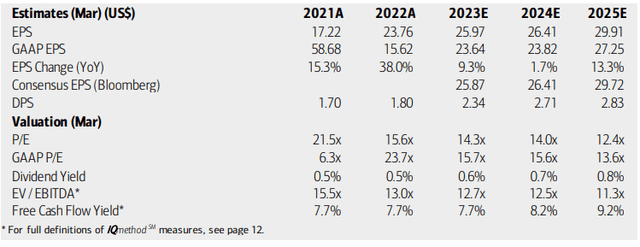

On evaluation, experts at BofA see revenues increasing at a strong clip this year prior to per-share earnings development slows in 2024. However a reacceleration is anticipated in 2025. The Bloomberg agreement projection has to do with on par with BofA’s forecast. Dividends, on the other hand, are anticipated to increase at a steadier rate than EPS, though the yield needs to stay modest.

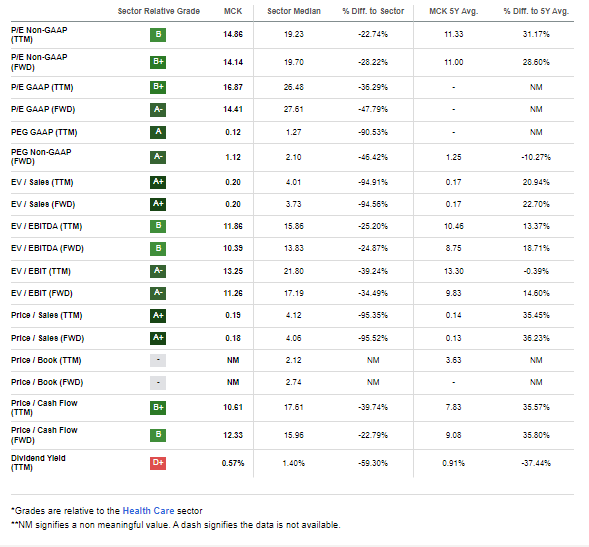

Both MCK’s operating and GAAP P/E ratios are engaging thinking about the basic development rate through 2025. The EV/EBITDA ratio is near the S&P 500’s typical, nevertheless. With strong totally free capital and a normally steady organization outlook, MCK can be considered both a worth have fun with some development together with sporting some protective attributes.

MCK: Incomes, Appraisal, Free Capital Projections

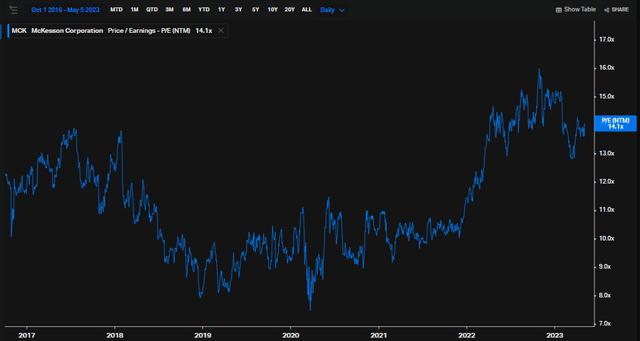

Thinking about the business’s 5-year typical P/E is simply 11 while its common PEG is 1.25, it would appear the evaluation is not that terrific versus history. Even a stabilized PEG pertains to about 2 (presuming 7% EPS development on a 14 numerous). So, I’m not all that passionate about how MCK is priced today. I yield that the company’s long-lasting evaluation might be re-rating greater towards a P/E in line with the marketplaces.

In general, nevertheless, I see reasonable worth near $378 based upon $27 of revenues on a 14 numerous.

MCK: Compelling Outright Assessments, However Not To Its 5-Year Typical

Looking For Alpha

MCK: P/E Historically Stretched

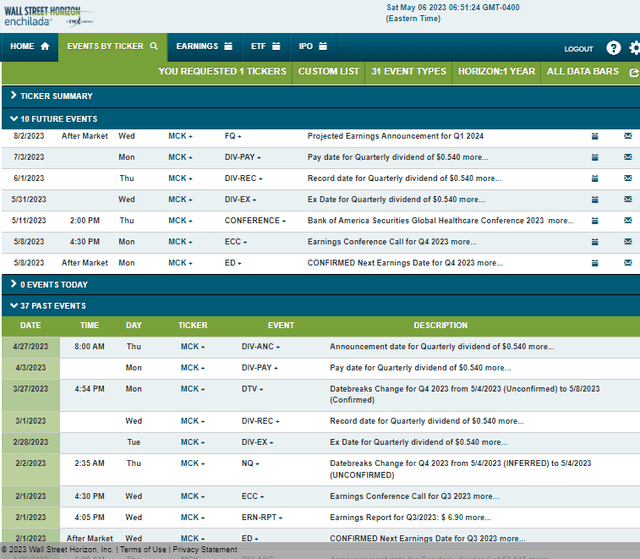

Looking ahead, business occasion information supplied by Wall Street Horizon reveal a verified Q4 2023 revenues date of Monday, Might 8 AMC with a teleconference instantly after outcomes cross the wires. Later on in the week, the management group is slated to provide at the BofA Worldwide Health Care Conference 2023, so there might be extra organization updates supplied then.

Business Occasion Threat Calendar

The Options Angle

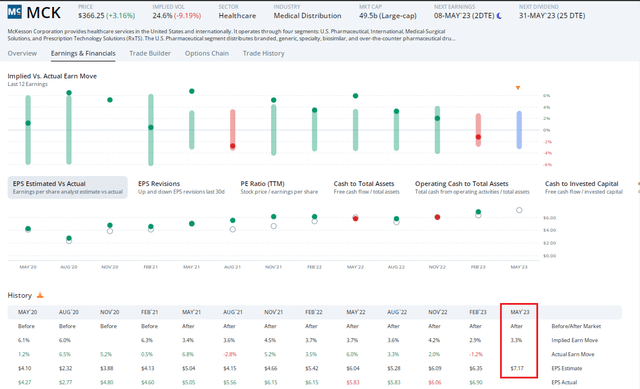

Going into the approaching revenues report, information from Choice Research study & & Innovation Provider (ORATS) reveal an agreement EPS projection of $7.17 which would be a sharp 23% boost from $5.83 of per-share earnings made in the very same duration a year earlier. MCK has a strong EPS beat rate history, and the stock has actually traded greater post-earnings in all however 2 of the previous 12 circumstances. So, the pattern is with the bulls.

This time around, the choices market has actually priced in a little 3.3% earnings-related stock cost swing when examining the at-the-money straddle, ending soonest after Monday night’s revenues report. That lines up with soft share cost responses over current quarters, so I would rather play the stock itself instead of the choices. Indicated volatility is simply 25% ahead of the statement, per ORATS.

MCK: Not Anticipating A Huge Incomes Move

The Technical Take

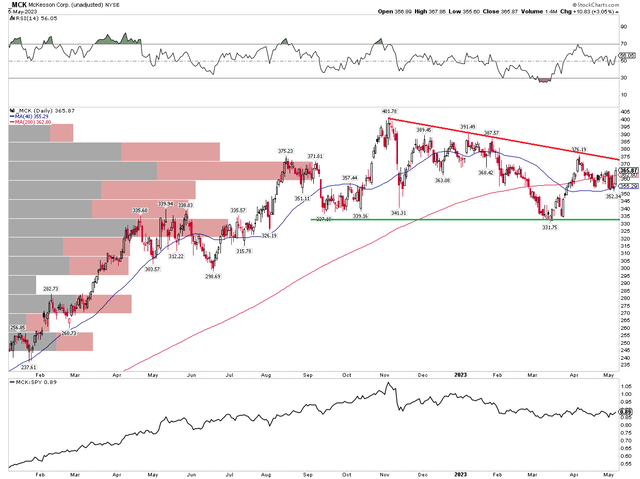

MCK has actually been among the marketplace’s leaders over the last couple of years. Shares have actually been combining in a bullish coming down triangle pattern– the anticipation is that the pattern will fix with cost relocating the pattern of a bigger degree– which would be greater in this case. The determined relocation cost unbiased presuming a breakout would be to near $450 (based upon the $70 triangle’s variety included on top of a possible breakout point of $380).

However a bearish breakdown under $332 assistance would activate a cost target to near $260. However with an increasing 200-day moving average, the pattern prefers the bulls, and the stock continues to display good relative strength compared to the S&P 500.

MCK: Bullish Combination, Considering $380 For A Breakout

The Bottom Line

I am a hang on MCK into revenues. I like the technical setup longer-term, however the evaluation is not extremely engaging following the significant share-price rally over the last couple of years. EPS development is not extremely strong this coming year.