Hiroko Yoshida/ iStock by means of Getty Images

Whirlpool ( NYSE: WHR) is trying to find a more robust real estate market and share gains to move its second-half outcomes. That appears a bit positive in my view provided the present unsure financial environment.

Business Profile

WHR is a maker of family devices. The business offers its devices under the Whirlpool, Maytag, Jenn-Air, KitchenAid, insinkerator, and Amana brand names, to name a few. About three-quarters of its sales are to the mass customers, while 15% are superior and 10% worth.

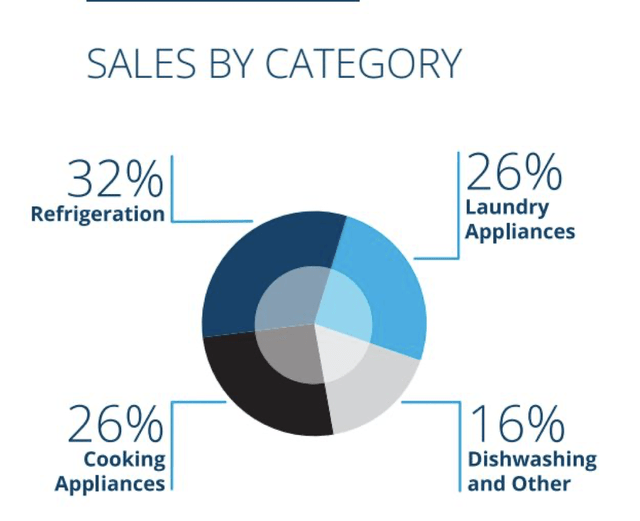

The business’s items consist of such things as fridges, freezers, washers, clothes dryers, ovens, varieties, microwaves, and dishwashing machines, along with little counter top devices. Refrigeration is its biggest classification, representing about 32% of sales. Laundry devices and cooking devices represent about 26% of earnings each. Dishwashing and other represent about 16% of its sales.

Business Discussion

The United States And Canada has to do with 48% of its sales, followed by EMEA at 20%. Latin America is 16% of sales, while Asia is 6%.

Q1 Outcomes

For Q1, WHR saw earnings fall -5.5% to $4.65 billion. Leaving out currency, sales were down -3.7%. That led the $ 4.5 billion expert agreement

North American sales fell -1.6% to $2.75 billion, while EBIT plunged -39.6%.

The business stated it’s getting share in The United States and Canada, with CEO Marc Bitzer stating:

” So if you take a look at the Q1, we feel excellent about the share gains in laundry, meal and cooking, and we still have some work to be carried out in refrigeration. That’s from an item point of view. On the circulation side, it’s basically throughout the board. We feel in fact respectable of above balance of sale, which we have with more trade clients. We feel especially excellent about our, not simply short-term however long-lasting share gains which we have in construct the sector. Now needless to state that in Q1, that is not a huge chauffeur due to the fact that the home builder channel in Q1 was not really high. I believe that’s more a factor we’re bullish on mid and long-lasting due to the fact that our position within the home builder sector is a really strong one and has actually enhanced over the last number of years.”

EMEA sales plunged -18% to $889 million, although EBIT turned favorable, being available in at $5 million versus -$ 27 million a year back. Organics sales fell -7.7%. Market weak point harmed sales, while $30 million in held-for-sale accounting advantages increased EBIT. The business remains in the procedure of moving its significant domestic home appliance organization into a freshly formed entity with Arcelik.

Latin American earnings fell -0.4% to $757 million, while EBIT fell -27.8%. The business stated Mexico saw strong need enhancement, however that Brazil was weak.

Asian sales decreased by -10.2% to $256 million, or -3.4% leaving out currency. EBIT fell -42.9% to $8 million.

Gross margins fell -190 basis indicate 16.4%.

Changed EPS was $2.66. That beat expert price quotes by 49 cents.

Looking forward, the business declared its earnings assistance for sales to be down -1% to -2% to $19.5 billion. It is still trying to find changed EPS of in between $16-18, although reduced its GAAP EPS expectation to $13-15. The business is anticipating totally free capital of $800 million.

In General, it was a good quarter compared to expectations, although the ongoing back-end crammed assistance is something of an issue. WHR is currently seeing some sales weak point, however the economy still hasn’t teetered into an economic downturn. A second-half healing appears a bit positive provided the financial unpredictability, and if the economy begins to compromise, WHR might need to decrease its full-year outlook.

Opportunities and Dangers

With the U.S. being its biggest market, patterns in house development and the home appliance replacement cycle will continue to play a huge function in WHR’s outcomes over the long term. In spite of a current downturn in brand-new building provided the increase in rate of interest, the U.S. is still thought about to have a big real estate scarcity, with price quotes usually varying from a lack of in between 2 million all the method as much as more than 5 million houses Therefore, in the medium to long term, this dynamic ought to be favorable for a business like WHR as the nation will continue to require more single-family and multi-family houses, all of which require devices.

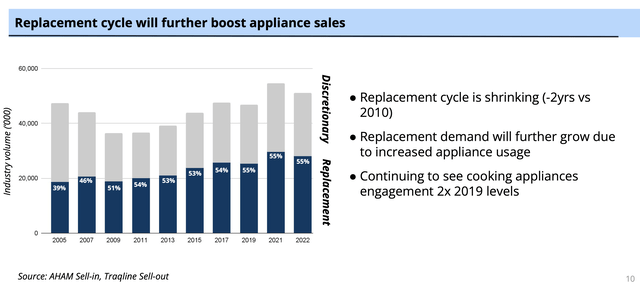

Home appliances, on the other hand, do not last permanently, and require to be changed usually every 9-15 years, depending of the kind of home appliance. WHR sees the replacement cycle diminishing also.

Business Discussion

Talking about the outlook for The United States and Canada on its Q4 call, CFO James Peters stated:

” I’ll supply extra color around our mid- to long-lasting The United States and Canada market outlook. While we are experiencing short-term need softness, we stay really positive about mid- and long-lasting need patterns. Replacement need, which represents 55% of the overall market, will increase in the mid- to long term. After the post-financial crisis, market, volume decreased from 2008 to 2011. The market started to grow once again in 2013. Even more, with remote and hybrid work patterns continue to drive raised use of well above 2x pre-pandemic levels in our cooking devices, decreasing the replacement cycle by roughly 2 years.

” Integrated with a really strong set up base of Whirlpool’s household of devices in 2 out of every 3 homes in America supports strong replacement momentum. Furthermore, real estate demographics such as a moderating rates of interest environment, the earliest real estate stock in U.S. history, the requirement for family developments to overtake population development rates and the 2 million to 3 million system undersupply of U.S. homes, supports mid- to long-lasting discretionary and brand-new building need, which is 45% of the overall market. We feel exceptionally positive in our capability to profit from these considerable tailwinds in spite of the near-term pressures of real estate cost and softening customer belief affecting discretionary costs and have actually shown all of these motorists in our mid- to long-lasting market development outlook of 3% to 4%.”

In addition to domestic U.S. development, the business is likewise wanting to broaden into the industrial organization. It has an industrial laundry organization under its Maytag brand name, however it sees a chance to use up business even more and to perhaps enter into business cooking also. WHR would likewise like to continue to grow and broaden its counter top home appliance organization. This is one location where it can actually invest and innovate. It’s likewise wanting to press more e-commerce purchases through its own websites.

International rearranging is another location of chance. WHR has actually done an excellent task in some global markets such as Latin America, however it has actually divested weaker services in other markets, such as China, Turkey and Russia. It’s likewise in the procedure of divesting its European organization, while keeping a 25% stake in the brand-new business. On the other hand, it sees India a huge development market. The business states the world is ending up being less worldwide due to increased trade barriers, freight expense inflation, and geopolitical stress, and as such local and regional scale have actually ended up being a lot more crucial than worldwide scale.

Just like many production business, ending up being more effective is likewise constantly a top priority. Decreasing part intricacy and the supply chain has actually been a huge focus for the business the previous number of years. On the other hand, it is wanting to secure $800-900 million in expenses in 2023. In between $300-400 countless this will be decreasing basic material expenses, while $500 million will be things like supply chain effectiveness, headcount, and minimize discretionary costs.

As far as threats, the economy, specifically in the U.S. and Latin America are the greatest threats. Lower need can likewise ultimately result in stock accumulations in the channel, which can result in less usage at its production centers. That then develops a situation of weaker sales and lower margins.

Evaluation

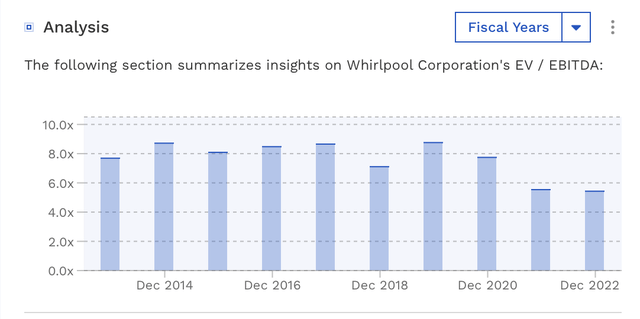

WHR stock trades at 8x the 2023 EBITDA of $1.83 billion and 7.2 x the 2024 EBITDA agreement of $2.02 billion.

On a P/E basis, it trades at 9x EPS price quotes of $15.96. Based upon the 2024 agreement for EPS of $18.15, it trades at 7.8 x.

The business is anticipated to see earnings fall -2.5% this year, and -5.2% next year.

The business does not have numerous excellent public compensations, and its forward EV/EBITDA multiple is around where it has actually traditionally traded on an in reverse basis.

WHR Historic Evaluation ( FinBox)

Conclusion

I believe WHR ought to have the ability to ride some great patterns in home appliance replacement and brand-new house development in the medium to long term. In the near term, nevertheless, I stress that its back-end crammed assistance is a bit too aggressive. The business is depending on market share gains and a more powerful U.S. real estate market in the 2nd half, which I’m not rather all set to bank on at this time.

From an evaluation viewpoint, the business is trading around where it traditionally has actually traded over the previous years. As such, I’m neutral on the name at present.